The Times, They Are A-Charging

Thanks to a subscriber for this report from Deutsche Bank which may be of interest. Here is a section:

In the near-term, adoption is likely to be constrained by this slightly extended payback, concerns over driving range and thus, charging infrastructure. That said, investors may be surprised at the speed at which infrastructure can be built out (Tesla has constructed 830 SuperCharger locations in 31 countries to date, expected to double in 2017). However, the short driving range (~200 miles) is likely to constrain the market to specific use cases, until battery technology improves/costs decline. We forecast 10% adoption by 2027 within the NAFTA Class 8 market.

The shorter, closed-loop nature of typical medium-duty truck routes should yield faster adoption of electric trucks vs. heavy-duty. Range is not a major concern for medium-duty trucks, given that they tend to drive much shorter routes (well below 200 miles/day), haul less tonnage, and often follow closed-loop networks, allowing for night-time charging. As such, we agree with consensus on this topic – medium-duty adoption of electric vehicles is likely to be much faster than with heavy-duty trucks. We project 15% adoption by 2027 within the NAFTA Class 5-7 market.

OEMs that offer the best payback period/total cost of ownership are likely to win share. Tesla will be a new entrant in the market, which presents risk to existing OEMs in itself (Daimler, Volvo, Navistar, PACCAR) – we believe the company that provides the best combination of average selling price with battery range/cost will win, and Tesla will have many advantages in this regard. Nonetheless, today it seems that all OEMs are developing electric trucks with range in the ~200-mile zone, which shifts the focus to the ASP. At this point, Daimler, MAN/Scania and Tesla appear to be preparing to launch electric truck offerings, so they could potentially have a head start vs. Navistar and PACCAR.

Legacy components suppliers could face significant headwinds. This centers around components that will be phased out in a fully electric world, such as the transmission (Allison Transmission) and engine (Cummins). Note that in conjunction with this report, we have downgraded Allison Transmission (covered by Nicole DeBlase) to Sell (price as of 8/31: $34.54), as we match longer-term electrification concerns with shorter-term earnings headwinds.

Here is a link to the full report.

Intel acquired Mobileye earlier this year to gain access to the autonomous vehicle sector because cars and trucks are going to require a lot more computing power in future regardless of how quickly autonomous features develop.

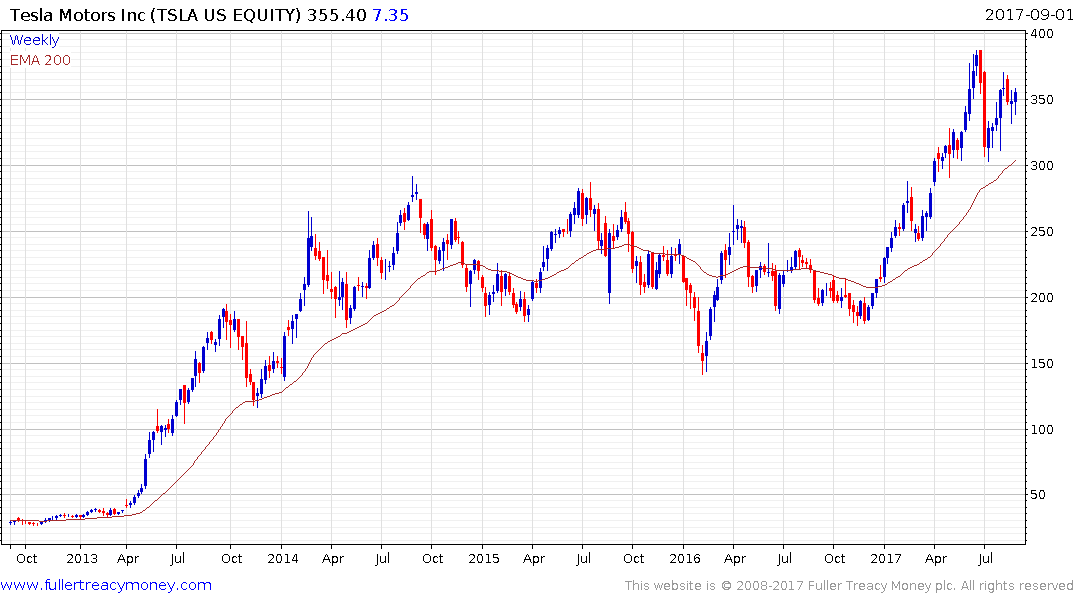

Tesla’s over the air updates for its vehicles are a current example of what to expect from just about every vehicle in future. The share found support in the region of the upper side of its underlying, almost three-year, range in July and a sustained move below $300 would be required to question medium-term scope for additional upside.

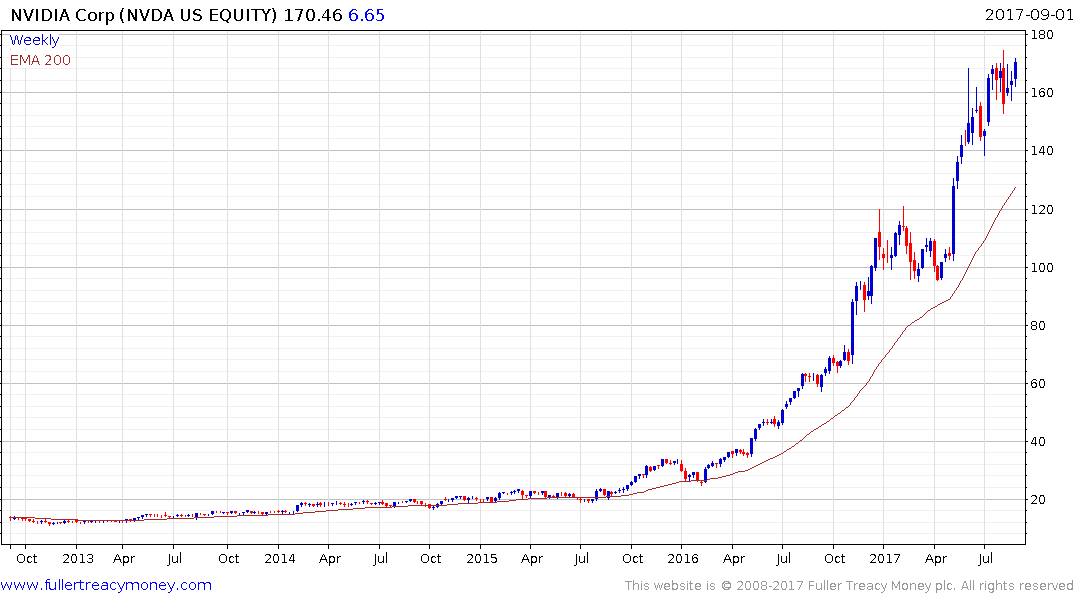

Nvidia is a leader in developing graphics chips which are used today in gaming PCs, virtual reality systems and also have a future in interpreting optical data for vehicles. The share has been ranging mostly below $170 since June but a break below $150 would be required signal more than a temporary pause.

Wabco broke out to new highs in July and continues to extend its advance.

Delphi Automotive has a similar pattern.