Iron Ore Surges Amid Coal's Record Rally, Lifting Miners' Shares

This article from Bloomberg may be of interest to subscribers. Here is a section:

Iron ore is rallying as coal prices surge, lifting the shares of producers in Australia, the world’s largest shipper. The benchmark spot price in China posted the biggest weekly increase since April after rising for the fourth day in five on Friday.

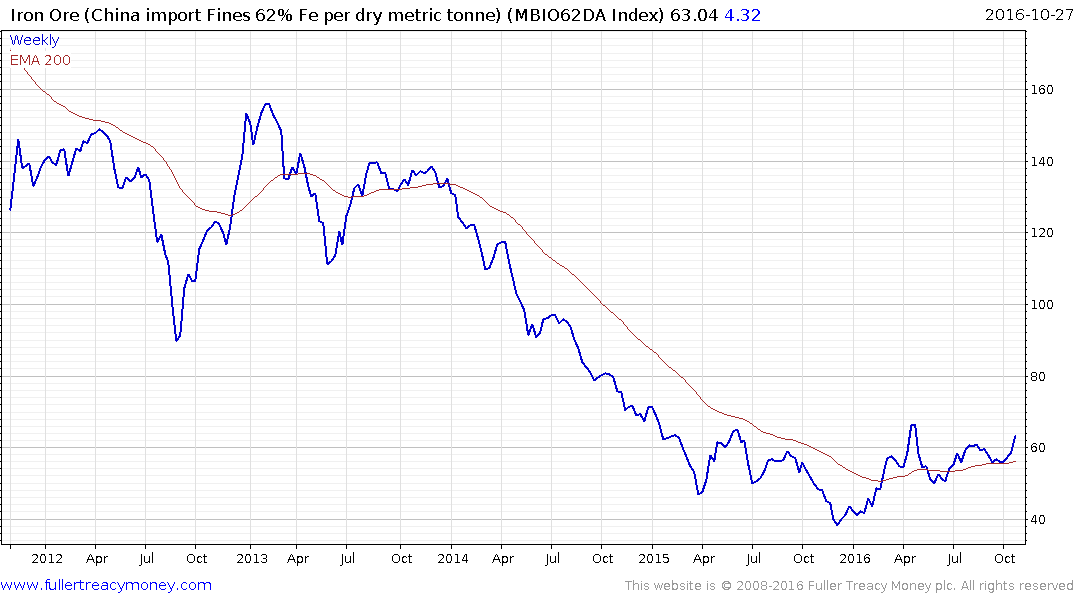

Ore with 62 percent content rose 1.5 percent to $63.96 a dry ton in Qingdao, the highest price since April, according to Metal Bulletin Ltd. Earlier in Asia, futures in Dalian rose for a seventh day, the longest run since 2013, as Singapore’s SGX AsiaClear most-active contract surged for a third week.

After three years of slumping prices as low-cost mine supply rose and China slowed, iron ore has surged in 2016 as Asia’s top economy boosted stimulus, supporting steel demand. Fortescue Metals Group Ltd.’s Chief Executive Officer Nev Power told reporters this week that the Perth-based company expected prices to hold firm in 2017. Recent advances in iron ore have been supported by gains in coal after a supply crunch in China.

“The price of coking coal continues to rise,” supporting iron ore, said Zhao Chaoyue, an analyst at China Merchants Futures Co. in Shenzhen. Coking coal, or metallurgical coal, has more than doubled this year, with futures in Dalian hitting a record on Wednesday. Prices rose Friday after sinking a day earlier.

China is now at a point in its development where pollution is costing it more money than it was making from the industries causing it. That’s an important tipping point and has been bullish for coking coal and iron-ore prices as some of the most marginal dirtiest Chinese mining operations have been forced to close.

Iron-ore prices rallied from late last year to break a lengthy progression of lower rally highs and have been forming a first step above the base since April. A sustained move below the trend mean, currently near $56, would be required to question medium-term scope for a successful upward break.

Coking coal continues to extend is advance from very depressed levels earlier this year. (Please also see Comment of the Day on September 28th).

The London Metal Exchange Index which includes all six industrial metals also looks primed for a breakout.

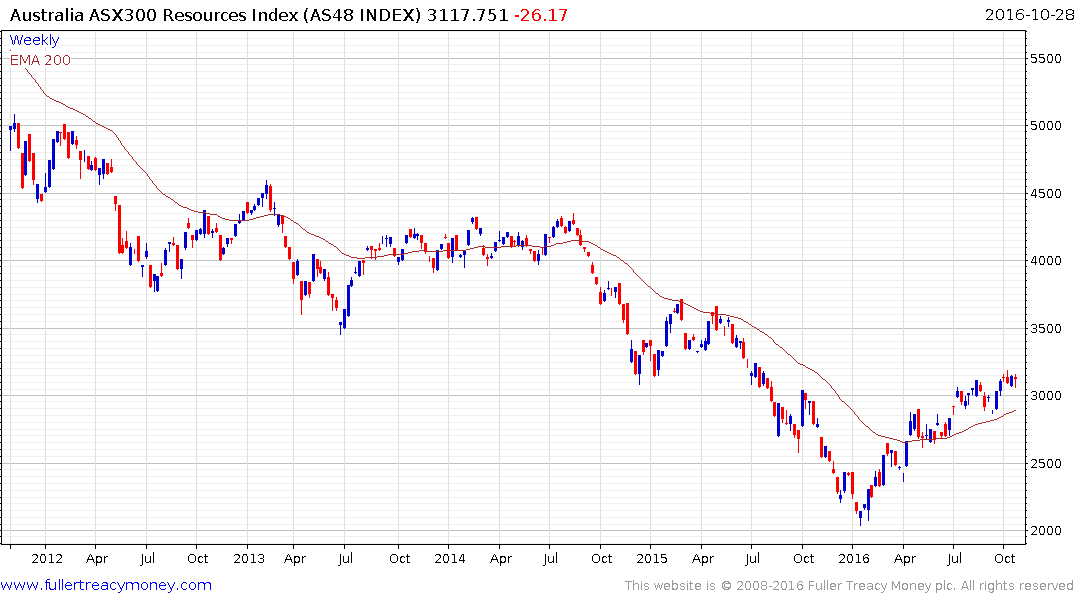

Against that background the industrial metal miners are staging a rebound with the S&P/ASX 300 Resources Index and the FTSE-350 Mining Index both on recovery trajectories.

The UK listed Blackrock World Mining trust is still trading on a discount to NAV of 10% and broke out this week to new recovery highs.

Of particular interest is copper where the weekly chart has developing type-2 base formation characteristics. A break in the progression of lower rally highs, which could occur as soon as next week, would signal a return to demand dominance beyond short-term steadying.

Broadly speaking the copper mining sector has been a laggard but a return to outperformance by the copper price could change that.