Technology Catch-Up plays

The Nasdaq-100 is within striking distance of a new all-time high following a market leading performance from the 2009 lows. As the psychological 4000 level is approached I thought it might be instructive to look at some of the more established technology companies with reasonably robust dividend policies that may play catch-up.

.png)

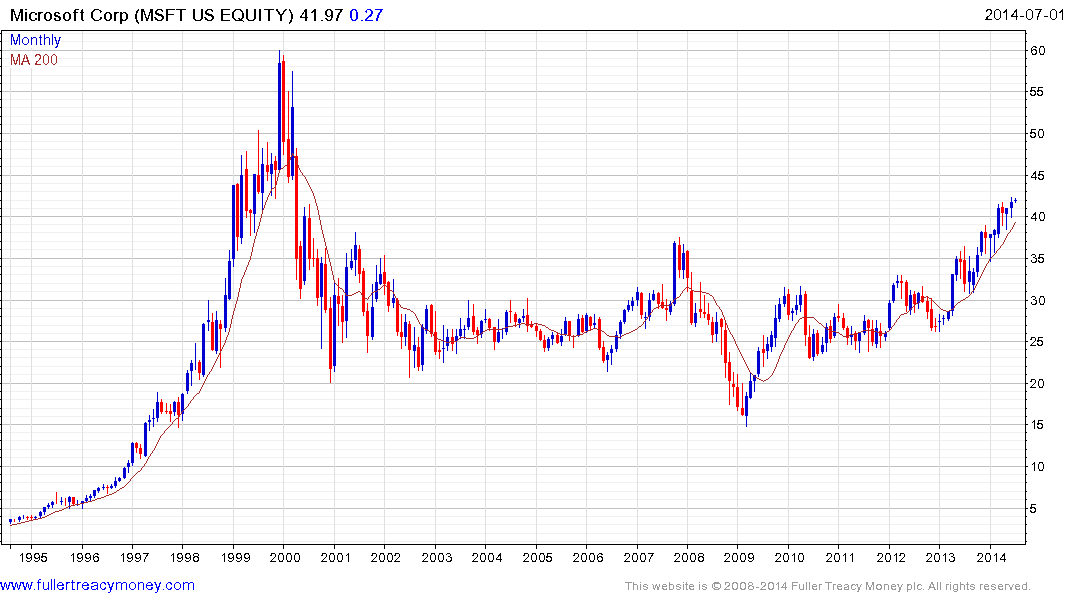

Microsoft (Est P/E 15.54, DY 2.67%) has a new CEO, has embarked into the hardware sector for the first time and completed a decade long base all within the last year. The share continues to hold a progression of higher reaction lows and a sustained move below the 200-day MA would be required to question medium-term upside potential.

Intel (Est P/E 15.25, DY 2.90%) has surged over the last few weeks to complete a decade long base.

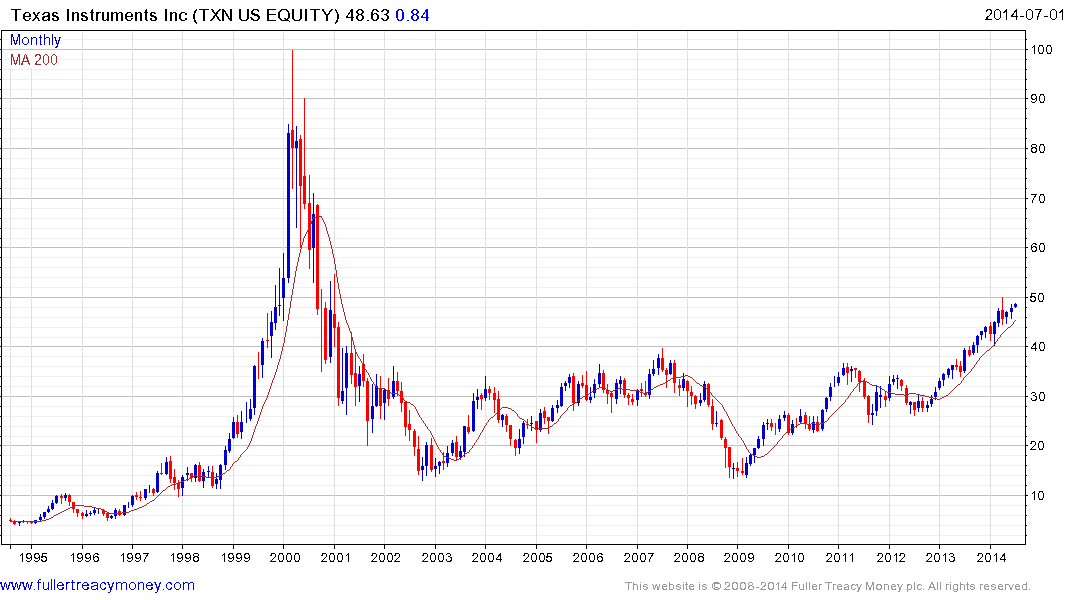

Texas Instruments (Est P/E 21.01, DY 2.47%) has been trending consistently higher for more than 18 months and completed its base last year.

