The Pound

The British Pound has been in a reasonably consistent downtrend against the US Dollar since 2014, defined by a staircase sequence of ranges mostly one below another. The present range has unwound the majority of the oversold condition relative to the trend mean and with the impending activation of Article 50, the question of whether the low near $1.20 is going to hold must be to the fore of many traders’ minds.

The Internal dynamics of the range, with clear upward dynamics from the lower side of the range and declines being slower is a positive signal that $1.20 represents a level at which people are willing to initiate long positions in size. Nevertheless, a sustained move above the trend mean will be required to challenge medium-term downtrend consistency.

Against the Euro, the Pound failed to sustain the break below €1.15 and rallied back to test the €1.20, which then coincided with the region of the 200-day MA, by December. It paused in the region of the trend mean again three weeks ago. The rate dropped back through €1.15 today and is now approaching the region of the mid-January low. If potential for support building it to be given the benefit of the doubt then it will need to find support soon.

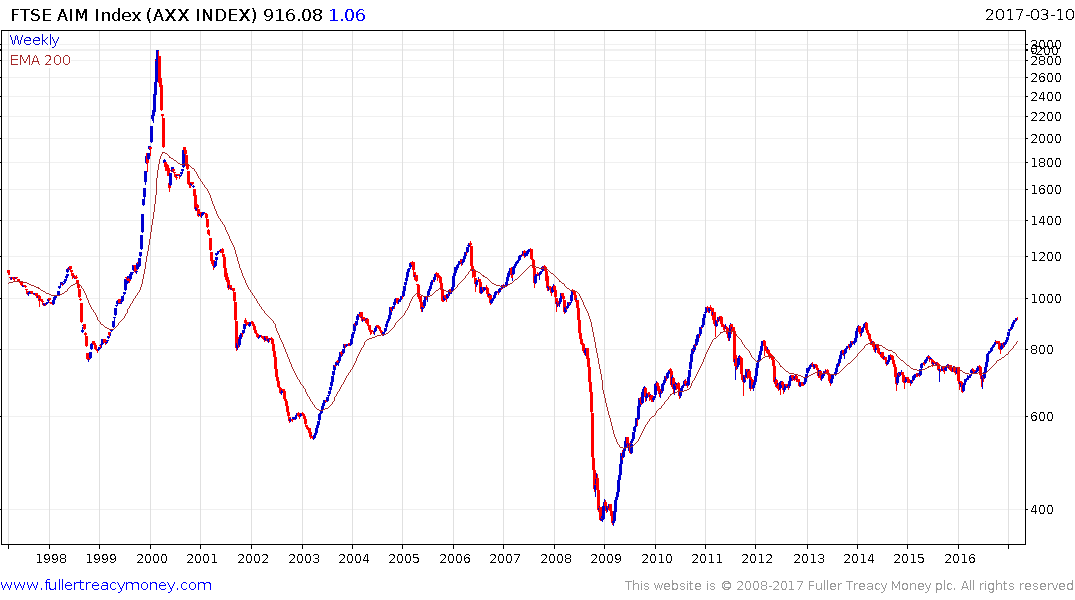

The implication of the Pound’s weakness has been particularly beneficial, at least nominally, for small caps. The AIM100 Index has been trending higher since early 2016 and the pace of the advance picked up ahead of the Brexit vote. The Index is now testing its 2011 peak and a clear downward dynamic would be required to check momentum beyond a pause.