Asia's Top-Performing Currency Is Missile-Proof

This article by Lilian Karunungan for Bloomberg may be of interest to subscribers. Here is a section:

One major draw for the won is a strengthening in global trade that’s benefited South Korean exporters, along with regional neighbor Taiwan, which has also seen its currency appreciate this year. South Korea’s current-account surplus is projected by the International Monetary Fund to exceed 6 percent of its gross domestic product this year and the next two years.

“Ironically, the ones that are appreciating are the low yielders,” Soon said. South Korean 10-year government bonds yield 2.26 percent, a little less than that of U.S. Treasuries. By contrast, Malaysian debt yields 3.96 percent and India’s notes 6.45 percent.

Rapprochement Policy

President Moon Jae-in has spurred foreign investor interest after taking office in May on a platform of reducing the influence of the chaebol and seeking a diplomatic rapprochement with its belligerent, missile-firing neighbor to the north. South Korea’s stocks and bonds attracted a net $4.6 billion so far in July, reversing the outflows seen earlier this month.The won hardly blinked after North Korea said on July 4 it fired an intercontinental ballistic missile for the first time. Moon is currently following on campaign pledges to pursue dialogue with Kim Jong Un by proposing some military and humanitarian exchanges.

Export-oriented economies like South Korea as well as Taiwan are benefiting from an upturn in the global technology sector that’s still “has got some legs to it,” Jonathan Cavenagh, head of emerging Asia currency strategy at JPMorgan Chase & Co. in Singapore, said in a Bloomberg Television interview with Betty Liu and Yvonne Man, last week.

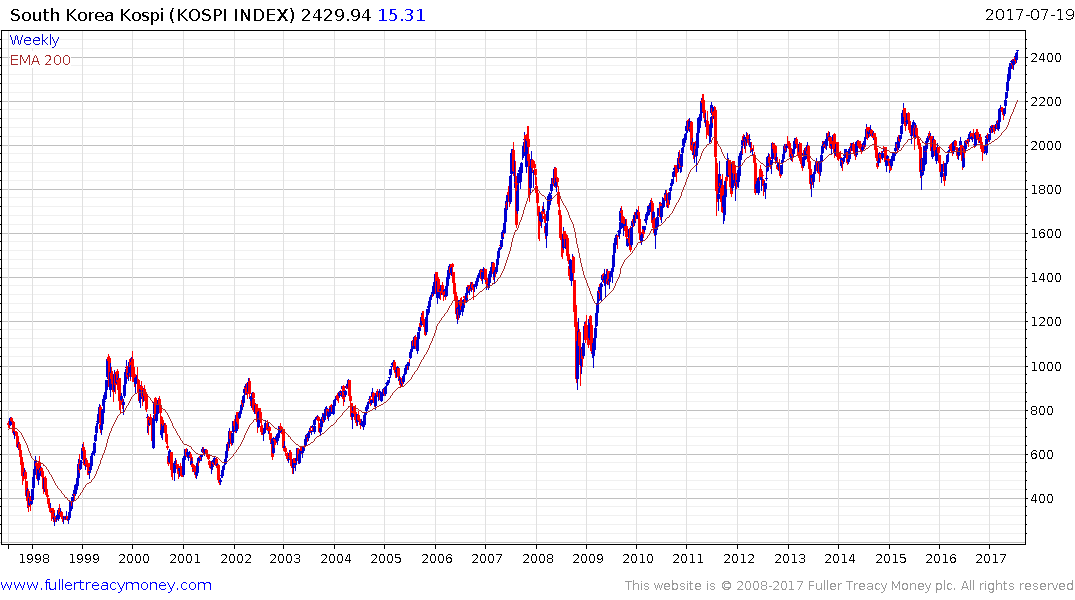

The original Asian Tigers, Taiwan, South Korea, Singapore and Hong Kong has been largely somnambulant for the last few years but have been exhibiting renewed signs of investor interest this year. From a chartist’s perspective, when indices complete lengthy ranges, not least when those ranges are decades long, it is time to pay closer attention.

South Korea’s Kospi completed a six-year range in May and continues to extend its advance. The UK listed iShares MSCI Korea ETF (IKOR LN) shares a similar pattern, not least because of the Pound’s relative weakness over the last year. The US listed iShares MSCI South Korea ETF (EWY) hit a new seven-year high today as it completes a lengthy range.

Taiwan’s TAIEX broke successfully above the psychological 10,000 level for the first time since 1992 in May. The UK listed iShares MSCI Taiwan ETF (IDTW) and US listed iShares MSCI Taiwan ETF (EWT) share similar patterns.

The Singapore Strait Times Index is rallying back towards the 3500 level which has offered resistance since at least 2007.

The Hong Kong Hang Seng is pulling away from the psychological 25000 level and a sustained move back below it would be required to question medium-term scope for additional upside.