Citigroup Shares Fall as Bank's Revenue Gains Are Seen as 'Soft'

This article by Dakin Campbell for Bloomberg may be of interest to subscribers. Here is a section:

Chief Executive Officer Michael Corbat has been disposing of unwanted businesses to make the company more profitable and its earnings more predictable -- a push that helped cut fourth- quarter costs from legal matters and restructuring to the lowest level since he took over in 2012. The bank also benefited from last year’s global surge in corporate dealmaking.

“We have sharpened our focus on target clients, shedding over 20 consumer and institutional businesses” in recent years, Corbat said in the statement. “We have undoubtedly become a simpler, smaller, safer and stronger institution.”

The burden of regulation has resulted in a major readjustment for large financial institutions with the cost of doing business ballooning and the headcount in compliance departments continuing to rise. International banks, subject to regulation in a number of jurisdictions have been forced to either find more efficient ways of doing business or choose to exit at least some markets. Citi has chosen the latter.

The share failed to hold the move to $60 in July and has since fallen to break down from a two-year range to extend the seven year base formation. A clear and sustained move above $55 will be required to signal a return to demand dominance beyond room for short-term steadying.

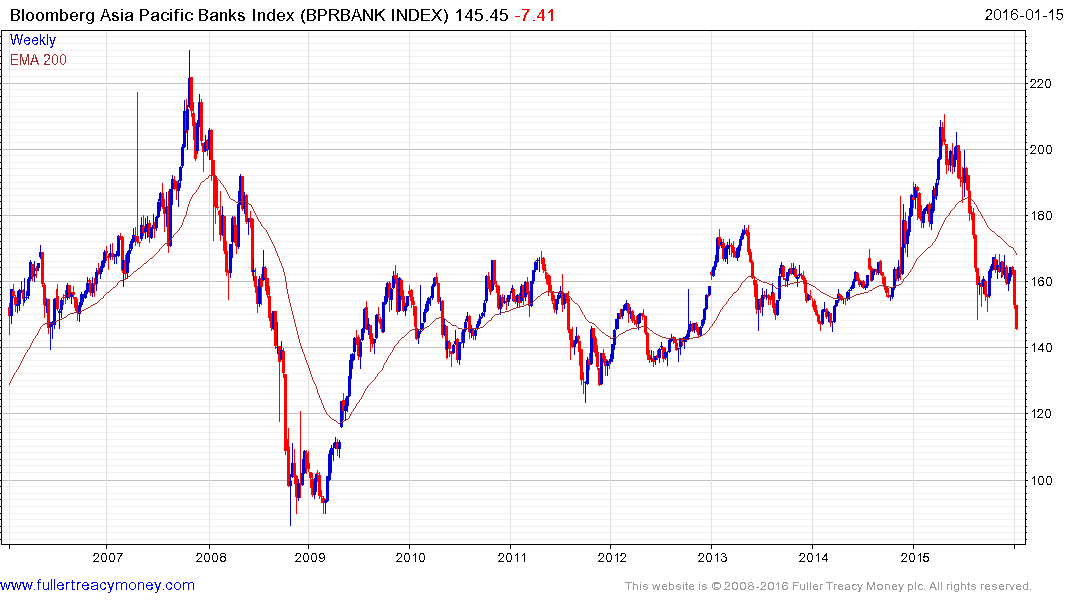

I posted a chart of the S&P Diversified Financials in yesterday’s Comment of the Day because it has Type -2 top characteristics. The Banks Index fell this week to break the four-year progression of higher reaction lows. The UK and Eurozone Banking sector both moved to new lows today. The Bloomberg Asia Pacific Banks Index is back testing a previous area of support near 140. This is a high degree of commonality and significant technical deterioration is evident. This is a supply dominated environment and while oversold conditions are developing it remains for the bulls to prove their case.

Taking a step back something we have talked about at The Chart Seminar for decades is the role banks play in the gestation of a bull market and the way they act as suppliers of liquidity. When banks underperform, such as they are doing right now that is not a positive sign for the ability of capital to move unencumbered to the most attractive assets. The question then is whether the burden of regulation, aimed at preventing another credit crisis, is in fact acting to withhold liquidity when it is needed? That’s a big question and is probably contributing to the bearish environment currently present in equity markets. However I would also like to draw attention to the Shadow Banking Fed Funds rate posted yesterday which already closed the arbitrage with the official Fed Funds rate, so the tightening has already occurred.

The British Pound might also be seen as an indication of stress in the financial sector because the City represents such an influence on the UK’s GDP. The six-month downtrend is now accelerating lower and a clear upward dynamic will be required to check the slide and to pressure shorts