Heightened fragility in Indonesia, Malaysia, and Thailand

Thanks to a subscriber for this report from Deutsche Bank which may be of interest. Here is a section

Just as growth is slowing, currencies are weakening, compounding the debt service difficulties of those with external currency obligations. Indeed, looking at the ratio of central bank reserves to gross external financing (defined as the sum of current account balance and debt due this year), Indonesia and Malaysia have the worst external metrics in Asia. Consider a typical commodity producer in Indonesia or Malaysia with external currency debt, facing a 50% decline in the price of exports and a 15% depreciation of the exchange rate.

Clearly the pressure on profitability would be substantial and debt sustainability risk would rise. We understand that Indonesian exporters have been nudged into increasing their hedge ratios in recent years, which may mitigate their difficulties to some degree, but if the exchange rate continues to slide into uncharted territory, systemic stress is bound to emerge.

The traditional metric of looking at an economy's reserves cover is gross international reserves in months of imports. What we do below however is apply a stricter criterion. Instead of gross reserves, we estimate usable reserves, i.e. excluding gold, SDR, IMF assets from the gross figure and netting out the central bank's forward position. Indonesia and Malaysia, using this metric, end up with around 7 months of imports. Malaysia in particular looks vulnerable to capital outflow as its reserves cover has been declining steadily. A study in contrast is India, which has improved its reserves cover considerably, rising markedly from the same level as Indonesia?" just two years ago.

Here is a link to the full report.

Developing ASEAN markets were among the first to bottom in 2008 and were already retesting their highs when Wall Street bottomed. They were also among the best performers in the subsequent few years but have been underperforming for two years. They had no exposure to the US housing market and had very little debt. Improving governance, an expanding middle class, relatively steady commodity prices and abundant global liquidity all contributed to their pre-eminence. So what changed?

The countries were very sensitive to foreign investment flows not least as the US Dollar trended lower and global liquidity surged. Such large infusions of investment capital often cause growing pains with asset price inflation and demands for higher wages impacting competitiveness. Commodity price weakness, overinvestment in additional commodity supply, a strengthening Dollar and foreign currency denominated loans have all contributed to the difficult environment currently evident across the region. China entering the competitive devaluation fray represents an additional challenge.

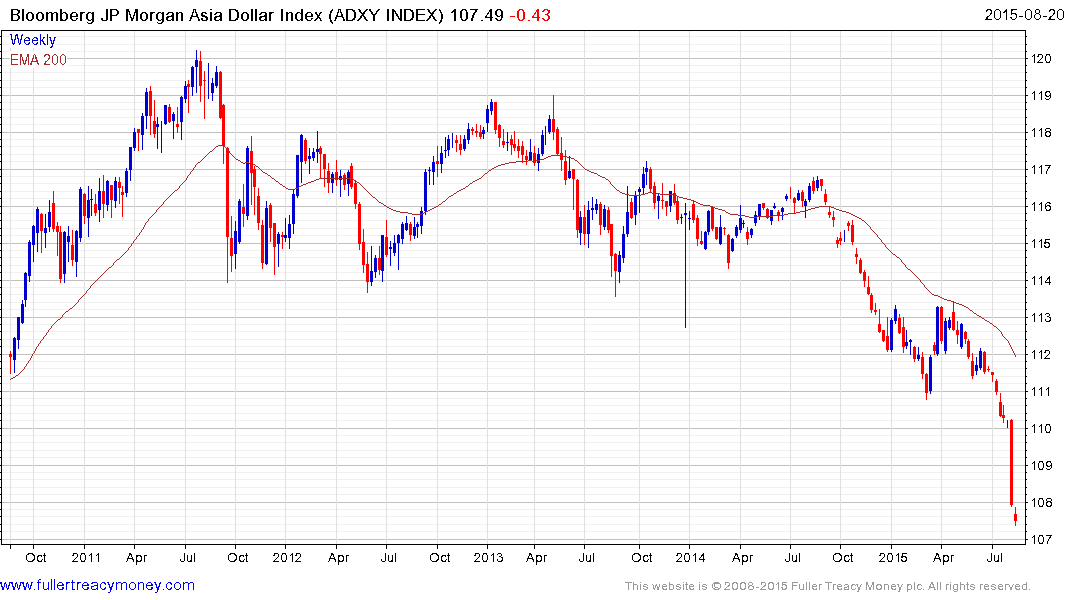

All of these factors will eventually converge to create a more competitive environment for these countries, but in the meantime their currencies are accelerating lower. The Asia Dollar Index is short-term oversold but there is no evidence just yet that support has been found.

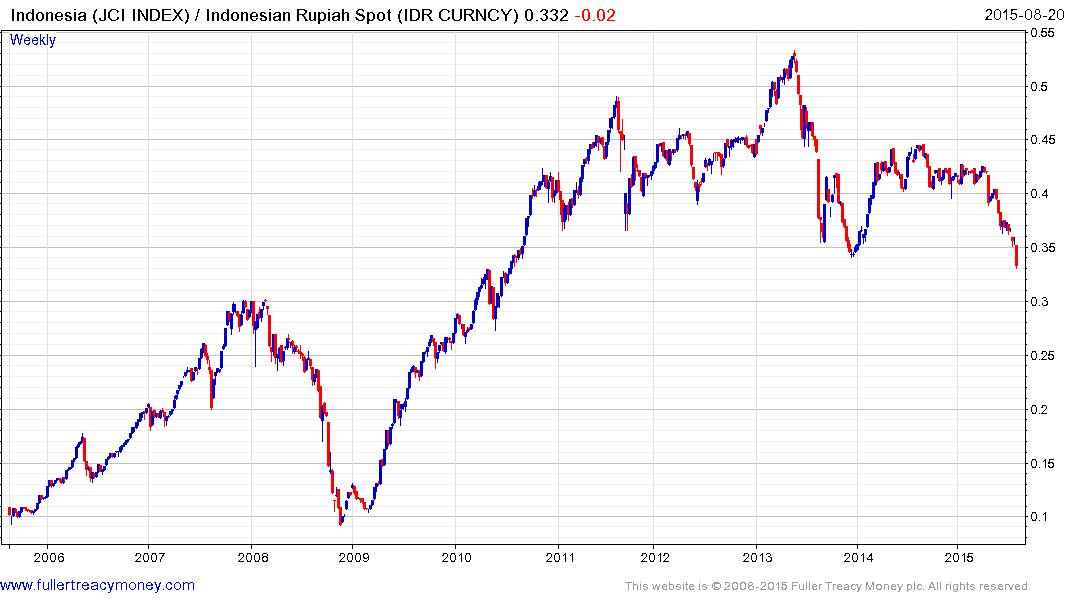

These charts of the Indonesian, Malaysian and Thai markets redenominated to US Dollars highlight just how much of an effect their respective currencies have had both on the upside and more recently on the downside.

At The Chart Seminar we often talk about leaders leading for a reason and leaders leading in both directions. The fact that ASEAN is now underperforming is not a bullish consideration for the wider market. This not a case of the tail wagging the dog but rather that small open markets are sensitive to liquidity flows and as such may be lead indicators.