LAM Research (Est P/E 15.67, DY 1.04%) broke out to new all-time highs in April to complete a volatile 14-year range.

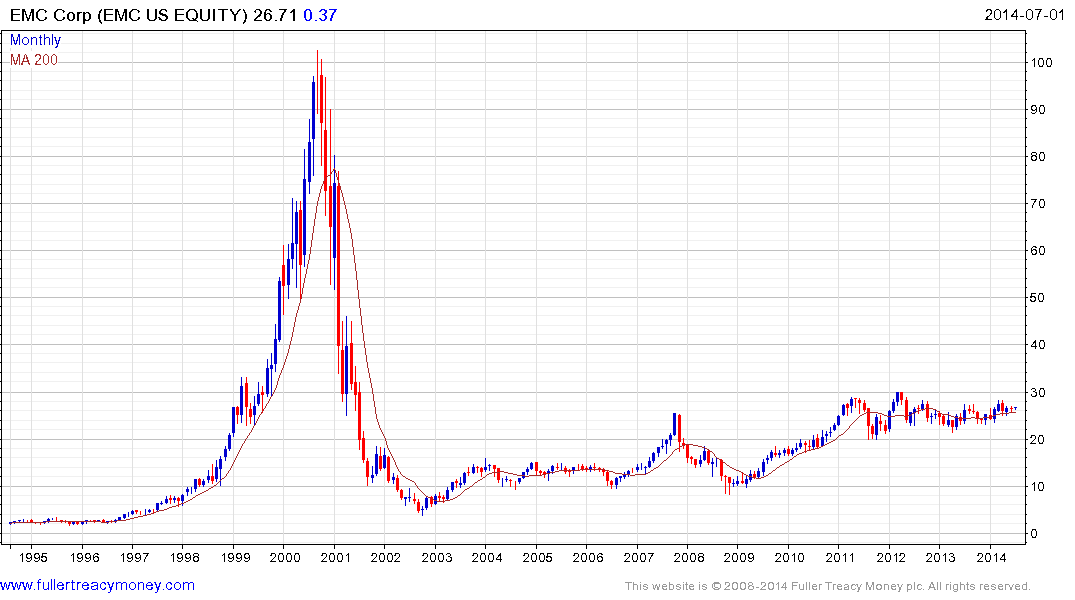

EMC Corp (Est P/E 14.01, DY 1.72%) remains in a lengthy first step above its base.

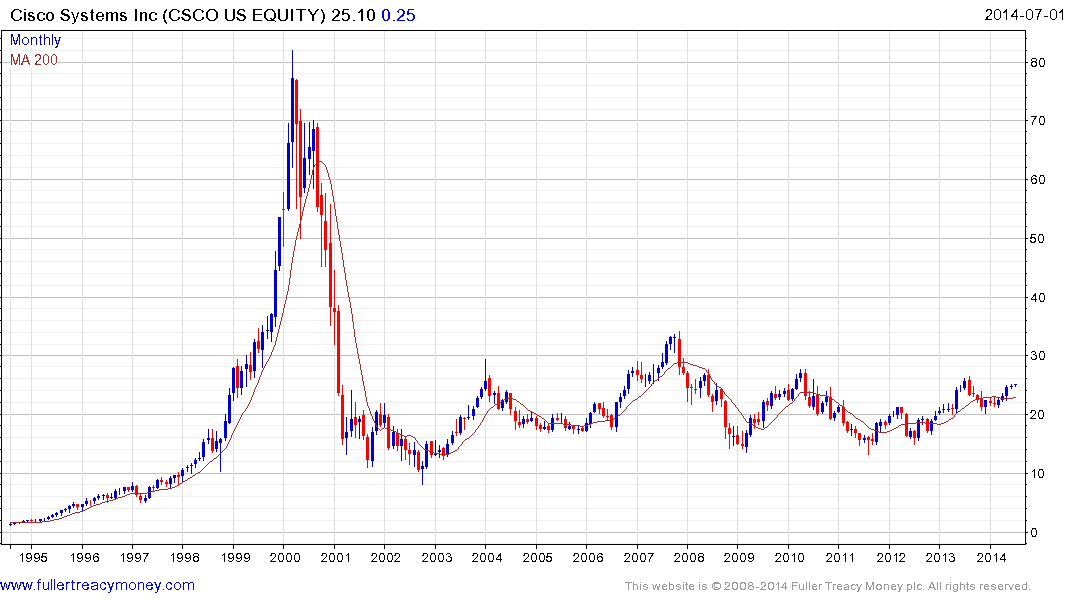

Cisco Systems (Est P/E 12.32, DY 3.03%) continues to range with an upward bias within its base.