Round Two still much more to come

Thanks to a subscriber for this report from Deutsche Bank focusing on the oil marketing companies' sector in India. Here is a section:

Although there is understandable scepticism given the government’s track record, our confidence on the implementation of free pricing for petroleum products stems from the following measures that the government has already taken:

The extinguishing of the diesel subsidy in October 2014 and the revision of prices in line with changes in international prices without any government intervention;

The increase in LPG and kerosene prices each month since June 2016;

Increases in the auto fuel price even during elections and in times of sharp price increases for crude;

The aggressive implementation of Direct Benefit Transfer (DBT) to LPG and kerosene to contain subsidies.

FCF yield improves by up to 280 bps over FY17-20

Operating cash flow for OMCs will likely be driven by improvement in marketing margins, rising refining margins and higher volumes. Over FY17-20, the FCF yield of state-owned OMCs should improve dramatically, by more than 280bps for IOC and BPCL. HPCL, with capex starting from FY18, will likely see its FCF yield decline by 130 bps. We expect the OMCs to generate robust free cash flows of about USD10bn over FY18-22E. We also estimate net debt/equity of OMCs to decrease further over FY16-22E – HPCL from 1.6x in FY16 to 0.6x in FY22, IOC from 0.6x in FY16 to 0.2x in FY22, and BPCL from 0.7x in FY16 to 0.1x in FY22.

Here is a link to the full report.

India is a quickly growing economy that needs to take the greatest possible advantage of its democratic dividend before that massive young population ages. Smoothening out what has often been a distinctly anti-business regulatory regime with a reputation for fickle decisions has been one of Modi’s ambitions in taking on the bureaucracy. Therefore there is reason for some optimism that policy continuity can be achieved in more sectors.

.png)

As a major importer the price of oil has a considerable effect on Indian inflation. The price of oil in Rupees surged to a new all-time high in 2013 as the currency collapsed by has mirrored the Dollar price over the last year as the Rupee stabilised.

The RBI intervened today to stem the Rupee’s advance since India does not wish to have the world’s strongest currency. Nevertheless, there are clear reasons for why investors might want to accumulate Rupees since Modi is more likely to win a second term and garner an even stronger mandate to introduce reforms that could unleash growth.

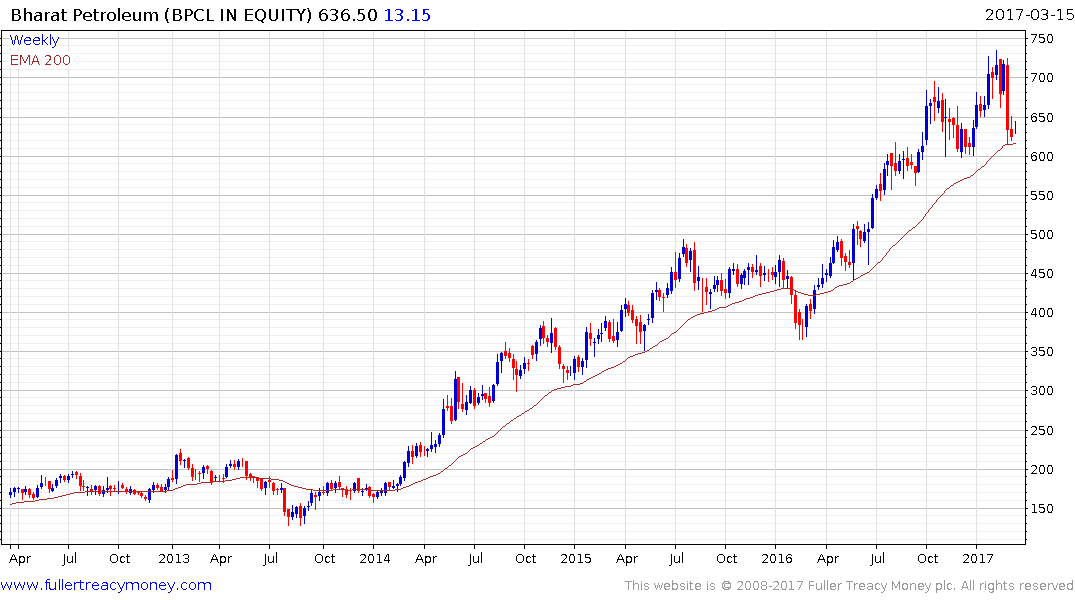

Looking at the shares of Bharat Petroleum and Indian Oil Corp, they offered leverage to oil prices on the way up but pulled back sharply over the last week as oil prices retreated. The case for additional upside is predicated both on the continuity of market friendly reforms and higher oil prices which is far from certain with so much uncertainty in the oil market.

Back to top