China's Currency Struggles Spell Trouble Across Emerging Markets

This article from Bloomberg may be of interest. Here is a section:

“With the yuan set to weaken further, other emerging markets will face downward pressure on their currencies,” said Per Hammarlund, the chief emerging markets strategist at Skandinaviska Enskilda Banken AB. “The impact will be felt the most by nations which compete directly with China on exports.”

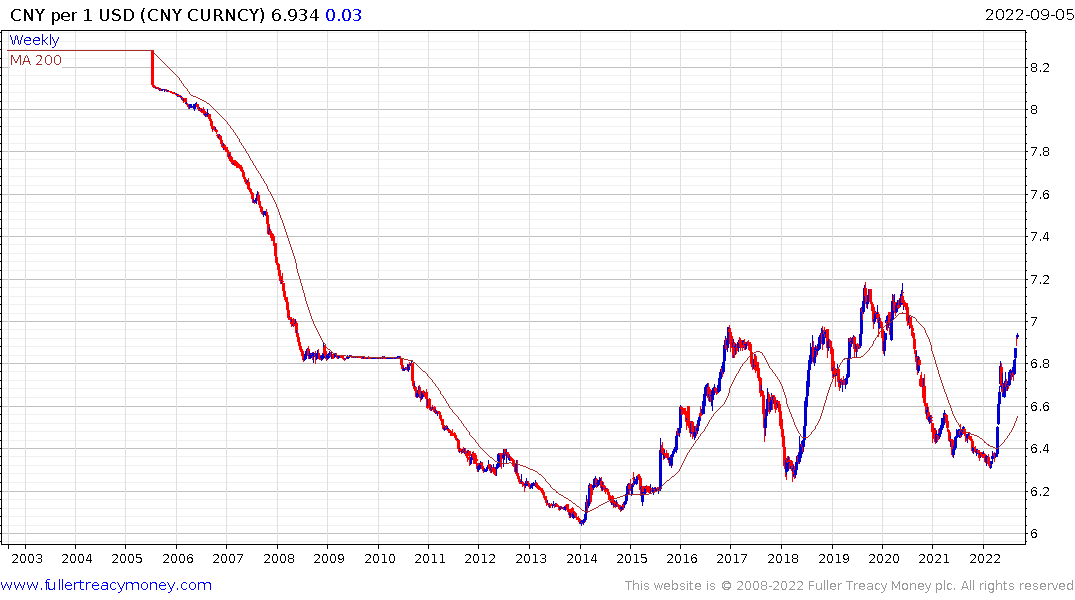

The yuan declined for a sixth consecutive month in August, capping the longest losing streak since the height of the US-led trade war in October 2018. It will fall even more and cross the psychological mark of 7 per dollar this year, banks including Societe Generale SA, Nomura Holdings Inc. and Bank of America Corp. say.

It’s a stunning reversal for a currency that stood out for its resilience at the outbreak of Russia’s war in Ukraine. In the days following the Feb. 24 invasion, the yuan was the only emerging-market exchange rate to avoid a decline, trading at an almost four-year high against MSCI Inc.’s benchmark index. Global demand for it deepened -- from countries like Russia and Saudi Arabia looking to reduce their reliance on the dollar to US bond investors seeking new havens.

China is the destination for most industrial commodity exports, so a weaker currency boosts domestic inflation. At the same time many countries in China’s hinterland compete with it for exports. A cheaper Renminbi forces them to also depress their currencies.

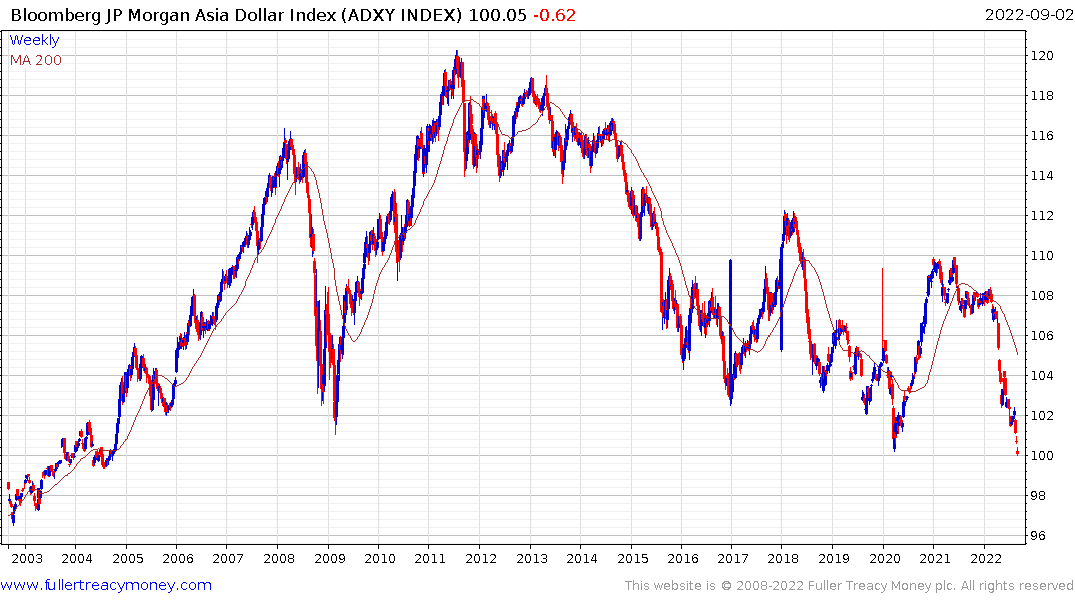

The Asia Dollar Index is very oversold but hit a new 18-year low today. This also helps to illustrate the role of the Dollar in supporting, or detracting, from demand for emerging market assets. Major bull runs in emerging markets, and by extension commodities, tend to coincide with significant Dollar weakness.

Major new lows in the Asia Dollar Index have coincided with periods of significant global economic stress. 1997/98, 2001, 2008/09, 2016, 2020 and now. The big challenge today is the Fed’s fight against inflation is siphoning liquidity out of the global economy at exactly the same time that China is attempting to prop up its property sector. That implies a significantly weaker Renminbi. The Dollar has been ranging mostly below CNY7 since 2017. A sustained move to new recovery highs is a realistic possibility.

Back to top