Platinum investors are finally taking note of South Africa's power problems

This note from Heraeus may be of interest to subscribers. Here is a section:

Platinum ETFs saw heavy buying at the end of April from South Africa based funds. Year-to-date regional inflows into platinum funds in South Africa (+333 koz) are the standout when compared to the US (-107 koz), the UK (-18 koz) and Switzerland (-17 koz). Net flows have been positive every month this year so far, as South African investors are more acutely aware of the electricity supply issues being faced by PGM producers. Total global holdings stand at 3.3 moz, up from 3.0 moz at the beginning of the year, although that was down 1 moz from the peak level of holdings in July 2021.

These investors bought into the recent price rally and hope for more. The platinum price had risen more than 20% since late February before the recent correction. Supply issues in South Africa (~75% of mined supply) are well documented. The regularity and severity of load-shedding in 2022 was unparalleled, with the situation unlikely to improve significantly during 2023. Load-shedding resulted in the build-up of above-ground stocks of unrefined PGMs last year and could lead to an estimated loss of ~250 koz of platinum production this year as the Southern Hemisphere winter begins to bite. Available first-quarter results of major South African PGM miners all cite load-shedding as impacting refined output to some degree.

Platinum prices went vertical during the last South African power cuts. That acceleration also marked the peak of the decade-long bull market as the global economy headed into the financial crisis in 2008.

At the time there was a lot of talk about platinum miners investing in their own generating capacity. The subsequent crash meant very few completed that work. The big decline in platinum prices following the diesel cheating scandal drove several platinum miners into bankruptcy. The recent issues with Eskom have revitalized talk of building solar and wind farms so operations can be independent of the utility.

Eskom has been chronically mismanaged and corruption has ensured the investment required to provide electricity for a growing population has not occurred. Rolling blackouts have been a feature of life for several months already, so the big question is how will supply be rationed to mines? That’s mostly a political decision.

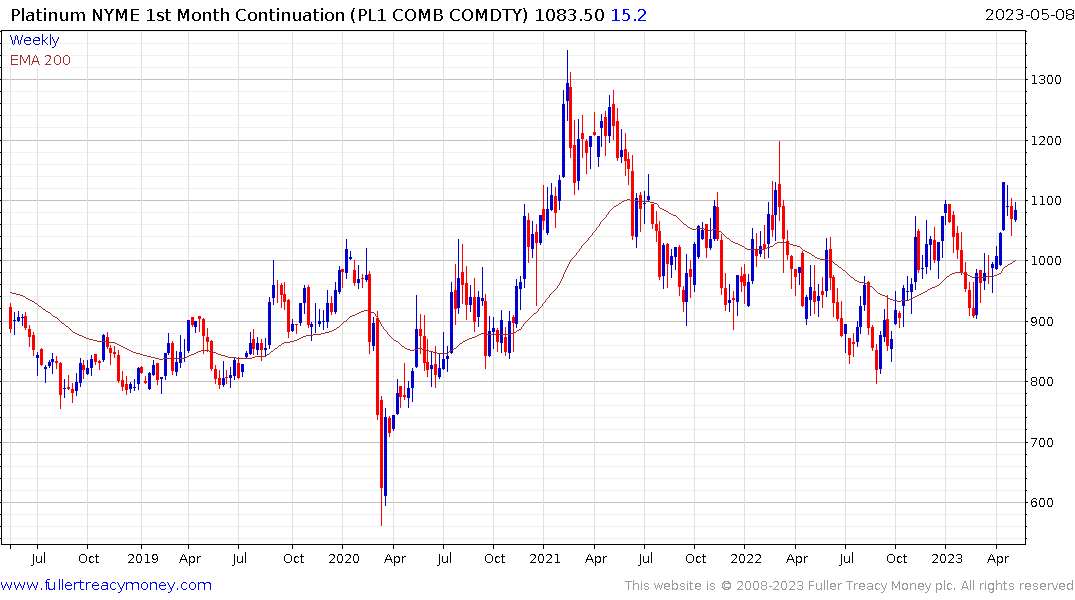

Platinum continues to exhibit base formation characteristics.

Platinum continues to exhibit base formation characteristics.

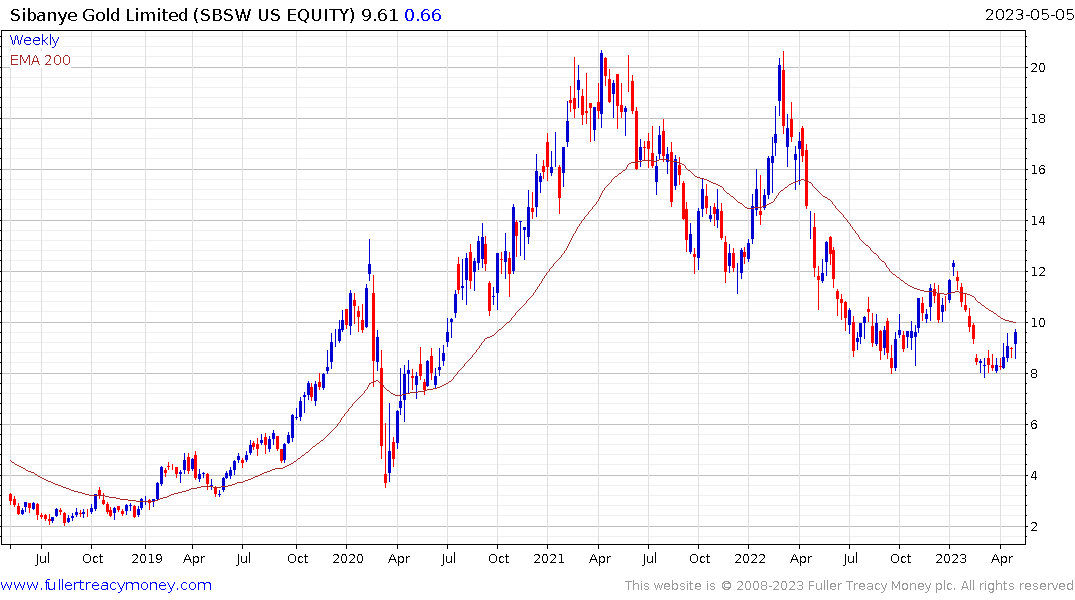

The Johannesburg Platinum Miners Index was discontinued in 2021. Meanwhile Sibanye Stillwater which has both South African and North American supply is firming from the upper side of its base formation.

The South African rand has been quite steady over the last few months as it pauses in the region of the 2020 lows. A sustained move above the 200-day MA will be but the trend of underperformance remains intact.

The South African rand has been quite steady over the last few months as it pauses in the region of the 2020 lows. A sustained move above the 200-day MA will be but the trend of underperformance remains intact.