Tocqueville Gold Strategy Third Quarter 2016 Investor Letter

Thanks to a subscriber for this report which may be of interest to subscribers. Here is a section:

Gold is extremely under owned in Western investment portfolios. Because supplies of above ground stocks normally available to satisfy Western investment demand have been severely depleted by flows to Asian investors, the price dynamics could be explosive.

Gold has enjoyed a stealth bull market since the advent of radical monetary policies around 2000. As the chart below shows, gold has been the best performing asset class since then, a fact that is completely unrecognized by main stream media and conventional investors. The painful correction from 2011 to year end 2015 camouflaged gold’s strength and explains why most investors remain complacent as to systemic risk, intellectually understanding the unsustainability of radical monetary policy but unmotivated to seek gold’s protection.

It seems unlikely that the long term erosion of investment confidence, the onset of a secular bear market in financial assets, and further advances in the stealth bull market for gold will take place in a linear fashion. There are bound to be shakeouts and fake outs along the way to camouflage the underlying reality that the global financial system as we know it is in extremis. We also believe that the current sharp correction in the precious metals complex is a setup for another major advance toward new highs in metal and share prices. We therefore recommend taking advantage of current weakness to build or establish new positions.

Here is a link to the full report.

I often think that the role of gold as a hedge is misunderstood. It did well in the 1970s because investors were worried about inflation and outperformed from the early 2000’s because people were worried about deflation. Therefore it is probably best to think about gold as a hedge against the best efforts of the monetary authorities to debase the currency; regardless of what that currency might be.

Breaking news surrounding continued FBI investigations into Hilary Clinton’s emails could also be positive for gold considering its status as a hedge during times of stress.

Very simply, we don’t know how the massive piles of debt accrued by central banks are going to be managed. We don’t know how the additional debt taken on to fund deficit spending (fiscal stimulus) is going to be paid for. If history is any guide a good portion of that debt is going to be paid back in currency that has been debased in one way or another. These are very big questions and gold is one of the better insurance policies against an unruly outcome.

The US Dollar gold price showed the first signs of demand returning to dominance in the region of the trend mean this week. Upside follow through next week would go a long way to confirm, at least, a near-term low. Finding support above $1250 on the first significant pullback would help to signal a low of medium-term significance.

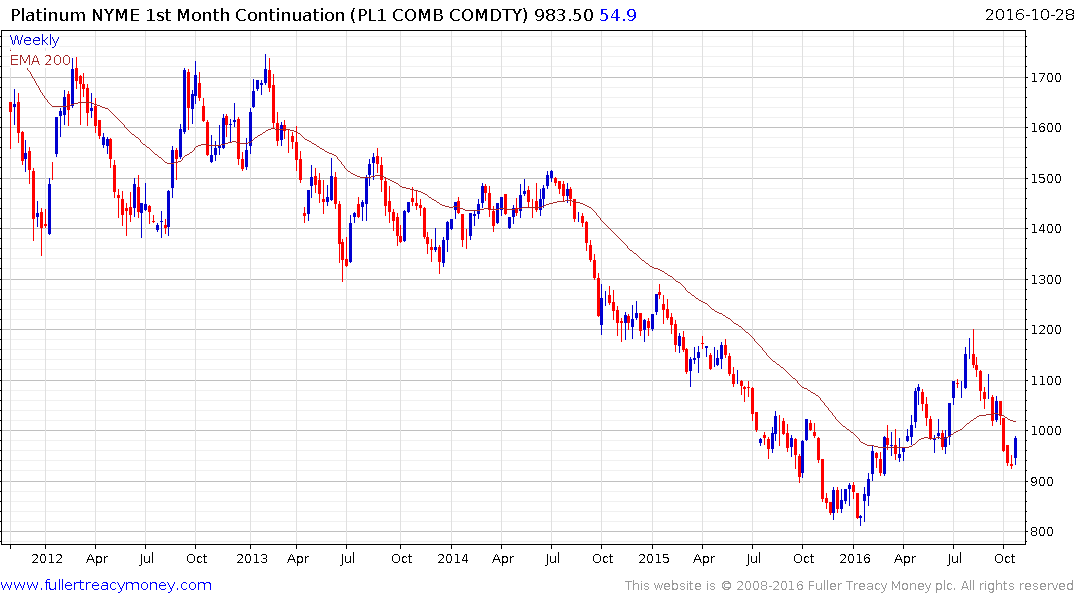

Importantly platinum which led on the downside also posted an upward dynamic this week while silver has also firmed within its short-term range.

The Gold mining sector has now also unwound at wide overextension relative to the MA and can be expected to continue to firm if precious metal prices manage to resume their medium-term uptrend.