Chinese Bank Stocks Soar, Adding $166 Billion in Trading Frenzy

This article from Bloomberg may be of interest to subscribers. Here is a section:

With China’s reopening trade stalled, Chinese investors are betting on a pledge by Beijing to let state-owned firms have access to more capital and play a bigger role. New guidelines on bond sales by SOEs is seen as another step in the reform as President Xi Jinping reshapes the economy. The frenzied trading has also been attributed to moves by three nationwide lenders to cut deposit rates to boost profit margins.

It’s a “valuation system with Chinese characteristics” story, said Willer Chen, a senior analyst at Forsyth Barr Asia Ltd. Some investors are also “seeing value in bank stocks because their valuation is cheap and dividend yields are attractive, despite the shrinking net interest margins and weak

Q1 results.”

For now, much of the gains may be driven by sentiment, rather than fundamentals. Chinese lenders posted a tepid set of first-quarter earnings as they faced deeper margin woes despite being sheltered from the recent global banking jitters. Analysts say the pressure may persist through the year as lending rates are lowered to revive the economy.

This is very defensive action from Chinese investors. The primary rationale for overweighting banks is the assumption that the government, through the state-owned enterprises (SOEs), is going to take a much more dominant position in the economy. That’s positive short-term but raises important questions about the welcome private enterprise will receive in China over coming years.

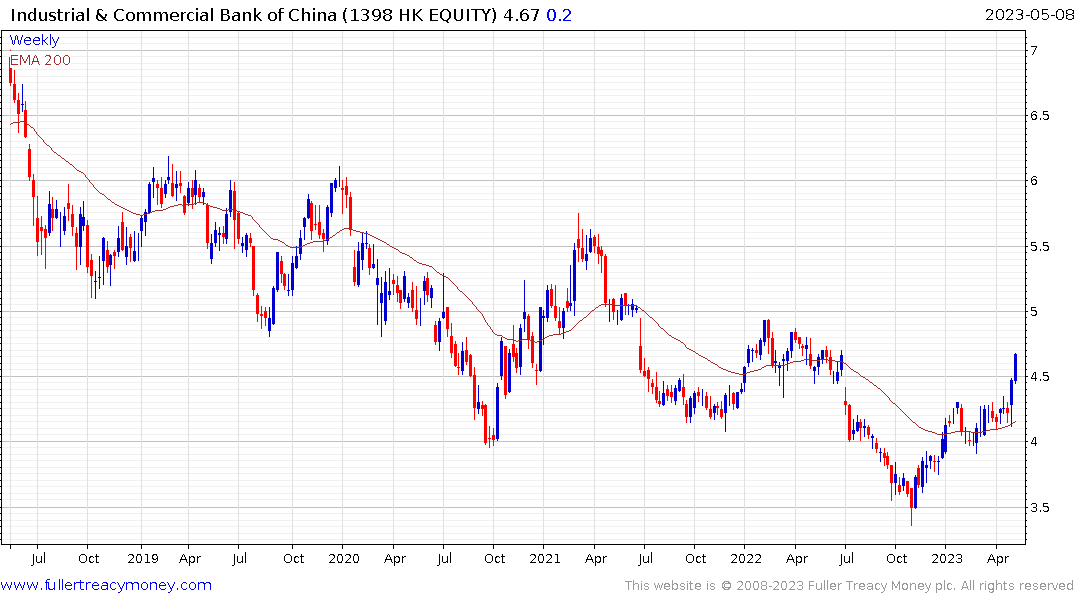

Potential for a boost to support for the flagging property market and large banks being better placed to benefit from that is pure liquidity bet. The Hang Seng Finance Index is rebounding from the region of the 200-day MA and could break the medium-term downtrend on this development.

ICBC (Est P/E 4.02, DY 7.38%) rallied today to test the region of the 1000-day MA. A sustained move above it would confirm a break of the five-year downtrend.

ICBC (Est P/E 4.02, DY 7.38%) rallied today to test the region of the 1000-day MA. A sustained move above it would confirm a break of the five-year downtrend.