Stable Coin and the SEC

Thanks to a subscriber for this report from RenMac which may be of interest. Here is a section:

Current-SEC Chair Gary Gensler cuts this gordian knot by making the obvious remark that asset-backed stable coins are repackaging the securities held in the reserve, and so are derivatives hence themselves securities: ‘Make no mistake: It doesn't matter whether it's a stock token, a stable value token backed by securities, or any other virtual product that provides synthetic exposure to underlying securities ...these platforms — whether in the decentralized or centralized finance space — are implicated by the securities laws and must work within our securities regime.’

In the way of the Terra/Luna collapse, he reiterated this conviction today: ‘there’s a need to bring greater investor protection to these crypto markets ... central to that are crypto trading and lending platforms, where investors buy, sell and lend around $100 billion of crypto assets a day. The crypto-related events in recent weeks have highlighted yet again how important it is to protect investors in this highly speculative asset class.’

The abrupt collapse of a $60 billion stablecoin has raised eyebrows. There has been a lot of discussion about how and whether to regulate the sector, but the size of the market and the potential for significant losses by retail investors is creating urgency. Regulation of crypto securities is inevitable. Jurisdiction is irrelevant if a country’s own citizens can purchase. That also suggests full transparency on where deposits are being invested is inevitable.

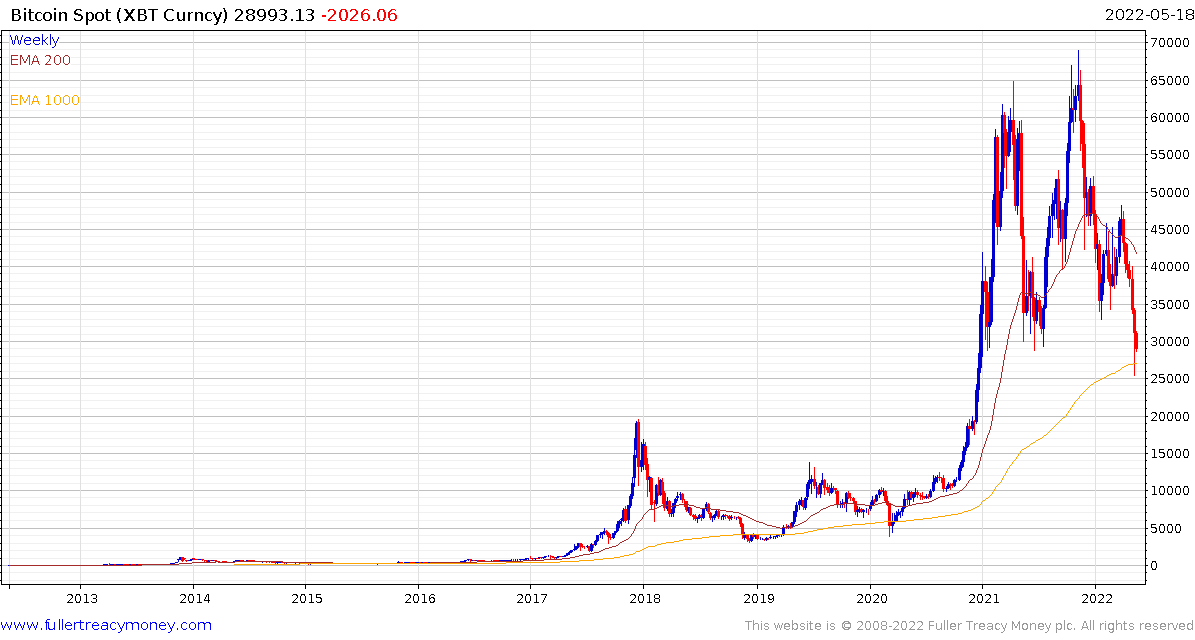

Bitcoin is at a critical point in its trends. The booms following halvings have been getting successively smaller as the size of the market has increased. That’s a product of the law of large numbers. Meanwhile, throughout the bull market, the 1000-day MA has offered support during crypto winter bear markets. The price bounced from that level last week but has not successfully traded back above $30,000.

Let’s set aside the promise of crypto, which has lots of future potential. Instead let’s focus on price which is a completely separate subject. The big bull markets for the assets have all coincided with periods of excessive money creation. Cryptocurrencies thrived in a loose money environment and tend to suffer in restrictive money environments. The clear conclusion is they are liquidity barometers. The bull case for prices is totally dependent on lower for longer interest rates and abundant money creation.

Altcoins like Ethereum are unlikely to hold out against a secular breakdown in bitcoin.

From listening to various nonfinancial market people talking about the crypto market I get the impression most are adopting a philosophical attitude to volatility. Seeing fortunes come and go is viewed as part of the territory.

The belief that all you need to do is hold on for four years to make a guaranteed outsized profit has permeated investor psychology. For example, the price in May 2018 was around $10,000. The logic goes that it does not matter what price you pay because the value will be higher four years from now.

Bitcoin has never dipped below a spike peak. That suggests if the price falls through the 1000-day MA, the next important area of potential support is $20,000. Below that level and any semblance of secular consistency will be gone.

