Revving Exports to US Keeps India in Race to Be Next China

This article from Bloomberg may be of interest to subscribers. Here is a section:

“We have started to see green-shoots of this with India’s exports in FY22 reaching around $420 billion, far higher than earlier years,” Jain said. “This was driven by a combination of external as well as internal factors.”

India also managed to surpass El Salvador to become one of the top 5 suppliers of cotton t-shirts to the US this year.

The apparels sector, where India competes with nations like Bangladesh, saw an up-tick owing to multiple factors including a ban of all cotton products from China’s Xinjiang region over alleged ill-treatment of its ethnic Uighur Muslim minority, said Gautam Nair, managing director at Matrix Clothing Pvt., a medium-sized garment export firm. “The surge also further accentuated due to huge boom in buyers’ purchase and supply chain diversification.”

Medium- and large-export firms saw a jump of 30%-40% in their order books last fiscal year and the upswing would be more visible in the current financial year ending March 2023, Nair said. Matrix Clothing, which exports apparels to global brands including Superdry, Ralph Lauren, Timberland, and Napapijri, has seen orders climb by 45% last fiscal year compared to the pre-covid year.

Still, there are hurdles to the growth of low-value added manufacturing in the form of non-labor costs, warn analysts.

“The bigger problems are the legacy issues of contract enforcements, tax transparency etc.,” said Priyanka Kishore, an economist at Oxford Economics. “These do pose a challenge to India’s manufacturing ambitions and need to be addressed for the country to fully tap its potential as a manufacturing hub.”

India doesn’t do lockdowns. It can’t afford to and doesn’t have to because the population is so young. With several hundred million people under the age of 25, job creation is a more urgent concern. Ensuring manufacturing is allowed to prosper and grow without being stifled by overbearing bureaucracy will need to become the national priority.

As China’s population ages and earns its way out of low-end manufacturing, there is still a need for the goods they produced. India is ahead of Nigeria and Ethiopia in that it has a large young population and is closer to developing significant export markets.

How successful India is in achieving market scale will be pivotal in plotting how persistent inflationary pressures. China exported deflationary forces for decades and India holds out the same potential.

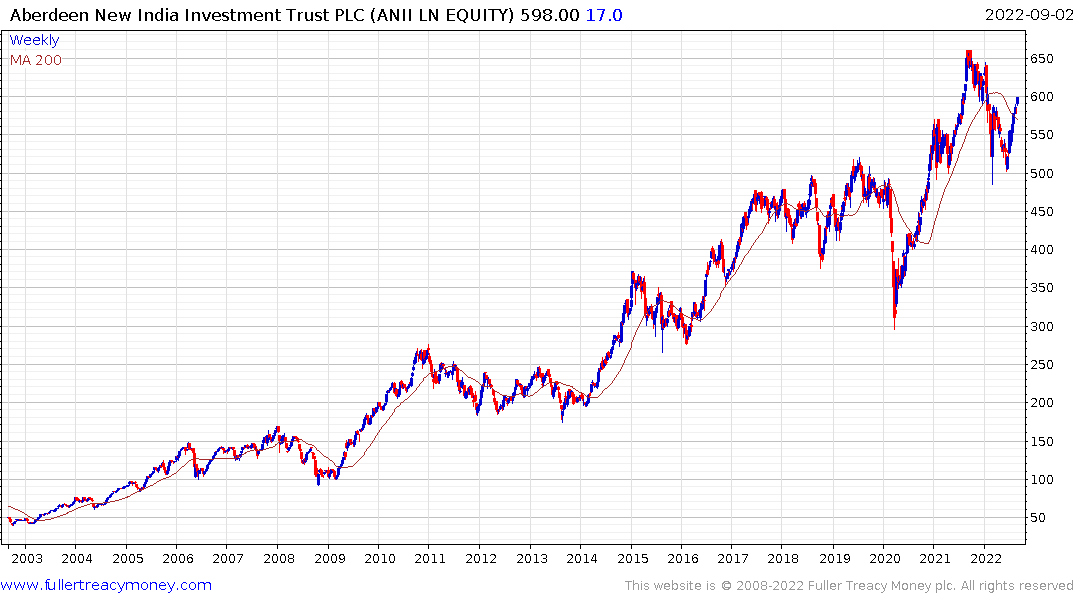

The UK listed Aberdeen New India Trust continues to extend its rebound from the region of the 1000-day MA.

The UK listed Aberdeen New India Trust continues to extend its rebound from the region of the 1000-day MA.

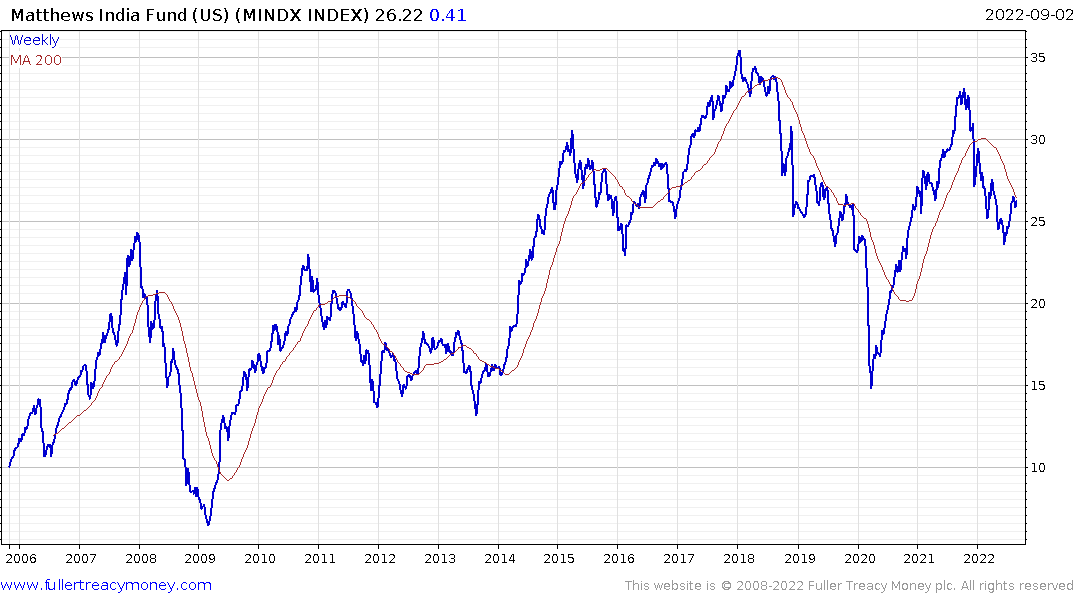

The Matthews India Fund has a similar pattern recently but not over the long-term.

The Matthews India Fund has a similar pattern recently but not over the long-term.