Exxon Triples Share Buybacks to $30 Billion as Profits Soar

This article from Bloomberg may be of interest to subscribers. Here is a section:

Exxon Mobil Corp. tripled its share-buyback program to as much as $30 billion after profits surged amid Russia’s invasion of Ukraine and a rally in worldwide energy prices.

The repurchases will be made through the end of next year, Exxon said in a statement on Friday. The oil giant more than doubled first-quarter adjusted net income to $8.8 billion, or $2.07 a share, lagging estimates by 17 cents.

Chief Executive Executive Darren Woods cited a dip in output from oil and natural gas wells stemming from adverse weather and other factors. Exxon rose 0.3% to $87.43 at 9:33 a.m. in New York.

The oil giant took a $3.4 billion writedown due to its planned exit from its Sakhalin-1 operation in Russia, compared with a previously announced estimate of as much as $4 billion. The company declared force majeure at the venture earlier this week and curtailed crude production.

Exxon follows TotalEnergies SE and Chevron Corp. in posting first-quarter results. The French oil titan pledged to buyback as much as $3 billion in shares before the end of June while Chevron disclosed its biggest profit in almost a decade.

In an environment where pandemic padding of balance sheets in the tech sector rapidly wearing thin, the energy sector hasn’t had a year this good in decades. In times of uncertainty, when interest rates are rising and geopolitical threats are mounting, the reliability of strong cashflows, rising dividends and a thinning supply of stock will be welcomed by investors.

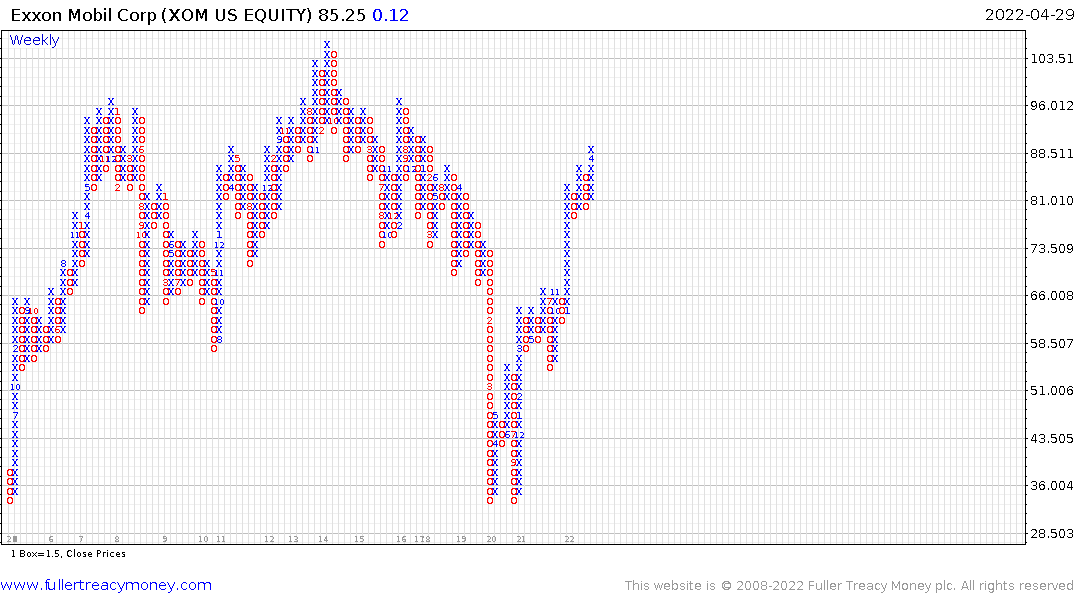

Exxon Mobil currently yields 4.12%. The share has been rangebound for the last couple of months but continues to sustain the medium-term upward bias. The Energy SPDR shares a similar pattern.

Exxon Mobil currently yields 4.12%. The share has been rangebound for the last couple of months but continues to sustain the medium-term upward bias. The Energy SPDR shares a similar pattern.

.png) Brent crude oil continues to bounce from the $100 area but will need to sustain a move above $115 to confirm a return to demand dominance beyond short-term steadying. Despite the tailwind of Russian sanctions, crude oil faced a challenge from slowing global demand. That’s one of the primary reasons OPEC is unwilling to increase supply. They are worried the price would collapse if supply increased amid a global slowdown.

Brent crude oil continues to bounce from the $100 area but will need to sustain a move above $115 to confirm a return to demand dominance beyond short-term steadying. Despite the tailwind of Russian sanctions, crude oil faced a challenge from slowing global demand. That’s one of the primary reasons OPEC is unwilling to increase supply. They are worried the price would collapse if supply increased amid a global slowdown.