Bank of Russia Rejects Ruble-Gold Peg Idea, Differs With Kremlin

This article from Bloomberg may be of interest to subscribers. Here it is in full:

Bank of Russia Governor Elvira Nabiullina dismissed the idea of pegging the ruble to gold after the Kremlin said it was a proposal under consideration.

“It is not being discussed in any way,” Nabiullina told reporters at a briefing Friday after the central bank cut the key interest rate by 300 basis points. The ruble must continue to have a floating exchange rate, she said, though volatility of the currency will be higher amid capital controls imposed after Russia began its invasion of Ukraine.

Her comment appeared to contradict President Vladimir Putin’s spokesman, Dmitry Peskov, who said earlier Friday that “this question is now being discussed.” Peskov pointed to comments by Security Council Secretary Nikolai Patrushev on linking the currency to gold and other commodities in an interview with a state-run newspaper this week, while offering no further details.

Unprecedented sanctions on Russia’s central bank over the invasion of Ukraine deprived it of access to about half of its holdings, leaving it in possession of only gold and yuan. Before the war, Putin repeatedly argued that Russia needs to cut dependence on the dollar as a global reserve currency.

Speculation has been rife that sanctions on Russia may herald a far-reaching shift that could bolster bullion. Analysts like Credit Suisse Group AG’s Zoltan Pozsar predict that the seizure of the central bank’s foreign exchange reserves will result in a new monetary paradigm where gold plays a greater role.

Speaking with Rossiyskaya Gazeta, Patrushev said experts are examining proposals to back the ruble’s value with gold and other goods as part of an alternative system of finance that guarantees a measure of sovereignty and reduces the link to the dollar.

Continuing a multi-year effort to reduce exposure to the U.S. currency, the Russian central bank cut the share of dollars in reserves to 10.9% as of Jan. 1 from from 21.2% a year earlier. Gold was down slightly at 21.5%.

Until the invasion of Ukraine forced Nabiullina to enact capital controls, the ruble was allowed to trade freely since 2014, its value determined by the market.

Demanding payment for commodity exports in Rubles is a major escalation of the stress Russia is imposing on the EU and the rest of the world. China speaking of its relationship with Russia as a new model for world order is an additional signal that conditions are not about to go back to the pre pandemic equilibrium.

The Russian administration is very likely talking about a gold or commodity-backed Ruble even if the central bank is not all that keen. They want to break the petrodollar system. That’s not a new development, Russia has been ill at ease with accepting Dollars for its exports for years. That aim is complicated by the fact the USA is now effectively energy independent which makes it all the more urgent.

The Russian bet is that by acting today to damage the supremacy of the Dollar in international trade they can pressure the finances of the US government and its massive debt load. Yields have certainly rallied aggressively since the invasion and that has helped to support the Dollar. We are accustomed to seeing competitive currency devaluation but perhaps what we are seeing today is competitive currency appreciation between the USA and Russia.

The Russian Ruble is among the strongest currencies in the world at present; having rallied impressively from the post invasion lows. The central banks lowered rates by 300 basis points today which is a sign of confidence in the currency’s ability to remain stable. Meanwhile international demand for Russia exports remains robust because they are trading at such wide discounts.

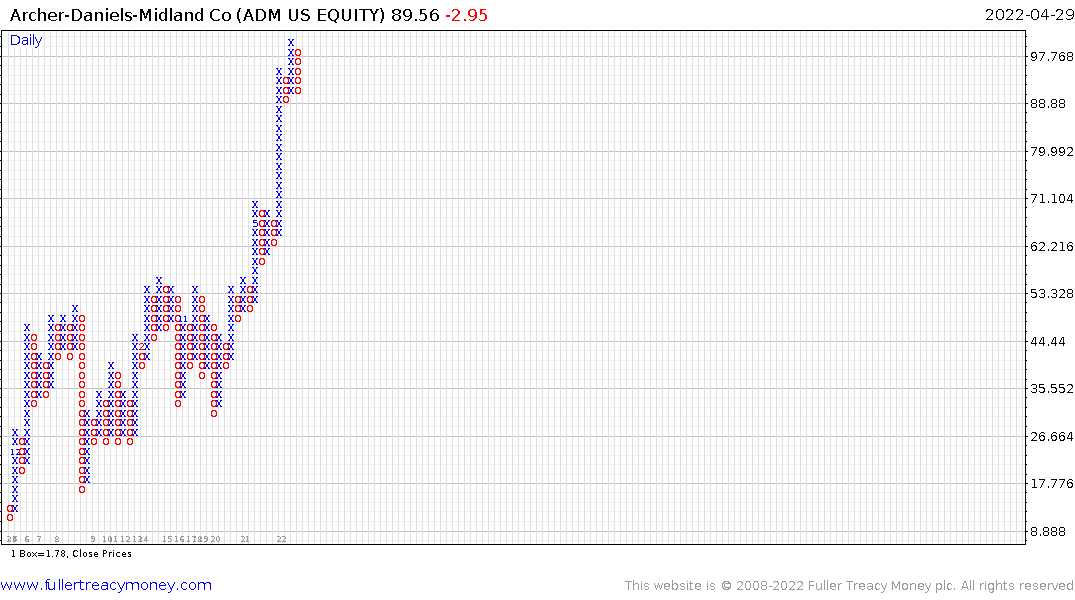

Russia has scope to pursue the war in Ukraine for the lengthy medium term. The ill effects from cutting off Europe from natural gas supplies have a long tail and will be particularly worrisome next winter. Meanwhile ADM’s CEO had this to say in the recent earnings call:

"We are already tight from a supply-demand perspective and we will get tighter as demand continues to grow," ADM Chief Executive Juan Luciano said during a conference call with analysts.

"We need two very good seasons of crops in North America and South America to ... become more comfortable in those supply-demand imbalances."

Together with Indonesia’s ban on Palm Oil exports, we can expect food prices to remain elevated.

Low growth and high inflation are the recipe for stagflation.

Back to top