Email of the day on the investment outlook for the Eurozone

The failings of the IMF described in this article read as if an unfriendly journalist is lashing out, but the criticisms were made by the IMF's own oversight committee. Here are some extracts: "The International Monetary Fund’s top staff misled their own board, made a series of calamitous misjudgments in Greece, became euphoric cheerleaders for the euro project, ignored warning signs of impending crisis, and collectively failed to grasp an elemental concept of currency theory." "This is the lacerating verdict of the IMF’s top watchdog on the fund’s tangled political role in the eurozone debt crisis.." and "the whole approach to the eurozone was characterised by ‘groupthink’ and intellectual capture. They had no fall-back plans on how to tackle a systemic crisis in the Eurozone” or how to deal with the politics of a multinational currency union – because they had ruled out any possibility that it could happen." None of this surprises me and I guess many subscribers living outside the eurozone will have the same reaction. I/we do not expect any better from the IMF when the next Eurozone crisis strikes the continent. So what do we do to protect ourselves? Here are my thoughts For those living within the eurozone some form of currency hedge would appear wise (gold, other currencies, other stock markets). I live and invest outside the eurozone (thankfully) so I am wary of eurozone stocks for currency loss reasons and I am rather expecting money to flow to the US dollar and US stocks in coming years (and maybe UK to some extent). But that is speculation so I watch the charts carefully. I would love to know, if you had foresee the future is your thinking very different?

Thank you for this educational article. When I first became interested in crowd psychology 20 years ago the aspect that most intrigued me was crowds become more emotional and less rational as they grow and as a result are tolerant of contradiction. I think if we are honest with ourselves each of us has had a self-destructive episode at some point in our lives. We might even have been aware of it at the time and yet we do it anyway.

It’s not as if people didn’t know the risks of creating a currency union without fiscal union when the Euro was created. However the desire to drive the political agenda coupled with a hunger for larger markets and cheaper credit propelled the hope that everything would be alright in the end. This report highlights the fact that the IMF was complicit in this fiction until at least 2011.

We all wish to learn from our mistakes but the reality is that the bigger point is to know when to employ the lessons learned. The rules about forcing depositors and junior bond holders to be wiped out before recapitalisation would have been prudent to employ before the imbalances that have evolved as a result of the creation of the Euro. It is an altogether different question whether it is a good idea today.

Insisting on monetary and fiscal probity as a way of trying to fix a problem is not a recipe for a quick resolution. Since we are 6 years into the Eurozone’s sovereign/banking crisis I think everyone now understands that. However the real question is whether the EU bureaucracy is willing to accept this conclusion. How the recapitalisation of Italian banks is handled will be a very clear signal to the market of how realistic they are willing to be.

An important point is it is still very much in the interests of Germany to have the Euro. Without it a new Deutsche Mark could be 50% above where the Euro trades today and that would have dire consequences for Germany’s major exporters. Those same companies benefit enormously from being able to conduct business in their base currency. The fact that the potential write-down of Greek debt was delayed until after the German elections in 2017 suggests politicians believe German taxpayers are not willing to indulge their export sector’s priorities if it means additional bailouts of the perceived profligacy of peripheral nations.

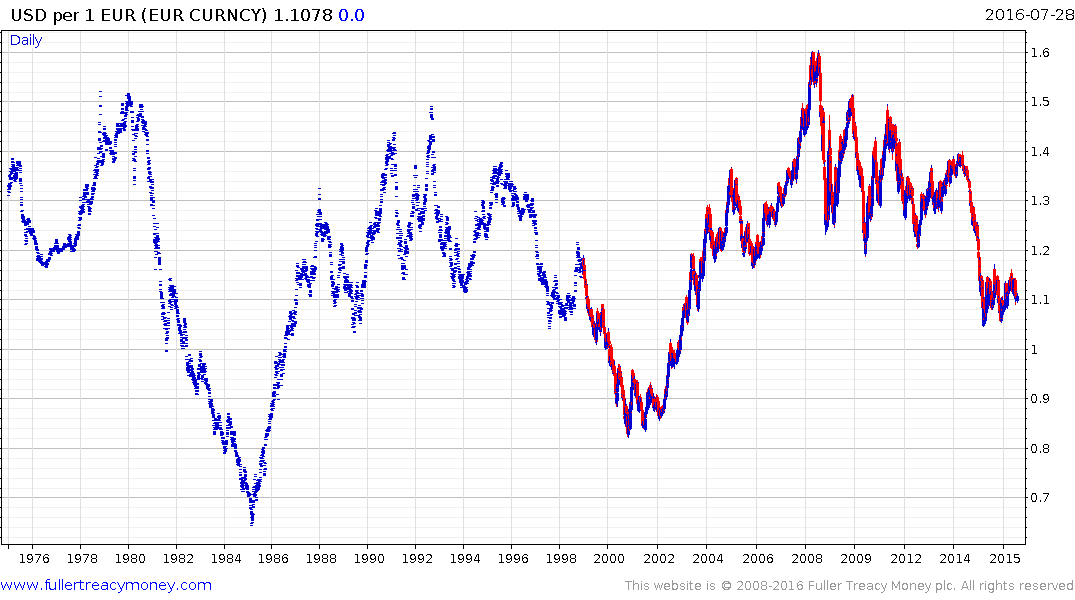

The ECB is not only printing money, buying bonds, reducing collateral demands but has also been vocal in saying that fiscal stimulus is required if growth is to be achieved. The classic way for debtor nations to recover lost competitiveness is with currency devaluations. Without that pressure release valve they face prolonged, and we are taking decades long, fiscal consolidation, where regulatory prudence and political stability are essential. Therefore it is easy to see why currency devaluation has always been the preferred option.

With the Euro, fiscal cohesion is not an option so occasional bailouts or, perhaps it would be more appropriate to call them what they are, transfers are necessary. That means debtor nations’ best case scenario is a boom bust economic model where reliance of creditor nations is essential. It is looking increasingly likely that hard pressed populations are unwilling to accept that fate.

In much the same way that globally oriented businesses benefitted most in nominal terms from the post Brexit devaluation, the same is likely true of Eurozone exporters in the event the Euro breaks apart. The exception would be German shares whose currency would likely rise, thus decreasing their international pricing power. .I think it is important to point out that the question of Eurozone integrity is not about to be addressed in the short-term. It took more than two decades to form and we can expect years of volatility as the eventual resolution unfolds.

The Euro Stoxx 50 Index is now testing its medium-term progression of lower rally highs but will need to break back above the trend mean to signal a return to medium-term demand dominance.

Against the background of continued uncertainty I agree Wall Street represents a more attractive medium-term investment prospect.

Back to top