New Infrastructure Themes and Top Ideas

Thanks to a subscriber for this report from Deutsche Bank highlighting the growth potential in new technology infrastructure. Here is a section:

A core insight in our theme report is the meaningful shift in spending priorities that our primary research notes at Hyperscale Clouds, Enterprises, and Service Providers. In particular, we highlight +50% Y/Y capex intensity at major Clouds for Terabit Scale Optical Interconnects; required for running Web Scale Applications such as Google Maps, Azure Cloud, AWS, GCP, etc.

A corollary insight is the accelerating IT demand for Software and SaaS based tools for Network and Application Analytics, AI and Machine Learning, and Automation tools – for “structurally lowering” the costs of running complex IT infrastructures at Hyperscale Clouds, Large Enterprises, and Carriers.

A case in point is CSCO “doubling down” on Security, Analytics, AI/ML, and Automation Software capabilities (Meraki, AppDynamics, Jasper, Tetration, etc) to drive incremental Top Line and EPS growth through a “recurring revenue” model – laddering upon CSCO’s +250B networking installed base.

Here is a link to the full report.

There is a lot of tech-speak in this report but the three main themes it is promulgating are the growth and increasing sophistication of cloud computing, the growth of fibre optics where Terabit speeds are potentially possible and the rollout of 5G mobile networks.

Most of what has made headlines in the technology sector over the last decade has been software related. In fact the pinnacle of this reliance on other company’s infrastructure might be Snap’s IPO. The company runs none of its own infrastructure, at least so far, and has instead chosen to outsource everything from managing the backend to client acquisition to third parties like Google and Amazon. However software relies on hardware and infrastructure to grow and if the aspirations of companies that depend on it like Netflix and Facebook are going to be realised then major connectivity investment needs to take place.

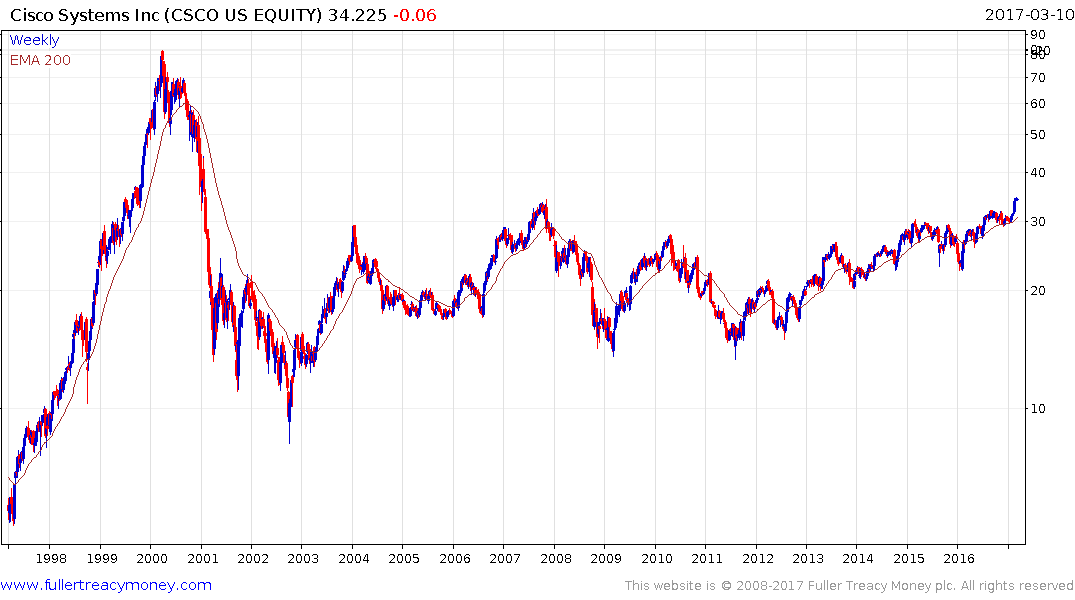

Cisco is well placed to benefit from that trend, just like it did in the 1990s. The share has held a mild upward bias, within a long-term base formation, since 2011 and has successfully broken above the psychological $30. A sustained move below that level would be required to question medium-term recovery potential.

Corning has a similar long-term pattern and is rapidly approaching its 16-year highs.

