Norway Targets Record Gas Sales This Year as Europe Shuns Russia

This article from Bloomberg may be of interest to subscribers. Here it is in full:

Norwegian gas sales are on course to test a record high this year as Europe seeks to reduce its dependence on top supplier Russia as soon as possible.

Total exports from fields in the Nordic nation are poised to jump about 8% this year to 122 billion cubic meters, the government said in its updated outlook on Wednesday. The country sold similar volumes in 2017, a record year for exports.

The continent’s second-biggest supplier is pumping at full tilt, benefiting from record prices and higher demand than ever for its fuel. The European Union aims to curb imports from Russia by two thirds this year because of the war in Ukraine.

European prices spiked after Russia’s invasion in late February, deepening an energy crisis that started last year. Costs have since eased but they remain historically high and traders remain on the edge because of the uncertainty of flows and payment regimes.

“High prices give the companies strong incentives to utilize the production capacity on the fields,” Petroleum and Energy Minister Terje Aasland said. “Companies are producing at full, or near full capacity.”

Norwegian producers have tweaked operations at some fields, including reducing gas injections for oil recovery. Energy major Equinor ASA will also restart its Hammerfest LNG plant this month. The facility has been shut after a fire in late 2020.

The extra volume would amount to an increase of about 9 billion cubic meters this year compared with 2021 sales. While every molecule counts, it’s just a fraction of Russia’s flows to the European Union, which exceeded 155 billion cubic meters last year. That was about 40% of the bloc’s total consumption.

Europe has a chronic need to boost energy security. Importing from a friendly country, with a long history of sound governance like Norway, is infinitely preferable to relying on Russia. That’s great news for Norway’s balance of payments.

Equinor has not looked back. The share has surged along with European gas prices and continues to trend higher.

Equinor has not looked back. The share has surged along with European gas prices and continues to trend higher.

The Norwegian Krone broke lower in March and remains weak. That’s despite the fact they have raised rates from zero to 0.75%. It is a testament to how strong the Dollar has been that a major energy producer’s currency is falling rather than rising as exports soar.

The Norwegian Krone broke lower in March and remains weak. That’s despite the fact they have raised rates from zero to 0.75%. It is a testament to how strong the Dollar has been that a major energy producer’s currency is falling rather than rising as exports soar.

Indonesia recorded a record trade surplus last quarter too. The ban on palm oil exports is partly to blame for the weakness of the rupiah, but the commonality with other commodity related currencies is also notable.

Indonesia recorded a record trade surplus last quarter too. The ban on palm oil exports is partly to blame for the weakness of the rupiah, but the commonality with other commodity related currencies is also notable.

