Chip Makers Cut Deals as Cars Get Smarter

This article from the Wall Street Journal may be of interest to subscribers. Here is a section:

Ford Motor Co., BMW AG and others have said they would have self-driving cars on the road in the next few years, while Tesla Motors has a semiautonomous system already on the road. Tesla last week began shipping vehicles that include hardware that could one day be empowered by software, which must be validated and approved by regulators, to operate in a fully autonomous mode. Tesla Chief Executive Officer Elon Musk aims to demonstrate fully autonomous cross-country drive by the end of next year.

Analog Devices Inc. cited auto applications as a key motivation in a deal announced in July to buy Linear Technology Corp. in a cash-and-stock deal valued at $14.8 billion. NXP became the top auto chip supplier by striking a deal valued at nearly $12 billion last year to buy Freescale Semiconductor Inc.

But the market for years has been fragmented among many suppliers with different specialties competing on price. Where an iPhone has one central chip to power its computing functions, many parts of cars have long used separate chips—a situation that could become even more complex as car makers add more features for safety and other purposes.

“Those will all require more processing capability and likely will be supplied by different suppliers who are not exactly working together,” said Dave Sullivan, an automotive industry analyst at AutoPacific, in an interview.

The push toward autonomous driving is a countervailing force, requiring more powerful chips and software that can analyze feeds from cameras, radar and other sensors using technologies such as deep learning. Tesla Motors Inc. has moved toward a central computing system, announcing last week it had picked chip maker Nvidia Corp. as part of the self-driving hardware it has vowed to include in all its new vehicles.

There is not going to be a single day when someone turns a switch and the global vehicle fleet becomes autonomous. Rather it is going to happen in a piecemeal fashion and regulators will hopefully pay attention to what is happening in other parts of the world to come up with an idea of best practice.

If we set aside the timeline for when cars are likely to be fully autonomous for a moment, the big question for auto manufacturers is still how to make new cars attractive enough to encourage people to pay up but not so attractive that they will cannibalise next year’s sales. The answer would appear to offer more added extras in the form of electronics and connectivity regardless of whether cars are autonomous.

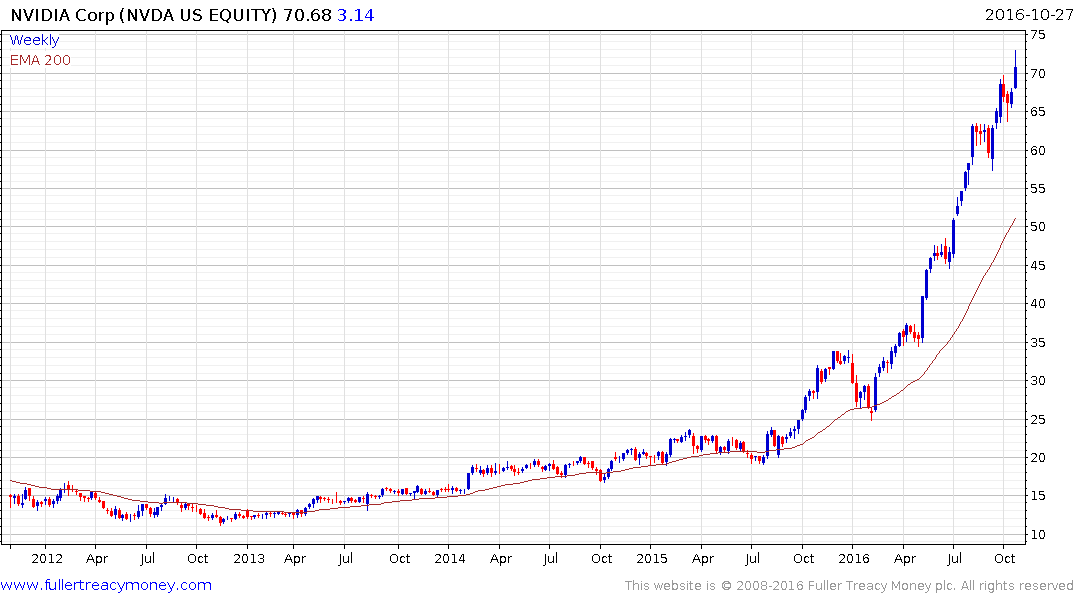

Nvidia has been this year’s star performer and continues to extend its steep uptrend despite the wide overextension relative to the trend mean.

