Tesla's Getting More Rivals as VW Scandal Clouds Diesel Outlook

This article from Bloomberg may be of interest to subscribers. Here is a section:

Volkswagen, meanwhile, has made electric vehicles a linchpin of its plan for recovering from the crisis, accelerating a push to add 20 additional plug-in hybrid and battery-powered cars to its lineup by 2020. That includes the first battery-powered vehicle for the Porsche sports-car brand as well as an electric Audi crossover. And it’s promising new leaps in technology, including ranges of more than 500 kilometers (310 miles) by the end of the decade.

“Charging will only take as long as a coffee break,” instead of hours, Volkswagen CEO Matthias Mueller said in Geneva. “And in the long term, an electric car will cost less than a car with an internal combustion engine.”

Such technology advances will help electric cars eventually. But in the meantime, demand is tepid, with the clean-running vehicles accounting for just 0.68 percent of sales in western Europe, according to Automotive Industry Data Ltd. Much of that demand comes from Norway, where electric cars enjoy generous perks such as tax exemptions and free charging. In Germany, where there are limited benefits, just over 30,000 have been sold to date. Cheap oil prices provide little incentive for consumers to take the leap.

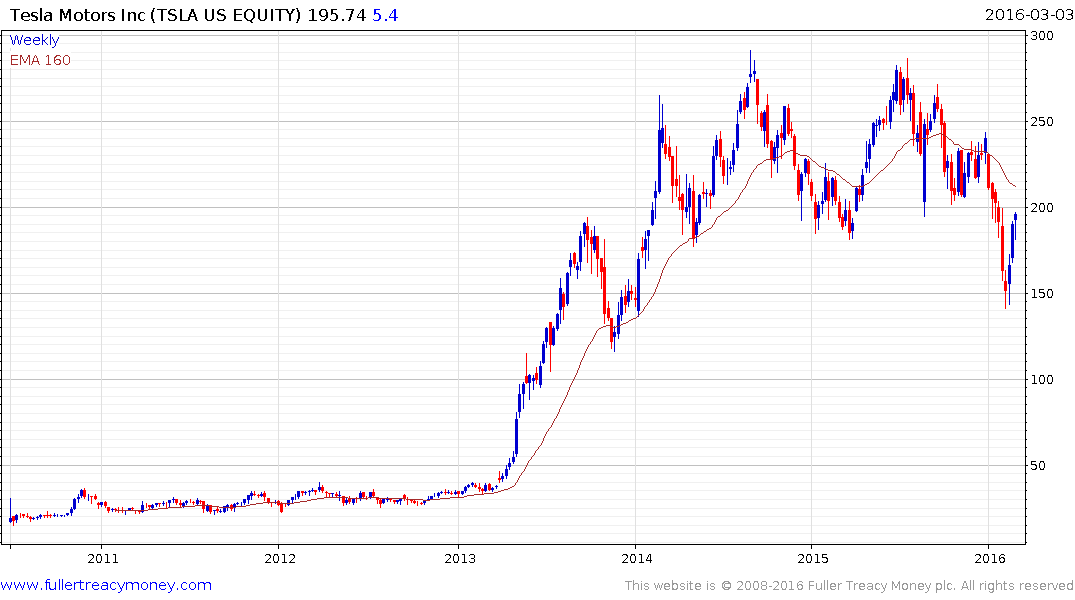

Tesla, more than any other company, has succeeded in making electric vehicles desirable. I personally have very little interest in cars but I have to admit that their marketing is having an effect on me and there is no denying I see a lot more Tesla’s on the road today than a year ago. News last week that Tesla is outselling other luxury cars in the USA is a wake-up call for its German competitors. This lends additional support for the argument that companies need to compete in the electric vehicle sector.

