Credit Reports to Exclude Certain Negative Information, Boosting FICO Scores

This article by AnneMaria Andriotis for the Wall Street Journal appeared in Yahoo Finance and may be of interest to subscribers. Here is a section:

The state settlements already had prompted the credit-reporting firms to remove several negative data sets from reports. These included non-loan related items that were sent to collections firms, such as gym memberships, library fines and traffic tickets. The firms also will have to remove medical-debt collections that have been paid by a patient’s insurance company from credit reports by 2018.

Such changes might help borrowers and could spur additional lending, possibly boosting economic activity. But it could potentially increase risks for lenders who might not be able to accurately assess borrowers’ default risk.

Consumers with liens or judgments are twice as likely to default on loan payments, according to LexisNexis Risk Solutions, a unit of RELX Group that supplies public-record information to the big three credit bureaus and lenders.

“It’s going to make someone who has poor credit look better than they should,” said John Ulzheimer, a credit specialist and former manager at Experian and credit-score creator FICO. “Just because the lien or judgment information has been removed and someone’s score has improved doesn’t mean they’ll magically become a better credit risk.”

Credit affects just about every large purchase. This is especially true for the USA, where possession of a credit card is practically a necessity for daily life and not least because of the substantial points programs they offer.

After a major dislocation in the market credit conditions tighten and regulations become more stringent which retards credit growth because those with the strongest scores have less need to borrow.

As an expansion progresses calls to relax conditions increase. There is already evidence of mortgage conditions being relaxed for extended family situations where more than a two people chip in for the payment. Relaxing credit score criteria is another step on the path to easier regulation and is likely to be a boon for the banking sector’s loan growth aspirations even though it also represents a future headache in the form of higher defaults.

The KBW Regional Banks Index surged to a new all-time high following the election and has been confined to a relatively inert range since December; allowing at least a partial process of mean reversion to unfold. A sustained move below the psychological 100 level would be required to check medium-term scope for additional upside.

Equifax remains in a relatively consistent medium-term uptrend and bounced impressively from the region of the trend mean in December.

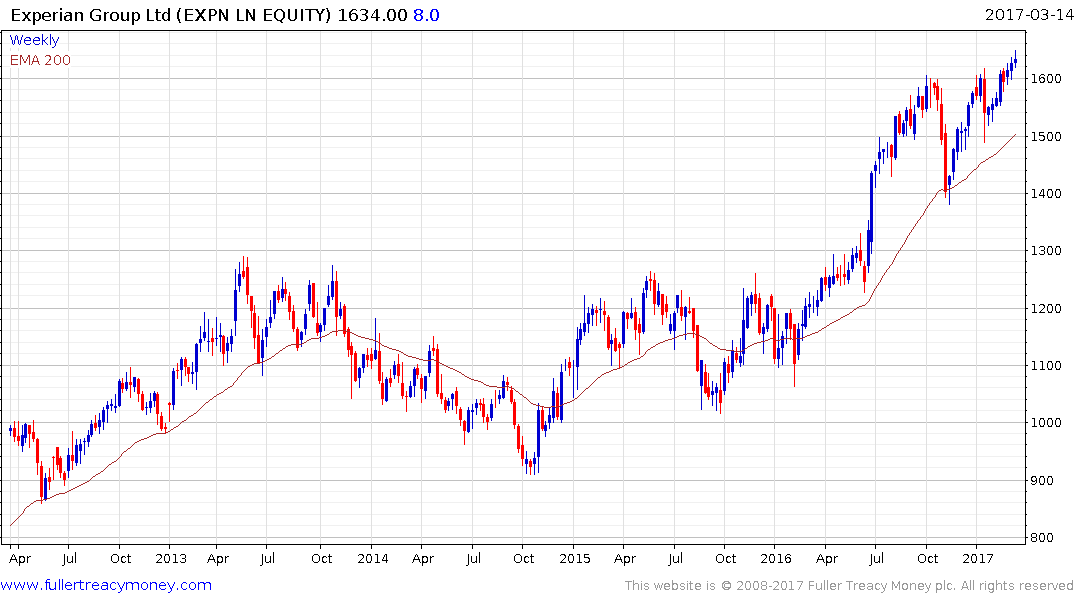

UK listed Experian also bounced from the region of the trend mean in December and moved to a new high this week.