Zara Owner's Margin Shrinks to Eight-Year Low on Currencies

This article by Rodrigo Orihuela for Bloomberg may be of interest to subscribers. Here is a section:

Inditex put greater emphasis on online expansion last year, cutting its target for new brick-and-mortar stores. The retailer is also making changes to some of its brands to gain market share, with the most recent example being February’s foray into men’s clothing by the Stradivarius brand, which has focused on women.

After starting online sales in Singapore and Malaysia this month, the company plans to add such services in Thailand and Vietnam in the next few weeks and also in India this year.

“India is a very attractive market for us,” Isla said on a conference call with analysts. This year Zara will open a 5,000 square-meter flagship store in Mumbai, which will be its largest store in the country. Inditex has 21 stores in that market.

Fast fashion is a major business but is also highly competitive and gaining access to consumers is the key to unlocking growth potential. Moving into high population countries with expanding middle classes is one solution to that challenge and expanding online is another. Creating multiple product lines in a short period of time and getting them to market instantaneously is what has allowed companies like Inditex, H&M and more recently Primark to expand globally but it’s a ruthless sector with clear winners and losers.

Inditex has been largely rangebound since 2015 but has stabilised in the region of the trend mean over the last few months and a sustained move below €30 would be required to question medium-term scope for additional higher to lateral ranging.

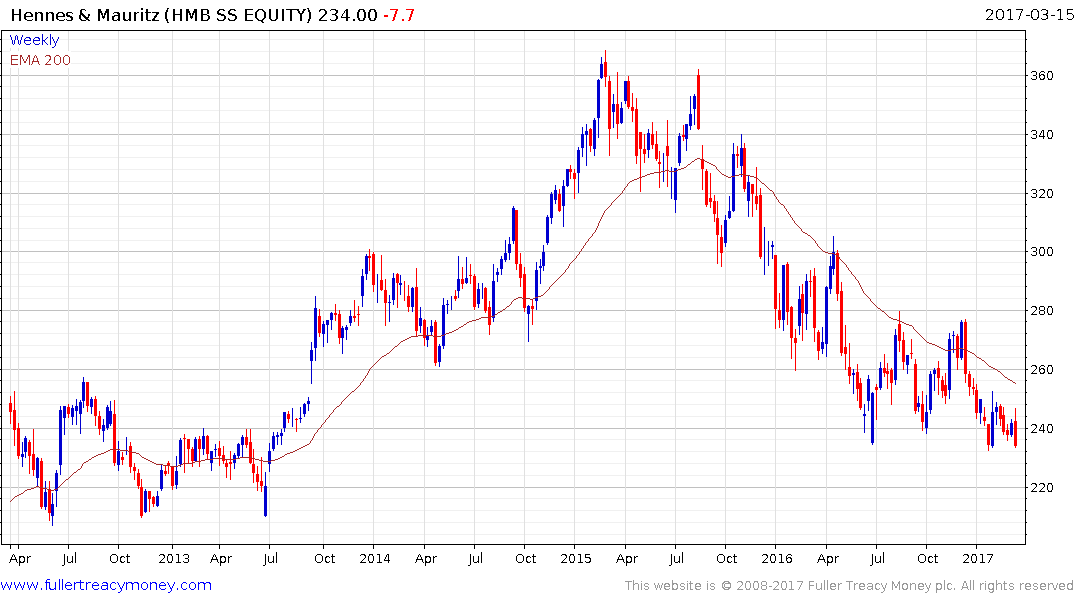

H&M has been trending lower since early 2015 and is testing its lows near SEK230 once again. A break in the medium-term progression of lower rally highs would be required to begin to question medium-term supply dominance.

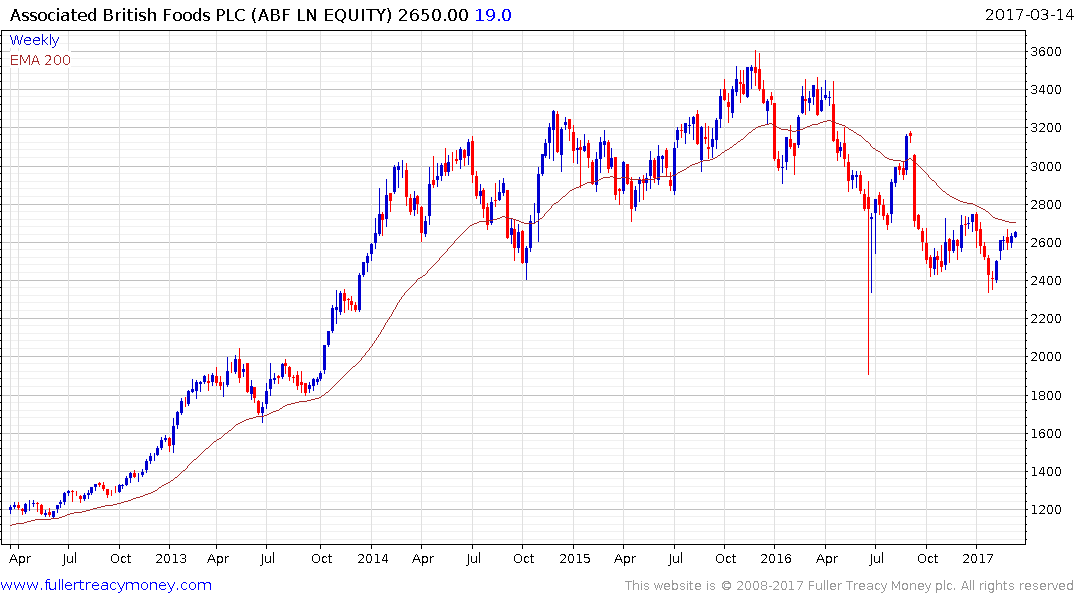

Primark accounts for 44.4% of Associated British Foods’ revenue. The share has been trending lower for a year and has rallied over the last few weeks to challenge the medium-term progression of lower rally highs. A sustained move above 2700p would be required to question the medium-term downward bias.