Platinum takes limelight from gold with best month in four years

This article by Eddie van der Walt and Ranjeetha Pakiam appeared in Mineweb. Here is a section:

The two lesser-known precious metals, used in devices that control toxic car emissions, are benefiting from better auto sales in China, concern over labour in South Africa and loose monetary policy from central banks around the world.

“Platinum and sometimes palladium occasionally get dragged along by gold, but here we’re also seeing internal market dynamics playing in their favour,” David Wilson, an analyst at Citigroup in London, said by phone.

Analysts have speculated that stricter legislation on vehicle pollution in China will raise demand in the long term. On the supply side, miners in South Africa, one of the biggest producers of the metals, are in wage talks with unions. In the past, labour strikes in the country curbed output.

Platinum rose 0.9% to $1 146.40 an ounce by 11:59am in London, touching the highest in more than a year. It now leads gold for the year with a 29% gain compared with bullion’s 26%.

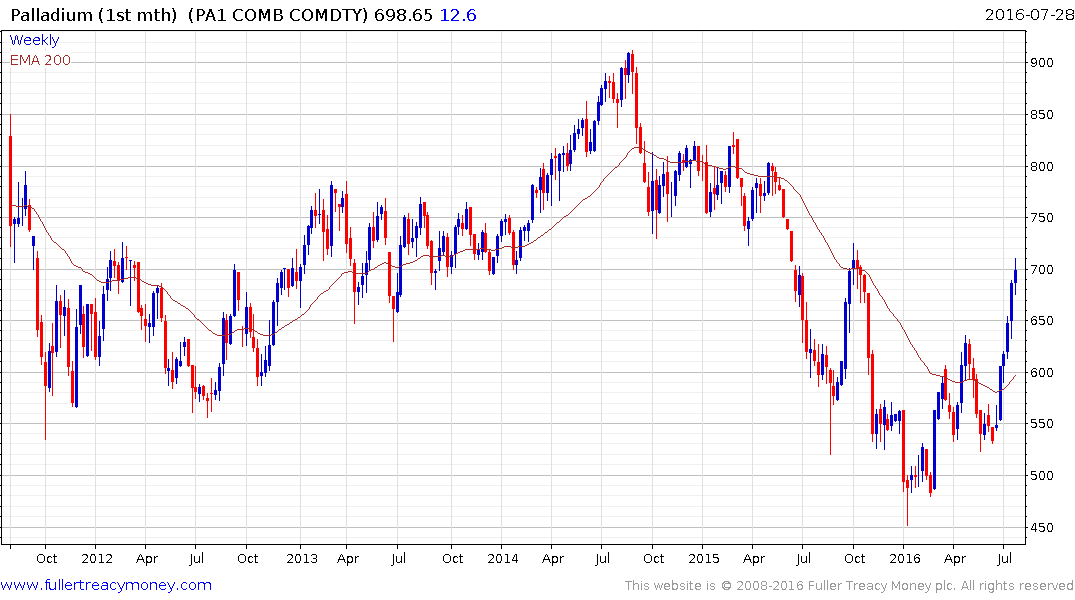

Palladium added 0.1% to $702.15 an ounce on Thursday. It has risen in all but one of the last 17 sessions.

Net-long positions held by managed money on the Comex exchange have climbed for at least the past three weeks in both metals, exchange data showed as of last Friday.

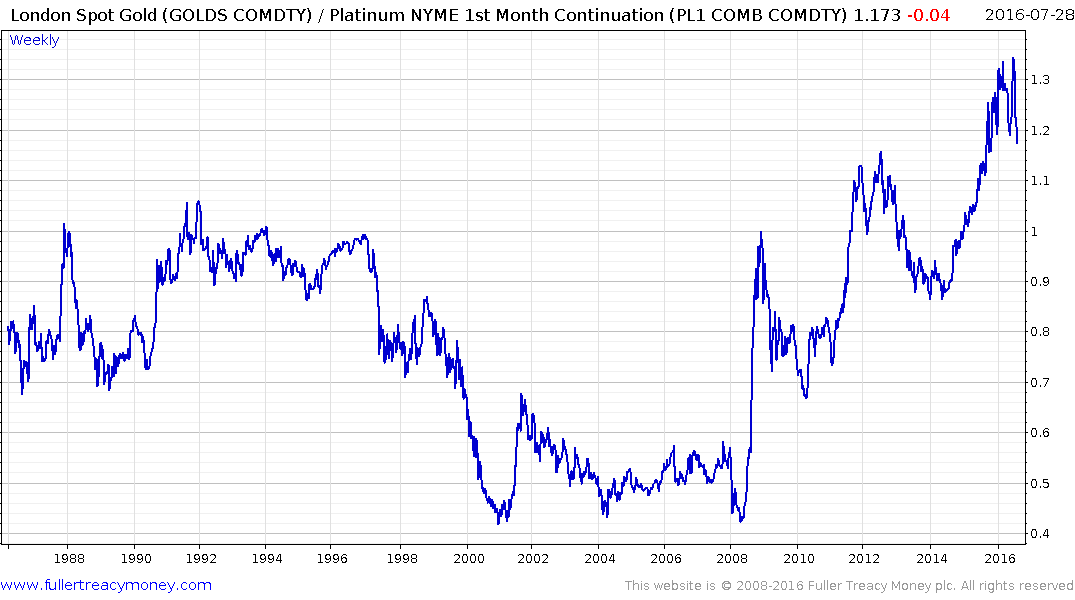

Platinum hit a medium-term low near $800 in January and has rallied impressively since, to at least partially close an historic undervaluation relative to gold. Platinum is denser than gold which helps to explain why platinum jewellery is more expensive; you need more of it to create the same piece. The fact it is rarer than the yellow metal also contributes to its appeal.

The bearish case rests on electric vehicles acting as a bearish catalyst for platinum and palladium since they do not require catalytic converters which accounts for the majority of demand. I have sympathy with this argument considering how much capital is being poured into development of new batteries and a network of charging stations. However it is a medium to long-term consideration since electric vehicles represent a small sliver of new sales today.

Against that background the prospect of acrimonious pay disputes at South African mines, continued desire for a safe haven in the form of an asset that cannot simply be lent into existence and its relative discount to gold are all more important factors right now.

The price partially unwound a short-term overbought condition, by forming a tight range below $100 for most of this month, before breaking out Wednesday. A sustained move below $1060 would now be required to question medium-term scope for continued upside.

Palladium has been rallying for six consecutive weeks and pushed through the $700 area today. While increasingly overbought in the short-term, a clear downward dynamic will be required to check momentum beyond a brief pause.

The FTSE//JSE Platinum Mining Index also broke out this week. Sibanye Gold, whose management appear to have a knack for timing, got into platinum mining at just the right time. The share has jumped higher since late June and a clear downward dynamic would be required to check the advance.

A return to outperformance by platinum has the potential to act as a lead indicator for the gold price.

.png)