Quarterly Market Commentary: The Investment Case for Real Assets

Thanks to Peter Van Dessel for example of his firm Abbington Investment Group, LLC’s letter which may be of interest to subscribers. Here is a section:

Chart 13, below, provides an indication of the price risks involved in a commodity such as Wheat. Using a log scale visual, we can see that Wheat is remarkably cheap when compared to its longer-term inflation-adjusted price history. We understand the reasons for today’s lower price range: the far higher productivity that comes from mechanisation, agronomy, the use of pesticides etc.; but to an impartially-minded statistician, and using the data that supports Chart 13, a five-fold increase in Wheat prices would represent no more than a mean reversion event.

Although a spike in the price of Wheat on such a scale may seem unlikely, the risk of it happening is real and the potential consequences are severe.

The following is a list of potential outcomes that would accompany a broader range of commodity price rises (Ref. Department of Agricultural and Resource Economics, University of California, U.S. Department of Agriculture, Goldman Sachs):

Unequivocally negative consequences for urban dwellers

Lower real incomes

Rising wage pressures

Lower income groups will be more negatively effected

Lower consumer confidence

Higher risk of stagflation

Social and political instabilityUnderstandably, the secondary effect of these outcomes on overbought and over-leveraged financial markets would be significant. So too would the flow of investments from financial assets to real assets.

With the continued backdrop of low interest rates and the current high levels of money supply, the risk of significant flows of investment from large financial markets, such as fixed income, to the far smaller, inflation-sensitive, commodity complex is substantial. If such an event were to happen, the recent 30% move higher in Wheat prices will prove to have been an early indicator of a broader trend.

Here is a link to the full post.

Quantitative easing was designed to inflate asset prices and it has been highly successful. Central bank balance sheets are at unprecedented high levels while stock and bond markets have surged. Against that background it is difficult to find objectively cheap assets.

Commodities have been through a painful process of rationalisation which contributed to last year’s powerful rally for miners and industrial resources. This year there has underperformed as a process of mean reversion took hold. However, over the last few weeks, with oil prices steadying, a firm tone has been evident.

Wheat prices surged higher in late June and have since given up part of that advance to pause in the region of 500¢. Having now broken a five-year progression of lower rally highs a sustained move below the trend mean, currently near 450¢ would be required to question medium-term potential for additional upside.

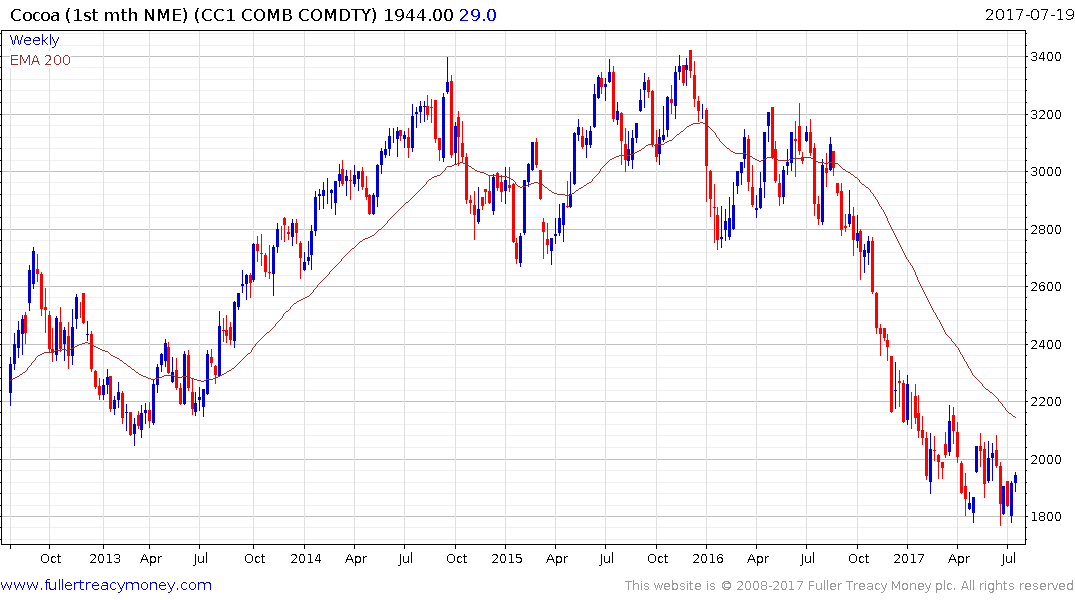

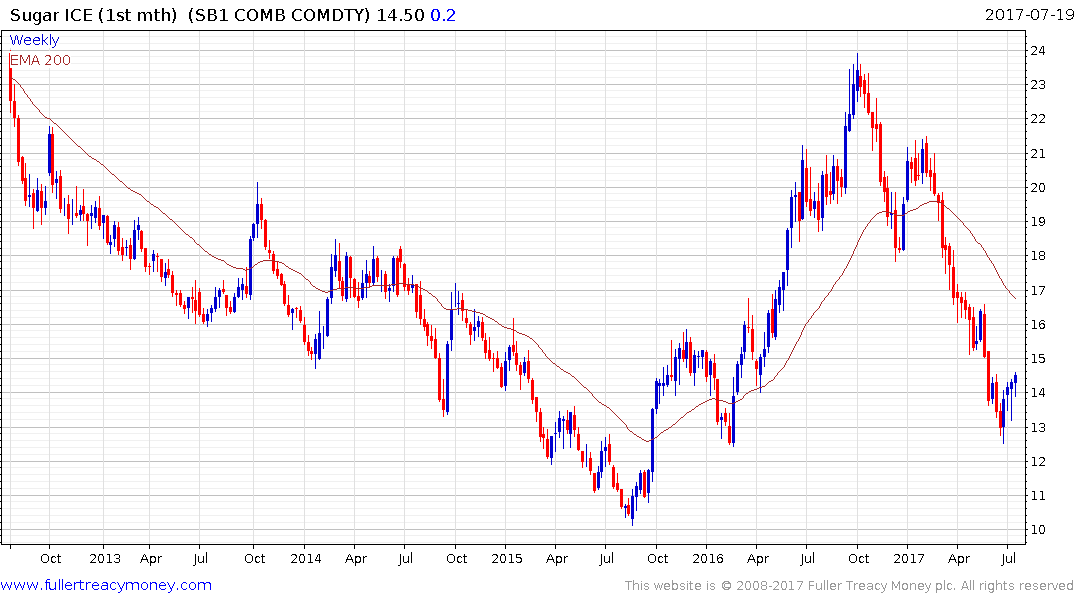

Cocoa, arabica and robusta coffee and sugar, which all had been at depressed levels increasingly exhibit evidence of a return to demand dominance.