Daily iron ore mine closures in China mean Citigroup is bullish

This article by Jasmine Ng appeared in Mineweb and may be of interest to subscribers. Here is a section

Local suppliers in Asia’s largest economy are cutting production even as mills increase steel output on improved margins, according to analyst Ivan Szpakowski. An iron ore mine in China is being shuttered every day, with closures seen in all main producing regions, he said in an interview from Shanghai.

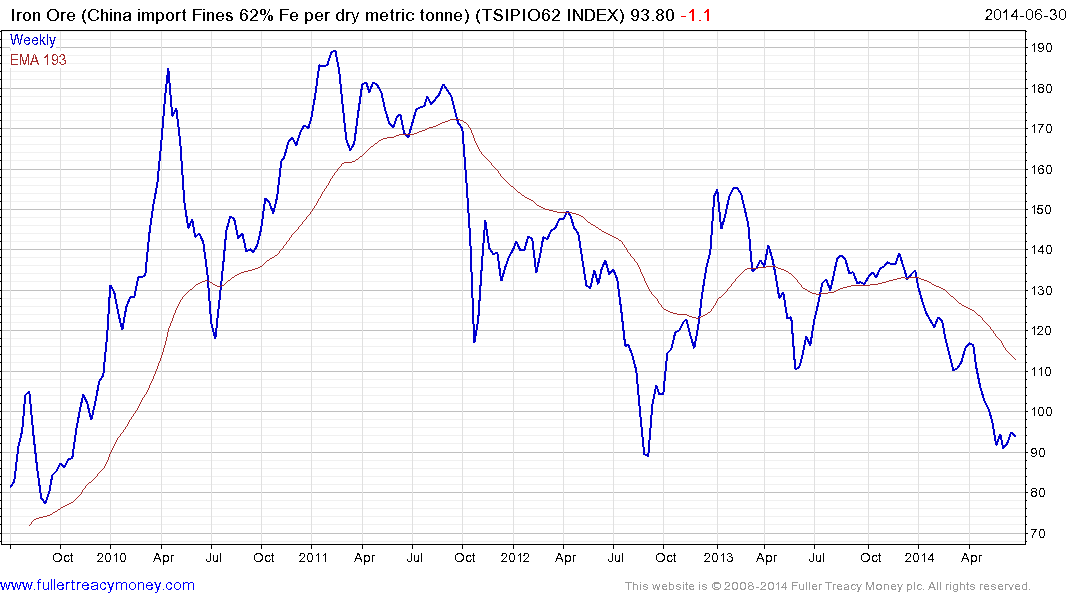

Producers in China, the world’s largest user, face a rising challenge of lower-cost supplies from BHP Billiton Ltd., Fortescue Metals Group Ltd. and Vale SA after the biggest miners in Australia and Brazil expanded output and spurred a global glut. While benchmark prices in China posted the biggest three- month loss since 2012, they rose 2.2 percent in June, the first monthly advance since November.

“We’re one of the most bullish people in the market,” said Szpakowski, reiterating a forecast for prices to average $100 a ton in the fourth quarter and $104 this year. “Imported ore is much cheaper than domestic ore, so the shift in buying has moved to imported ore. That’s supporting imported prices.”

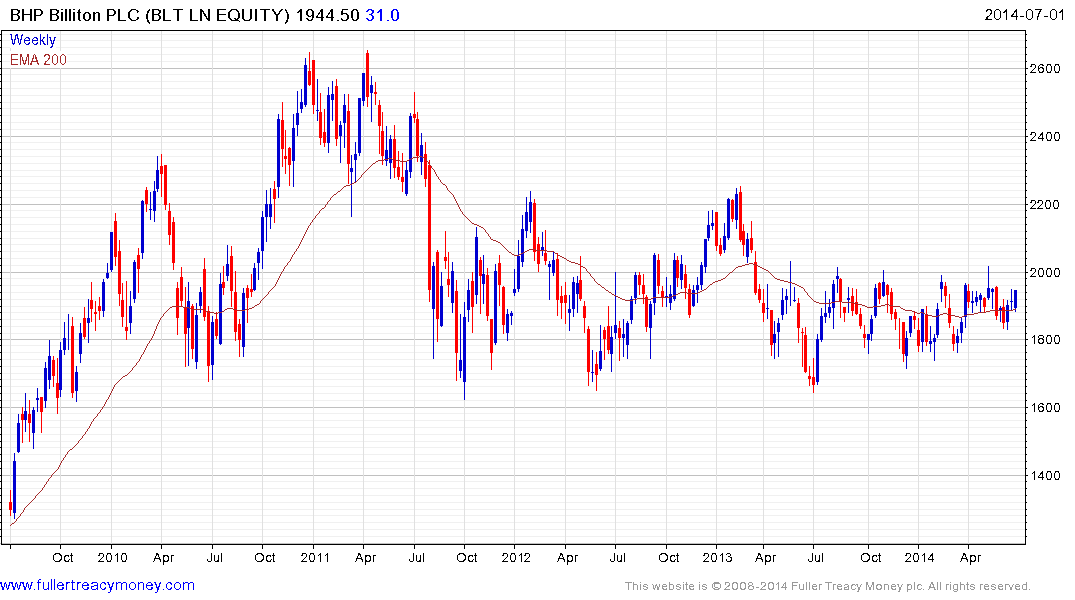

Earlier this year the major iron-ore miners made clear they were willing to tolerate short-term pain in order to re-establish their competitive advantage in the market. The central aim of this strategy has been to drive Chinese miners, dependent on high prices, out of business which now appears to be showing some success.

Iron-ore prices have at least stabilised near $90 over the last couple of weeks but will need to hold this level in order to convince investors the worst is over.

The Blackrock World Mining Trust rallied by more than 4% today; moving from a discount to a premium relative to NAV in the process. To my eye this looks like a major investors opted to buy a significant position in iron-ore shares at a discount.

BHP Billiton and Rio Tinto are firming within their ranges.

Glencore continues to test its medium-term downtrend.

Anglo American is firming in the region of the 200-day MA

VALE continues to firm from the region of its lows.

Cliffs Natural Resources accelerated lower from November but found at least short-term support from early June and potential for at least a reversionary rally has increased.

Back to top