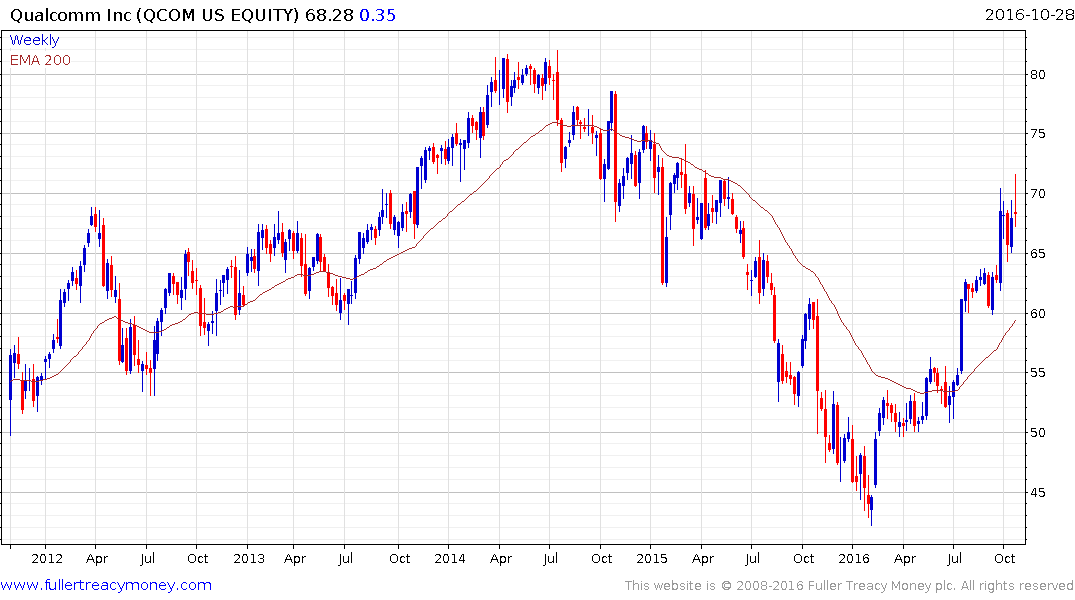

Qualcomm (DY 3%) has been growing its dividend steadily for the last decade and rallied in May to break a medium-term downtrend. While somewhat overbought in the short-term a sustained move below the trend mean would be required to question medium-term recovery potential.

Mobileye has been ranging in a volatile manner since its IPO in 2014 and needs to demonstrate support in the region of $35 to begin to suggest a return to demand dominance.

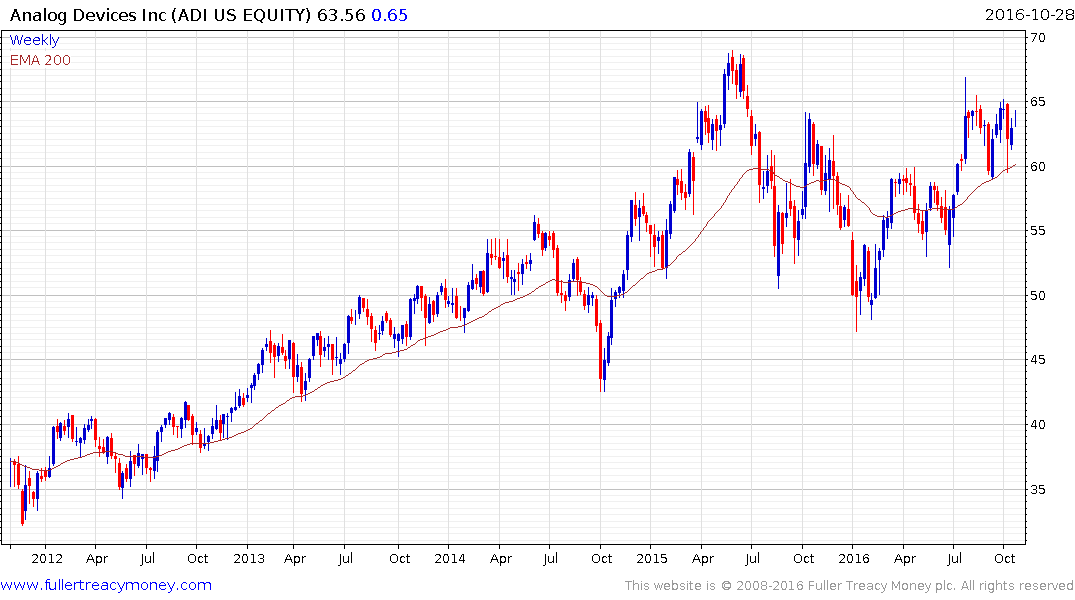

Analogue Devices has been subject to greater volatility over the last two years which is an inconsistency relative to the previous uptrend. However it has stabilised above the 200-day MA over the last three months. A sustained move below $60 would be required to question potential for additional upside.