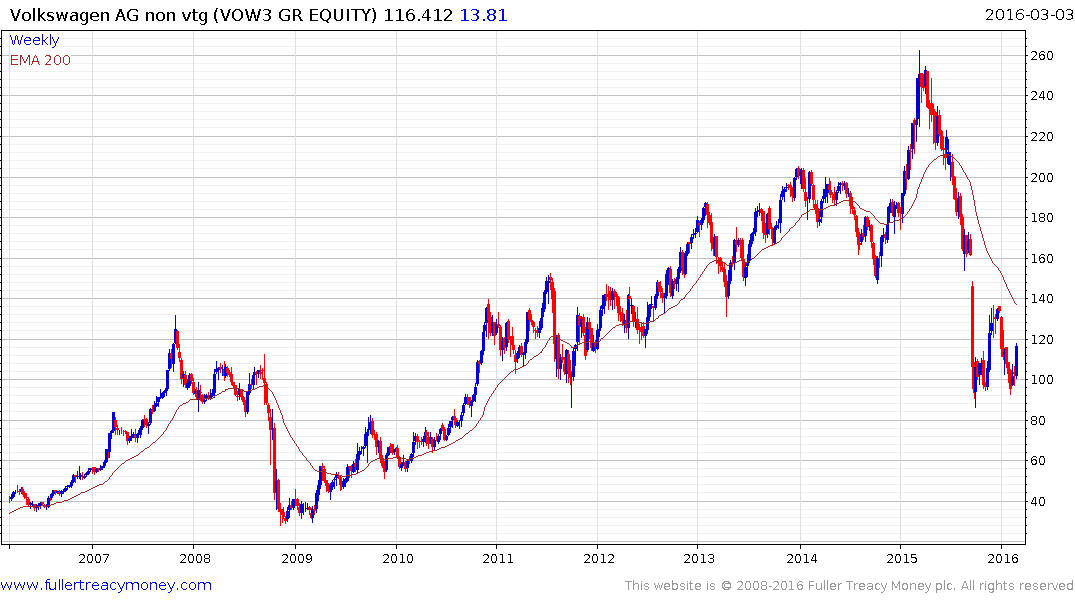

Volkswagen (Est P/E 6.21, DY 4%) has been adrift since the diesel cheating scandal broke, so the release of a vision for the future is a welcome development. The share is bouncing from the most recent test of €100 and a sustained move below that level would be required to question medium-term support building.

BMW (Est P/E 8.79, DY 3.5%) failed to sustain the break below the November lows and a sustained move back above the trend mean would enhance potential that a medium-term low has been found.

Tesla’s meteoric rise stalled when it announced plans to build a $5 billion battery plant in 2014. The first batteries are due to be produced from the 1st stage of the facility later this year or early next year. Interest is beginning to turn to where all the lithium is going to come from to feed the facility, which is expected to consume more than 10% of current global supply.

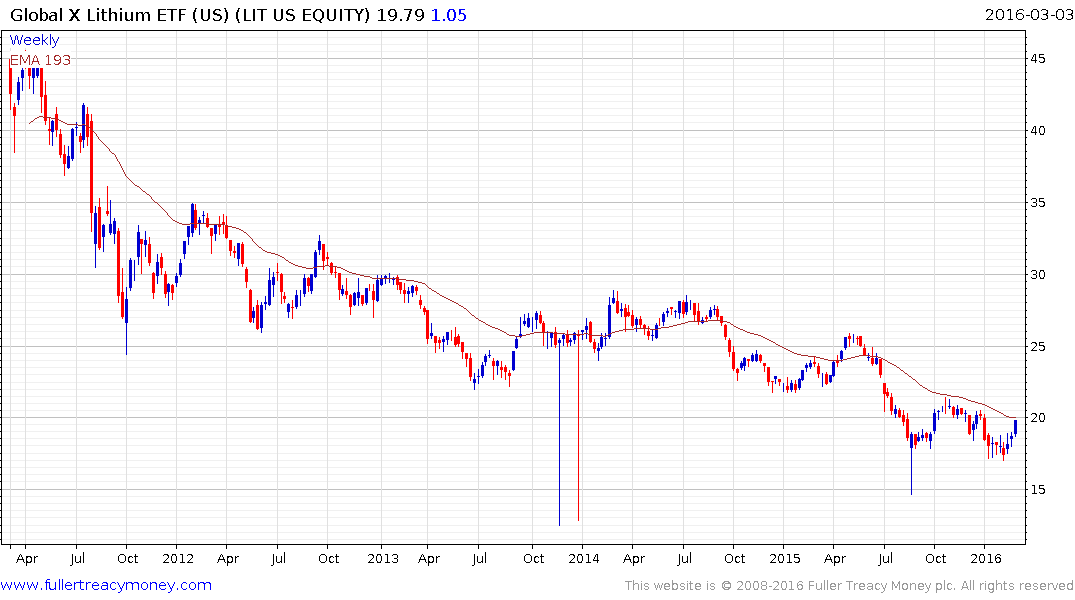

The Global X Lithium ETF which includes lithium miners and battery manufacturers is now testing the region of the trend mean and will need to sustain a move above it to confirm recovery potential.

South Korea listed LG Chem is currently consolidating in the region of the trend mean, having broken its medium-term progression of lower rally highs. It will need to continue to hold the KRW275,000 area if medium-term recovery potential is to be given the benefit of the doubt.