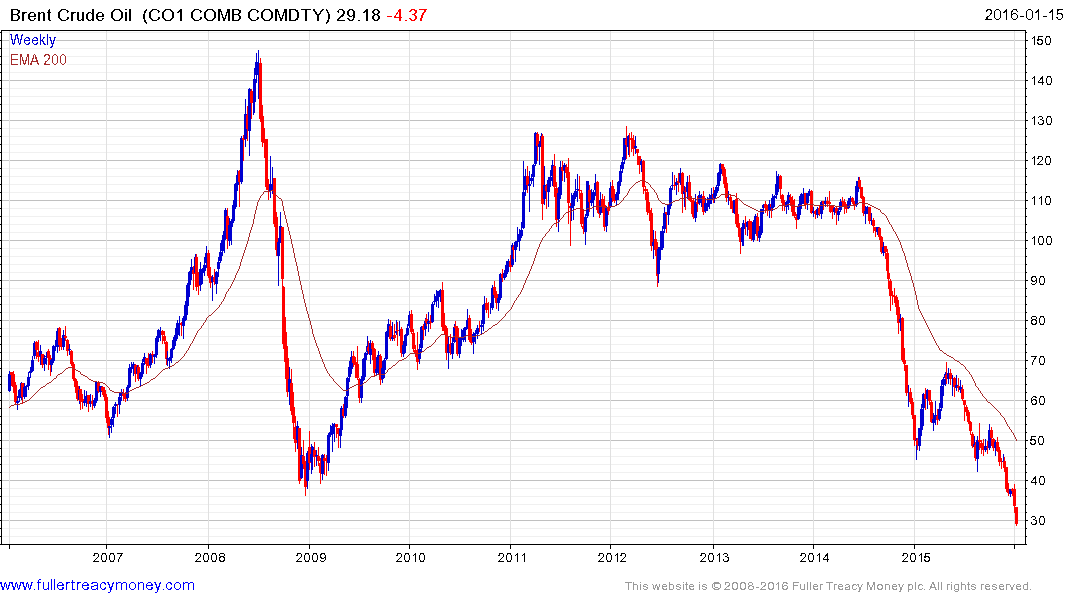

Meltdown But oil prices have fallen enough

Thanks to a subscriber for this report from DNB which may be of interest. Here is a section:

We are convinced that the moment the oil market starts to shift the focus towards 2017 and stops worrying about brimming inventories in 2016; that is the moment the oil price starts to increase. We have seen time and time again that the change in the oil price happens before changes in the supply demand balance. It has to do with interpretations of the future more than current fundamentals. The oil market has become similar to the equity market where the players try to “see around the corner” in order to get a head start vs the rest of the market. Investors would want to be early movers in order not to “miss the train”.

We believe that the moment for higher oil prices will be the moment the investors starts to rebuild their long positions and buy back the short positions they have put on during 2015.

And

?Other potential catalysts are already on the list (known, unknowns), like for example the write-downs of shale oil resources from shale oil producers which we believe will start to materialize by end February. There are also other factors to watch like potential unrest in Venezuela after the parliamentary elections, falling US oil production which will likely lead to crude oil stock draws from March and onwards, increased focus on lower production from non-OPEC as a result of spending cuts, etc, etc.

We believe that one of the key drivers for higher oil prices through the second quarter will be a strong gasoline market, similar to what happened in 2015. The NYMEX gasoline crack spread increased significantly from late February last year and this was one of the key drivers behind the increase in oil prices during the second quarter last year. WTI increased from about 44 USD/b in March to 61 USD/b in June. Brent increased even more and reached almost 70 USD/b in May before it started to drift lower again. It was demand for gasoline which was the key driver on the demand side for refined products in 2015 and we believe the gasoline market will be strong also in 2016. This is due to the fact that gasoline is a consumer product and not an industrial product like diesel.

Here is a link to the full report.

Oil prices are accelerating lower and we know for a fact that they will not go to zero. The counter argument is that the definition of an instrument that is down 90% is one that was down 80% and halved. Nevertheless the pace of the decline is picking up suggesting shorts are being increased and holders are panicking.

At some point, and we don’t know if that will be Monday or later, everyone who wishes to sell will have sold, shorts will have had introduced trailing stops and all that will be left are potential buyers. At that point we will see a short covering rally but a clear upward dynamic will be required to signal it is underway.

It’s been my contention for some time that natural gas represents perhaps the best analogue for what we might expect from oil prices and that would suggest once support has been found we can expect prolonged volatile ranging with some wild trough to peak swings.

Back to top