Hormel pork margins to dip, as hog prices plunge

This article from Agrimoney may be of interest to subscribers. Here is a section:

However, "pork operating margins are not expected to be as beneficial" in the current quarter, the last of Hormel's fiscal year, group chief executive Jeffrey Ettinger said.

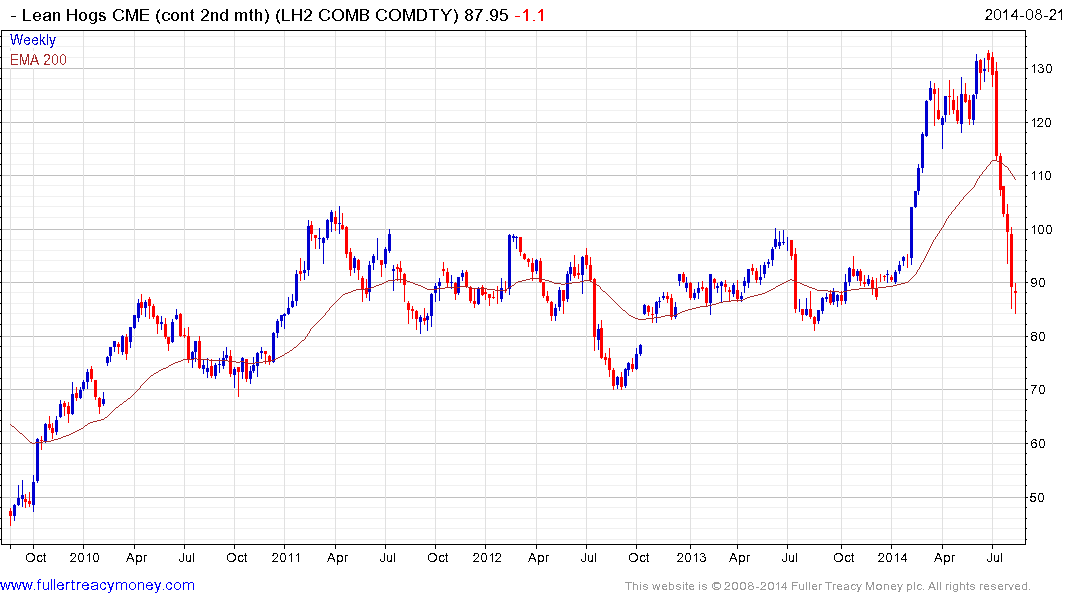

Although pork producers are benefiting from lower feed costs, thanks to weaker corn and soybean prices, lean hog values have tumbled from the record high of 133.80 cents a pound for Chicago's spot futures contract on July 10.

Chicago's current spot lean hog futures contract, October, stood at 91.425 cents a pound on Thursday, down 1.2% on the day and 32% below last month's all-time high.

Futures have been undermined in part by the Russian ban on imports of US agricultural products, but also because of high hog slaughter weights, boosting supplies at a time when the knock-on effects of high retail pork prices are amplifying a seasonal downturn in demand."Cash pork markets have been on a downtrend, in part because of seasonality but also because the higher prices have finally been passed on at the retail level," a report from Paragon Economics and Steiner Consulting said.

"Ham prices are significantly lower and how they perform in the next 60 days will likely set the tone for the entire hog complex in the fall months."

Lean hog prices gave up their entire advance for the year from early July and returned to test the $80 area which offered support on a number of occasions from 2011. Some steadying in this area is taking place and there is some scope for an unwind of the short-term oversold condition. However, the most likely scenario is for a return to a predominately rangebound environment that prevailed from early 2011.

Feeder Cattle failed to sustain the breakout to new highs at the beginning of the month and fell today to break the progression of higher reaction lows evident since early 2013. This action suggests at least a reversion towards the mean is underway.

.png)

Since feeder cattle was one of the strongest, corn one of the weakest commodities and one represents a source of demand for the other I thought it would be interesting to address the ratio. Following consecutive weeks to the upside Feeder Cattle hit at least short-term peak relative to Corn last week suggesting a return to relative outperformance by grains and beans is underway.

.png)

Corn continues to steady in the region of 350¢.

.png)