Raiffeisen Sticks to Russia Amid Sanctions as Profit Rises

This article by Boris Groendahl for Bloomberg may be of interest to subscribers. Here is a section:

Raiffeisen Bank International AG, the foreign bank with the most at risk in Russia, shrugged off U.S. and EU sanctions against its most profitable market and said it has no plans to reduce its presence there.

Raiffeisen’s shares soared after the Vienna-based bank reported second-quarter net income climbed 53 percent to 183 million euros ($242 million) from a year earlier, according to a statement today. That beat the average estimate of 136 million euros in a company survey of 17 analysts, as interest income was higher and loan-loss provisions were lower than estimated.

“The impact of the current sanctions on our business is very low,” Chief Executive Officer Karl Sevelda told reporters in Vienna. “I don’t see any reason to question our business in Russia. We have proven our stamina in Russia in the past. We still consider Russia to be a very attractive banking market in the medium and long-term and therefore we will stay there.”

Raiffeisen, the second-largest bank in eastern Europe after UniCredit SpA, has relied on Russia as its biggest profit generator in the past three years. Sanctions imposed by the U.S. and the European Union in response to President Vladimir Putin’s stance on Ukraine are menacing that source of income as bad loans continue to eat into profit in other markets, like Hungary and Romania.

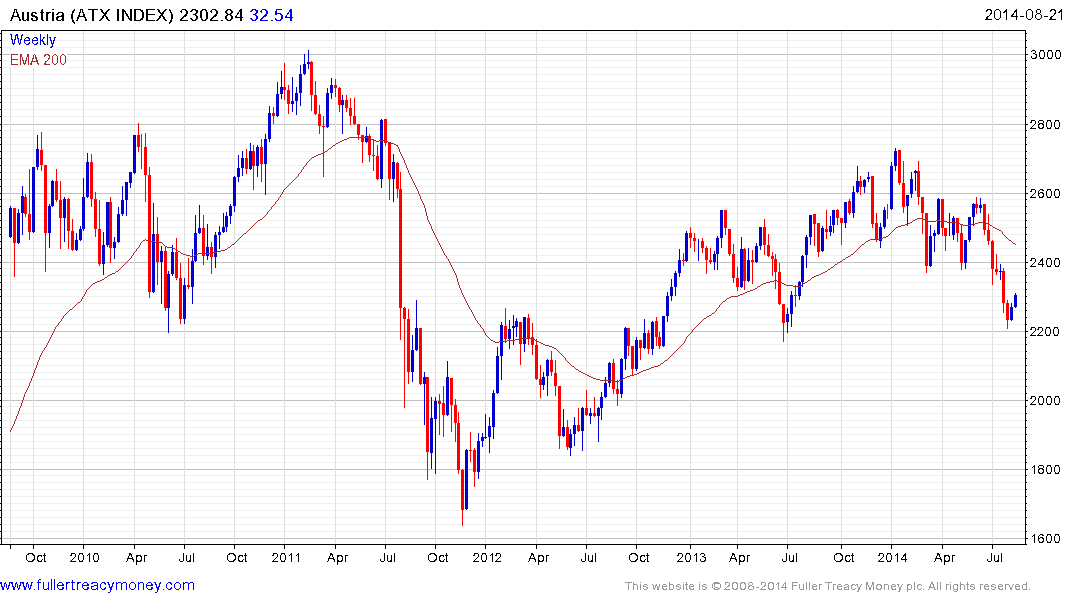

Austria, with its corporate ties to Eastern Europe, was among the stock markets that experienced the deepest declined this year. However the Index has found at least short-term support and a reversionary rally back up towards the 200-day MA appears to be underway. It will need to break the progression of lower rally highs to suggest a return to demand dominance beyond the short term.

