Gold investors pile into equities

This article by Deborah Roy for Bloomberg appeared in today’s Mineweb newsletter. Here is a section:

Gold prices are down 31 percent from an all-time high of $1,923.70 reached in September 2011. Holdings in global ETPs backed by the metal declined more than 47 metric tons this year, after slumping 869 tons in 2013, capping six straight quarters of declines, data compiled by Bloomberg show.

While investors are shunning gold, they’re buying ETPs backed by equities, which added $27 billion in June through June 27 and $44.8 billion in the second quarter, the data compiled by Bloomberg show. The Standard & Poor’s 500 Index of shares is up 6.1 percent this year, touching a record on June 24, while the MSCI All-Country World Index advanced for five straight months.

“The equity market continues to attract money as people expect that the economy will improve further,” Scott Gardner, who helps manage $450 million at Verdmont Capital SA in Panama City, said in a telephone interview. “Gold has risen this year, but it seems that some investors don’t expect the gains to stick.”

Generally speaking equity valuations are no longer cheap but momentum is still a powerfully bullish force. However value investors will be on the lookout for cheap sectors that have the capacity to play catch up. Following a painful process of rationalisation, gold miners have rediscovered the fact that they need to concentrate on making net profits if they wish to attract investor interest. As one of last year’s worst performing asset classes, a worst case scenario was priced into gold mining equities.

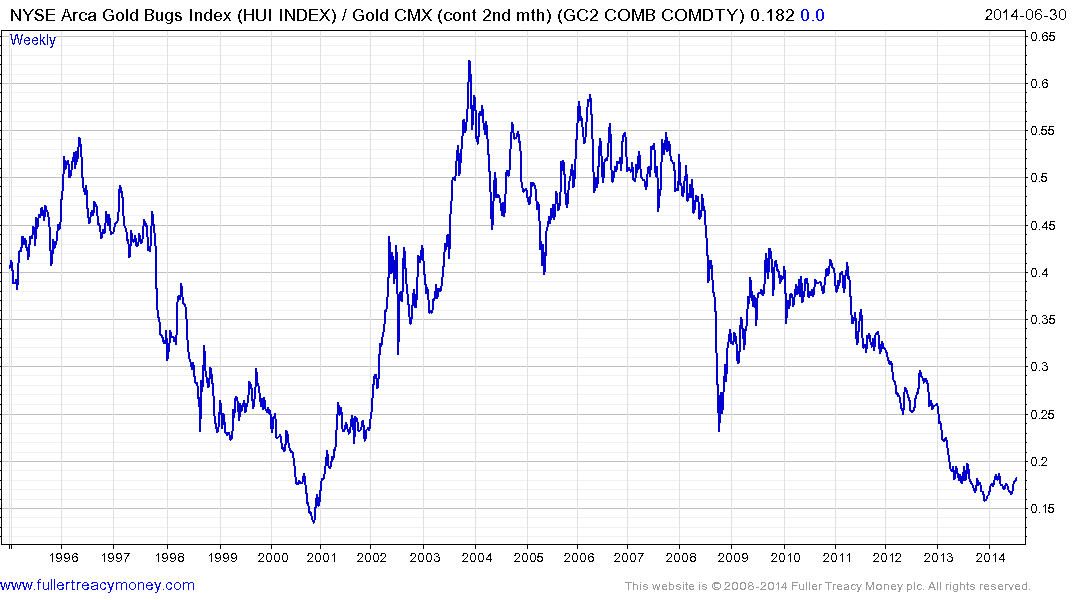

The Gold/NYSE Arca Gold BUGS Index ratio retraced its entire bull market advance over the last few years but has firmed in the region of the 2001 lows. Gold prices are reasonably stable above $1200 suggesting gold miners are cheap on a relative basis.

