Bitcoin Based-Memecoin Surge Seen Driving Binance Anxiety

This article from Bloomberg may be of interest to subscribers. Here is a section:

These Bitcoin-based tokens are queuing up along with regular Bitcoin transactions to be processed by miners. One of the most popular such coins, which are also known as BRC 20 tokens, is Ordi. Its market capitalization has reached more than $500 million since its recent introduction.

“The high network fees have been caused by the en-masse minting of BRC-20 token,” said Jaime Baeza, founder and managing partner at digital asset hedge fund ANB Investments. Until recently, memecoins and NFT collections such as Bored Apes and CryptoPunks were predominately based on Ethereum and served as a catalyst that helped to make that platform the world’s most commercially important blockchain.

The introduction of the Lightning network last year was supposed to speed up transactions. It was also the innovation that enabled the creation of bitcoin offshoots which has boosted traffic across the bitcoin network over the last six months.

The creators of the add-on network obviously did not rely on their experience of meme popularity to build sufficient capacity. One of the biggest challenges to the claim bitcoin will eventually be a major vehicle of exchange is the inadequacy of the network capacity. The Lightning network was hailed as a solution to that problem and it is obviously not working.

When a major exchange like Binance cannot keep up with demand it is a worrying development for the larger crypto community. It reminds everyone that buying is much easier than selling in the bitcoin space.

The bitcoin cycle tends to drive speculative flow. Everyone knows the halvening will be in April 2024. That’s when the limited supply argument will be most convincing. It is normal to see an initial swell of interest a year out. Once the early buying has been exhausted, bitcoin can retreat and rebound immediately ahead of the halvening. It generally does not surge until after the halvening. If the 2019/20 experience is to be repeated we could be entering a less than optimal time for the sector.

Bitcoin continues to range below the $30000 level and a sustained move above it will be required to signal a return to demand dominance.

Bitcoin continues to range below the $30000 level and a sustained move above it will be required to signal a return to demand dominance.

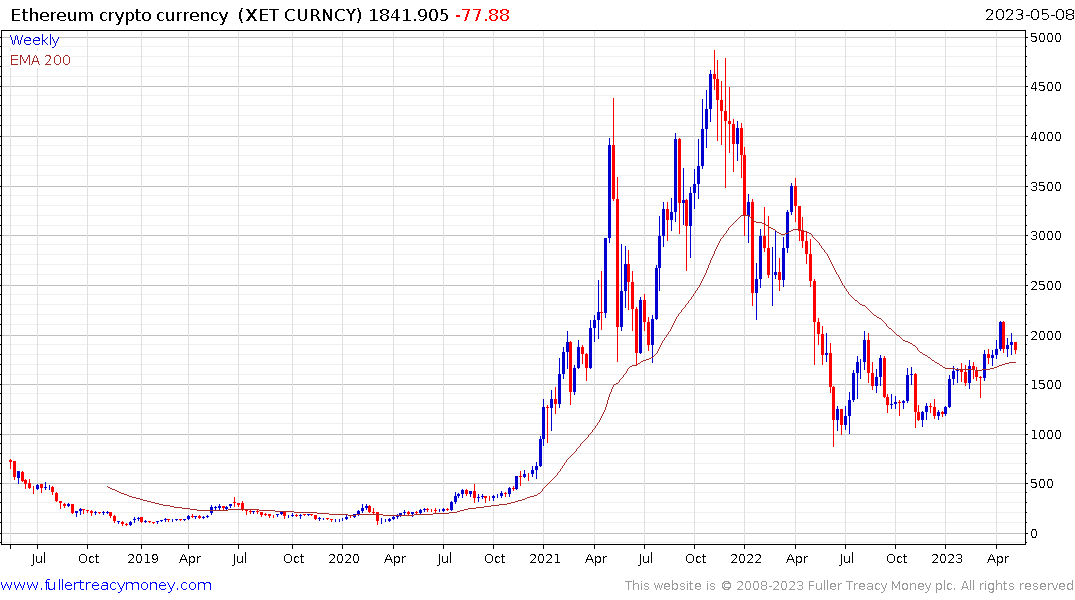

Ethereum is also pausing below a significant area of resistance at the $2000 level.

There has been a long running argument about whether gold or bitcoin is the better hedge against rapacious money printing. For the last decade where interest rates were low, money creation was at historic highs, the dollar was firm, and inflation was under control, bitcoin won out. That was a market where asset price appreciation focused most acutely on long duration assets like growth and long-dated bonds.

In a stagflation environment, where money supply growth is not taken for granted, the ability of long-duration assets to perform is questionable. Meanwhile, limited supply assets do better. Bitcoin is both a long-duration growth and limited supply asset, but gold is the classic limited supply physical asset. There is clear potential that gold will do better than bitcoin during a stagflation cycle even if the volatility in between threatens to make a nonsense of that statement. Zimbabwe’s decision to launch a token backed by gold is inconsequential at present, unless of course it turns into a wider trend.

Back to top