Don't panic about high-yield defaults

Thanks to a subscriber for this report from Deutsche Bank which may be of interest. Here is a section:

An alternate view is that US high yield, with or without the commodities sector, remains within the trading range we have seen since 2010. The European market is similar. In other words, high yield has been behaving much as it has throughout the post-financial crisis period which has witnessed several episodes of major market stress. These include Greece in 2010, the US rating downgrade in 2011, the eurozone crisis in 2011/12, and the China equity meltdown in August 2015. During these periods, high-yield spreads gapped out as investors feared a re-run of the 2008-09 experience when spreads and defaults soared.

This time around, things are a bit different in that spreads have widened on account of macro concerns combined with genuinely higher defaults in the energy and materials sectors (Figure 2). Investors must distinguish these two issues. Sure, macro concerns do keep mounting – prominent on the radar recently are US growth slowdown, China devaluation fears, slumping commodity prices, health of emerging market economies, European banks, the shift to negative interest rates and Brexit. But the view on the broader highyield market should have very little to do with the commodity cycle or the longevity of the recovery. Rather, it should have everything to do with whether one believes policymakers will keep muddling through or if they are about to make an error that plunges the global economy into another 2008-09 crash.

If one believes policymakers will not make a significant blunder then high-yield is probably not on the verge of a default debacle, even if macro risks are on the rise. Even in the event of a major crisis, it is likely defaults will not reach the levels of recent cycles. Looking closely at past credit cycles provides some useful lessons.

Since 1970 there have been four major default cycles and one minor one in the mid-1980s (Figure 3). Note that while the default rate has averaged about four per cent over these 45 years, it is not a mean-reverting relationship – default rates are either low or high. Some have warned that hitting four per cent is an ominous sign beyond which defaults will likely keep rising much higher. However, the four per cent default level was breached thrice in the 1980s and again in 2012 without significant further increases. There is nothing sacrosanct or cataclysmic about hitting four per cent; every cycle has to be evaluated on its merits.

The business and default cycles of the past 45 years have mostly shared two broad characteristics – the Treasury yield curve has flattened and inverted and there has been explosive growth in corporate debt other than bonds. In the past three cycles a third factor has been asset bubble conditions in one or more sectors which caused these cycles to be particularly vicious. None of these three conditions conclusively exists now.

Here is a link to the full report.

This is one of the most bullish reports on bonds I’ve seen in quite a while and thought subscribers would benefit from a fresh perspective. One argument I have also seen proposed which makes sense is that while low oil prices have been a harbinger of defaults in the energy sector, the rebound will remove some of the pressure so the pace of defaults might be lower that currently priced in.

BB spreads over Treasuries have almost completely unwound the overextension relative to the trend mean. A progression of higher reaction lows has been evident for over a year and if the underperformance of high yield is to persist, the spread will need to find support near current levels.

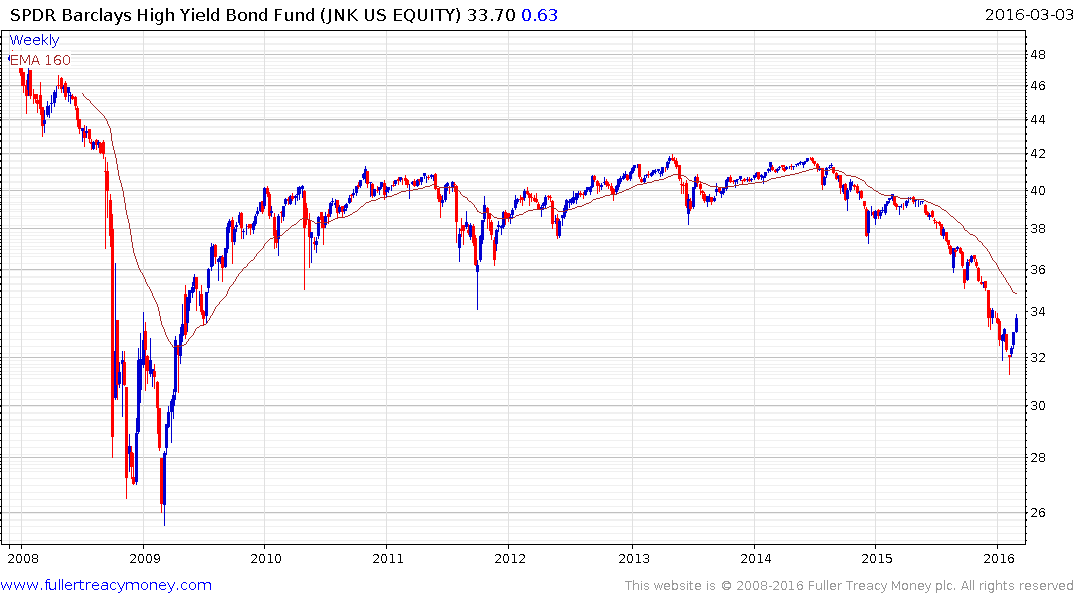

The SPDR Barclays High Yield ETF broke downwards from a lengthy Type-3 top in December. It continues to unwind its oversold condition relative to the trend mean but will need to sustain a move above $35 to begin to question the medium-term supply dominated environment.