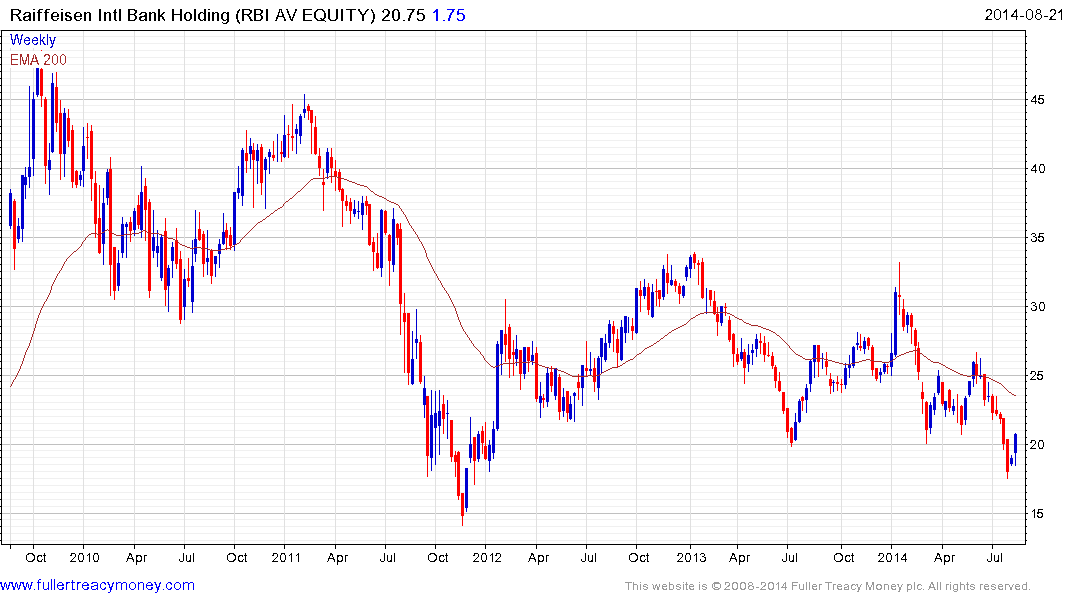

Raiffeisen Bank International retested the €19 area last week and bounced from that area today to at least partially unwind the short-term oversold condition. Considering how deep its connections with Russia are, it would be rash to conclude the share is on a recovery trajectory.

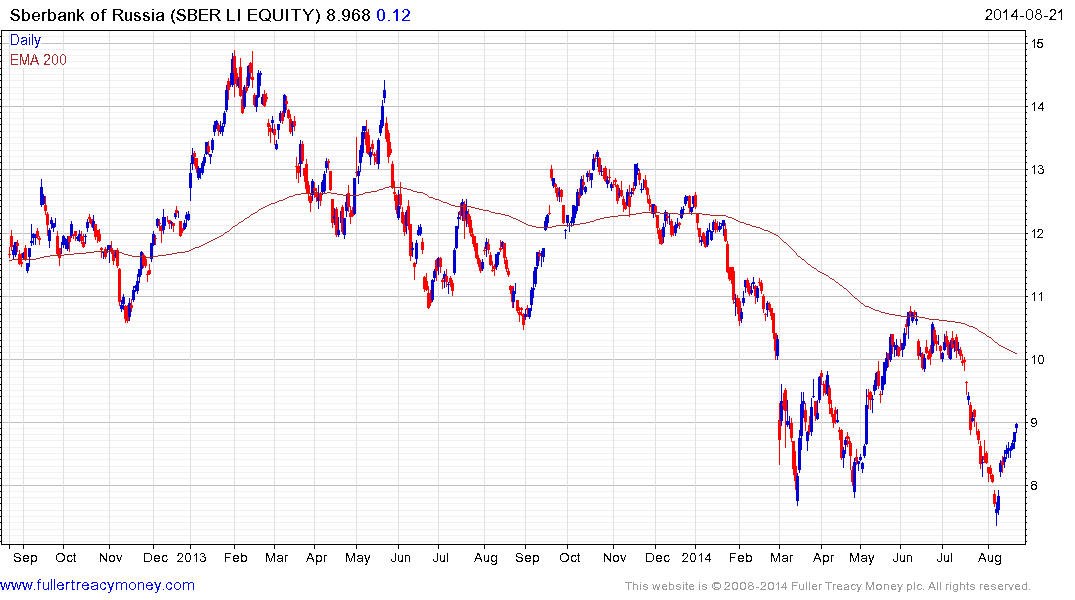

Russia’s Sberbank failed to sustain the break to fresh lows three weeks ago and continues to unwind the short-term oversold condition. It will need to sustain a move above $11 to confirm a return to demand dominance beyond the short term.