.png)

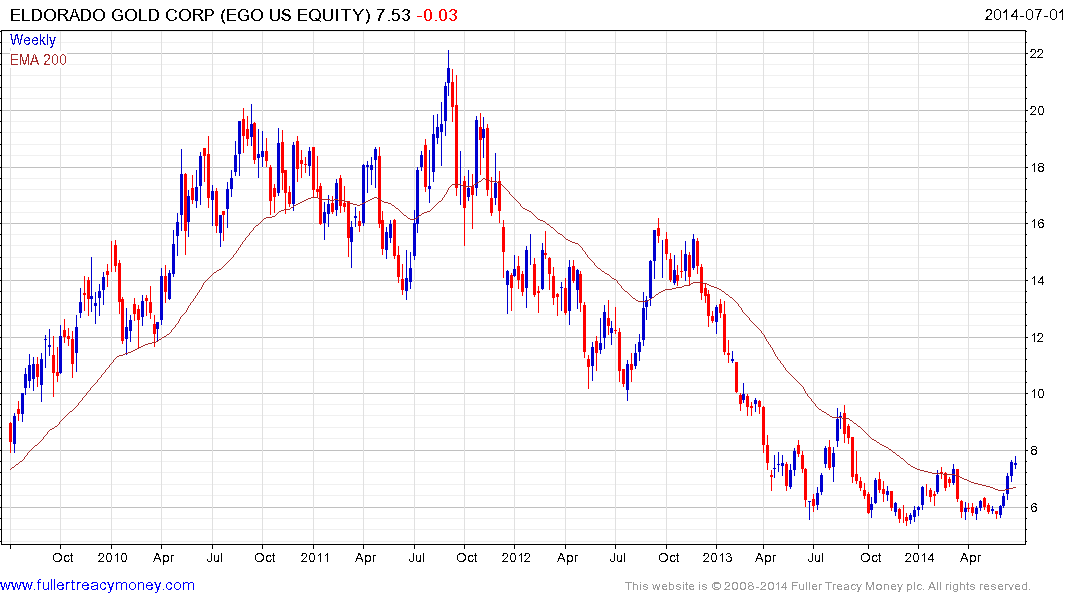

The Index found support above the December nadir a month ago and is now trading above the 200-day MA once more. Base formation development is still underway but with an increasing number of its constituents completing their bases the potential for a broader based advance is increasing.

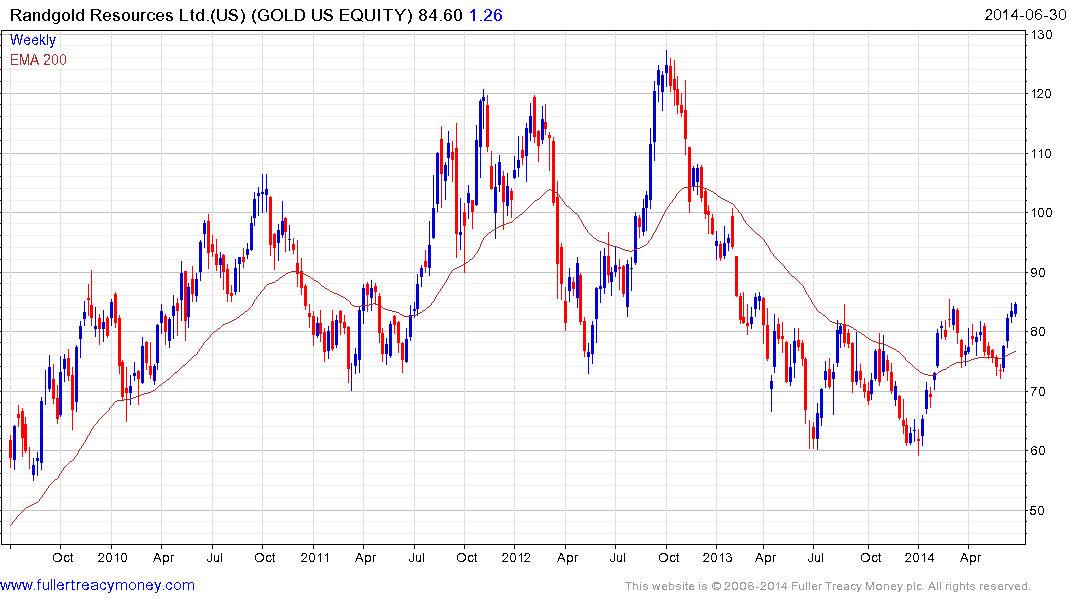

Eldorado Gold, Randgold Resources and Agnico-Eagle have already completed base formations and continue to improve on that performance.