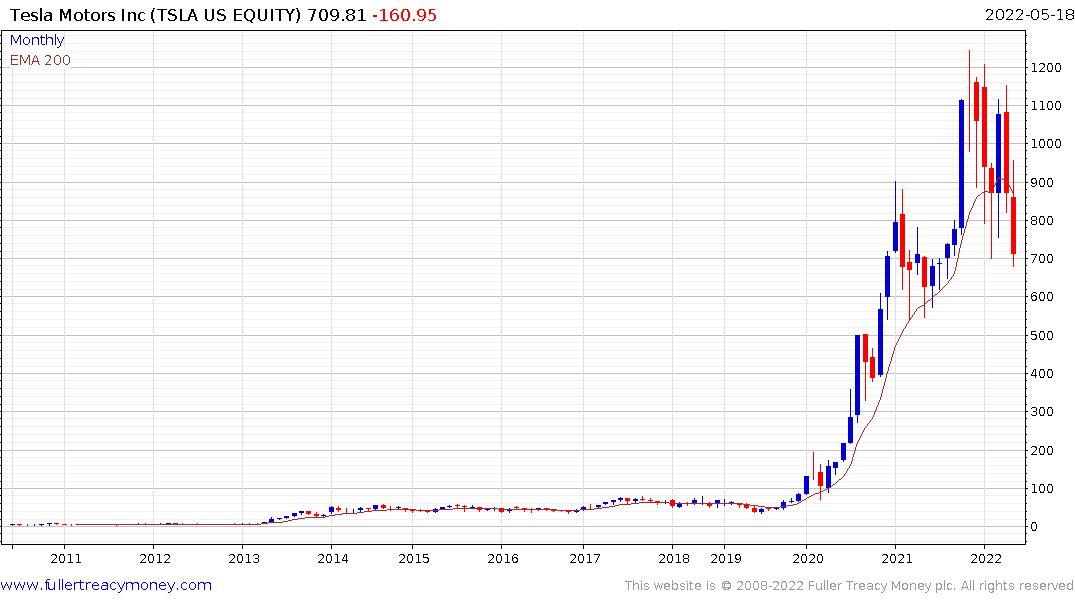

Tesla lost its spot as an ESG favourite today. The share continues to decline and the chart pattern shows considerable consistency deterioration. For one thing the unfolding correction is well below the early 2021 peak. https://www.bloomberg.com/news/articles/2022-05-18/tesla-crashes-work-conditions-see-it-pushed-off-s-p-esg-index

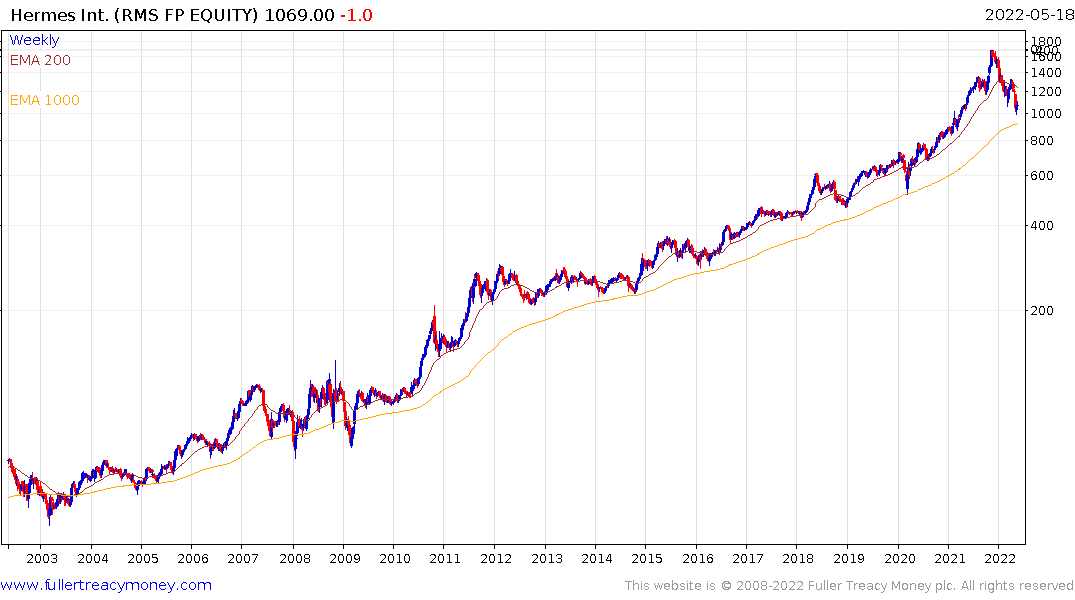

Another barometer of liquidity and conspicuous consumption, Hermes, has also lost uptrend consistency. The share bounced last week from the psychological €1000 area and has unwound most of the overextension relative to the secular 1000-day MA trend mean. Investors have regarded sojourns below the 1000-day MA as buying opportunities for more than 25 years.

The closely held share is still trading on a price to sales ratio of 12.5 and 58% of revenue is sourced in Asia. The outlook for Chinese stimulus will be pivotal to any potential recovery.