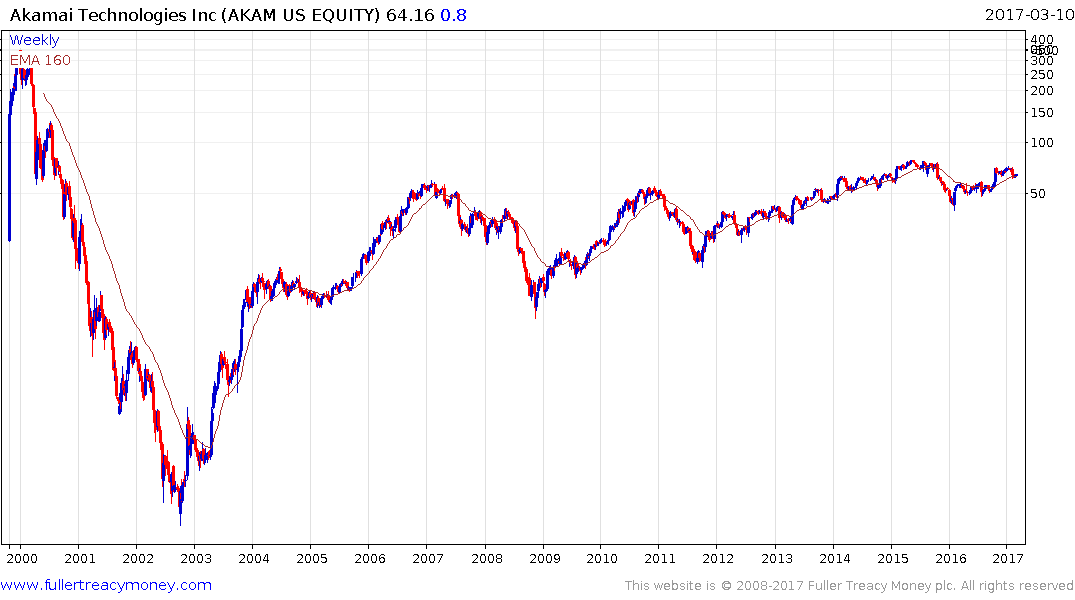

Akamai Technologies experienced a deep pullback in 2015, which broke a five-year progression of higher reaction lows. However it rallied impressively over the last year and is now testing potential support in the region of the trend mean.

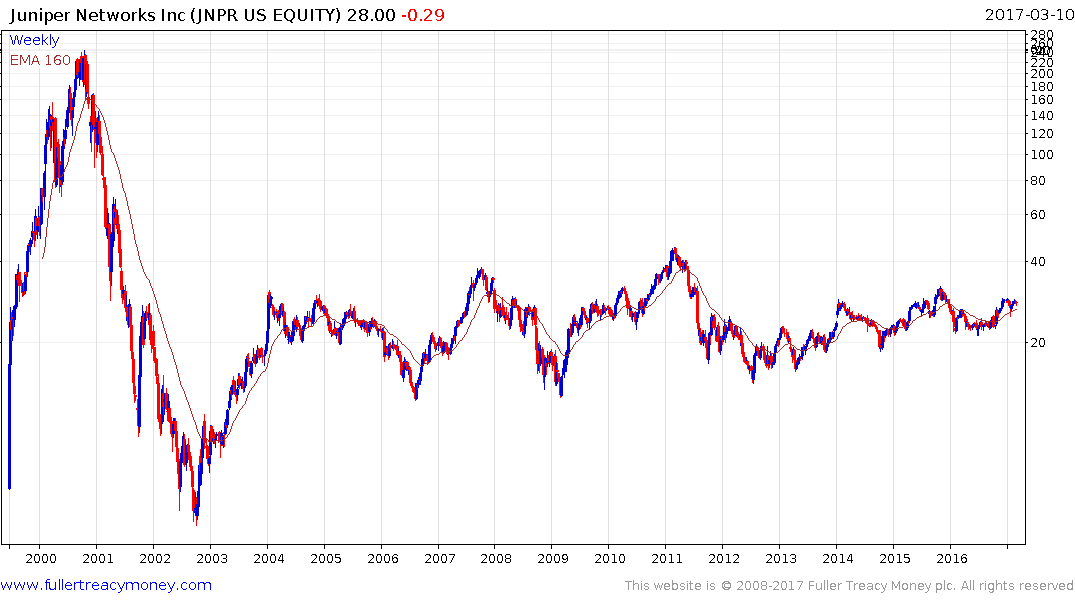

Juniper Networks has been drifting for sixteen years but has held an upward bias, despite some acute bouts of volatility, since 2012.

Arista Networks IPOed in 2014 and broke out to new highs late last year. It surged higher in January and a sustained move below the trend mean would be required to question medium-term upside potential.

Keysight Technologies was spun out from Agilent Technologies in 2014. The share has been trending higher for the last year and is now challenging its post IPO high near $40.

Ciena Corp pulled back from the upper side of a five-year range this week and will need to hold the region of the trend mean, near $22.50, if medium-term scope for continued upside is to be given the benefit of the doubt.

Infinera trended lower for a year before posting an upward dynamic in December on a better outlook for this year. The share needs to hold the $9 if recovery potential is to be given the benefit of the doubt.