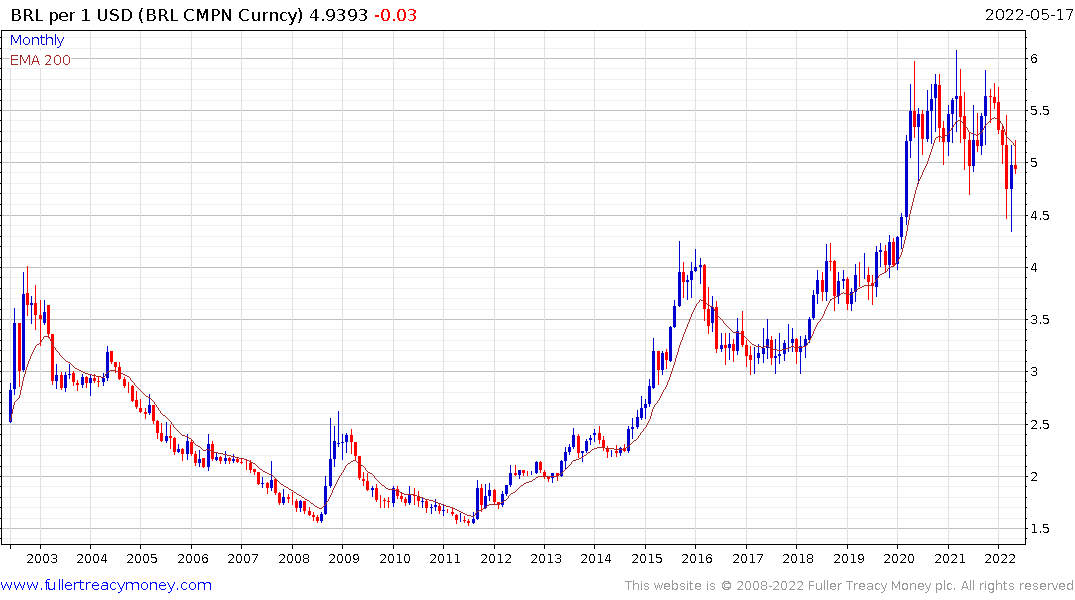

The Brazilian Real also weakened over the last month but found support last week in the region of the 200-day MA and improved on that performance this week. Brazil has significantly higher rates than just about anywhere else so that is helping to support the currency.

The Brazilian Real also weakened over the last month but found support last week in the region of the 200-day MA and improved on that performance this week. Brazil has significantly higher rates than just about anywhere else so that is helping to support the currency.

Petrobras yields 33% this year and is expected to have a 19% yield following the special payments slated for next week.

Petrobras yields 33% this year and is expected to have a 19% yield following the special payments slated for next week.

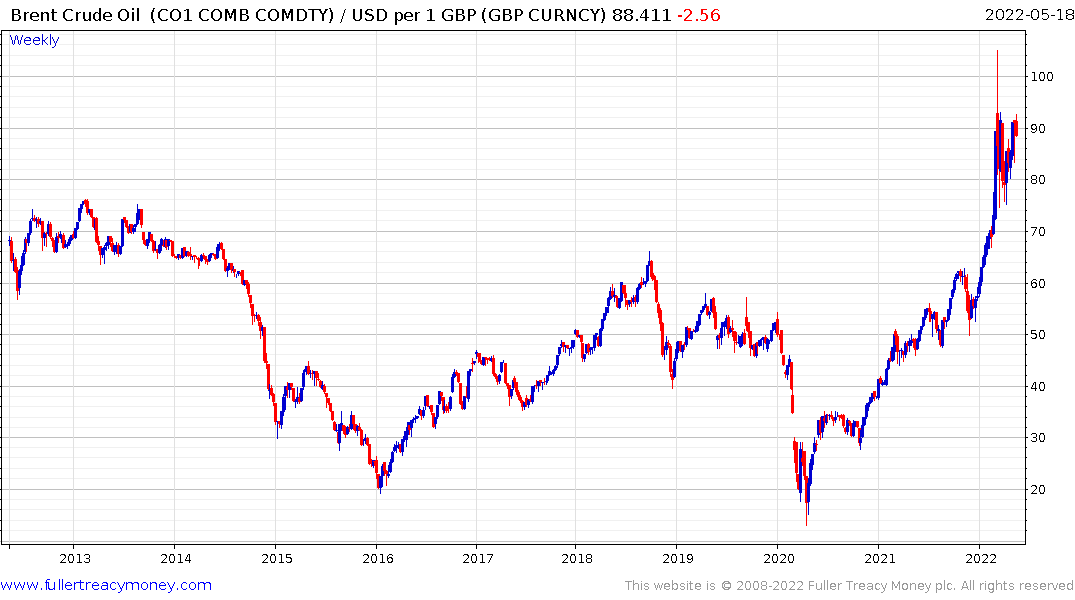

It seems inevitable that the strength in energy prices will feed through into related currencies eventually. At present, investors are still wedded to the idea commodity strength is transitory. It’s not at all clear that NATO’s relationship with Russia is going to improve anytime soon. Additionally, the disruptive effect of the IMO2020 regulations on demand for middle distillates is only going to intensify as emissions regulations tighten.

Crude oil is at a critical point right now. The narrow wedging pattern suggests a breakout, when it comes, will be powerful. The argument is finely balanced between supply inelasticity and slowing global demand. The weakness in energy currencies could be a symptom of investors betting slowing demand will win out. However, I believe the more likely explanation is the weakness of Wall Street has resulted in a lot of contagion amid deleveraging.

At present oil prices as easing back from the upper side of the range. A sustained break below $100 would be required to signal a return to supply dominance.

Back to top