Apple Rises to Record on Optimism Over New Batch of Products

This article by Adam Satariano for Bloomberg may be of interest to subscribers. Here is a section:

The stock’s rise shows investors are buying into the strategy outlined by Chief Executive Officer Tim Cook, who has been prodded to introduce bigger iPhones, give more money back to stockholders and introduce new devices.

Those shareholders are now getting what they want. In addition to the larger iPhones, Cook has vowed that Apple will enter a new product category this year. The company is said to be developing a smartwatch, and Morgan Stanley’s Katy Huberty has said Apple may sell as many as 60 million of the new wearable device in its first year on the market, adding up to $9 billion in revenue for fiscal 2015. Apple hasn’t commented on the prospect of larger iPhones or a possible smartwatch.

Cook also has been more open than Jobs was to using the company’s cash hoard to return money to shareholders. Apple is in the midst of a program to give back $130 billion through buybacks and dividends. He’s also been more active in acquisitions, including spending $3 billion to buy Beats Electronics LLC, the company’s biggest-ever purchase.

Is Apple hitting a new all-time high because investors are enthused about a beefed up product line or because they wish to benefit from the $130 billion in buybacks and dividend increases promised by the company? The first is rather ephemeral until the products are in fact launched but share buybacks are very real.

The share bounced emphatically from the region of its 200-day MA in May and rallied steadily to post a new high yesterday. While some consolidation in the region of the round $100 is possible a clear downward dynamic similar that posted at the 2012 peak is required to signal more than a temporary pause and beginning of mean reversion.

Among other high flying Nasdaq shares, Google continues to range with an upward bias below its peak.

Microsoft continues to extend its consistent uptrend

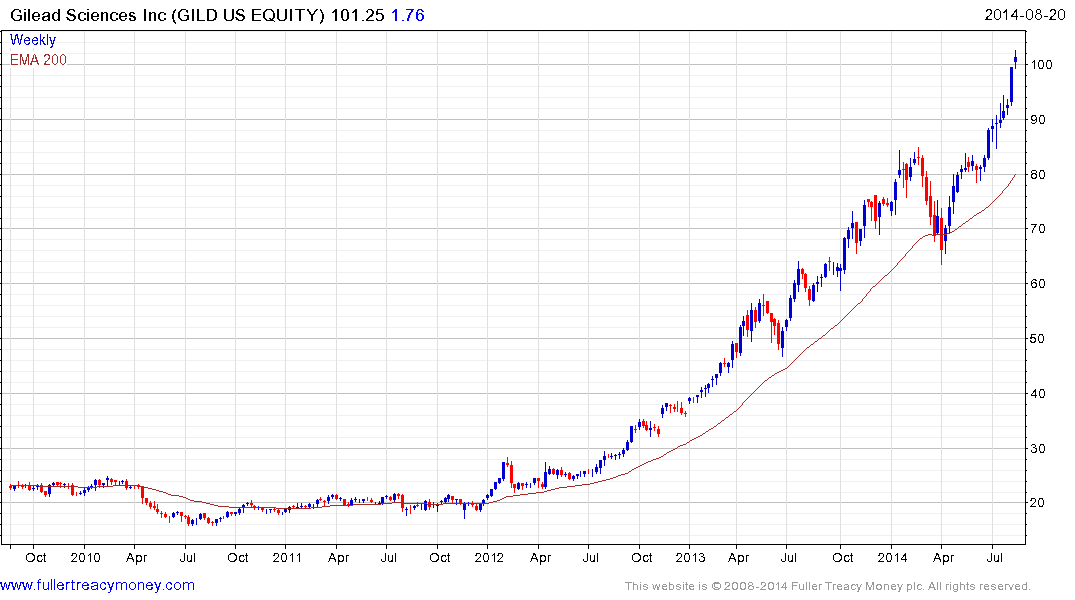

Gilead Sciences is accelerating higher and the first clear downward dynamic is likely to signal the onset of mean reversion.

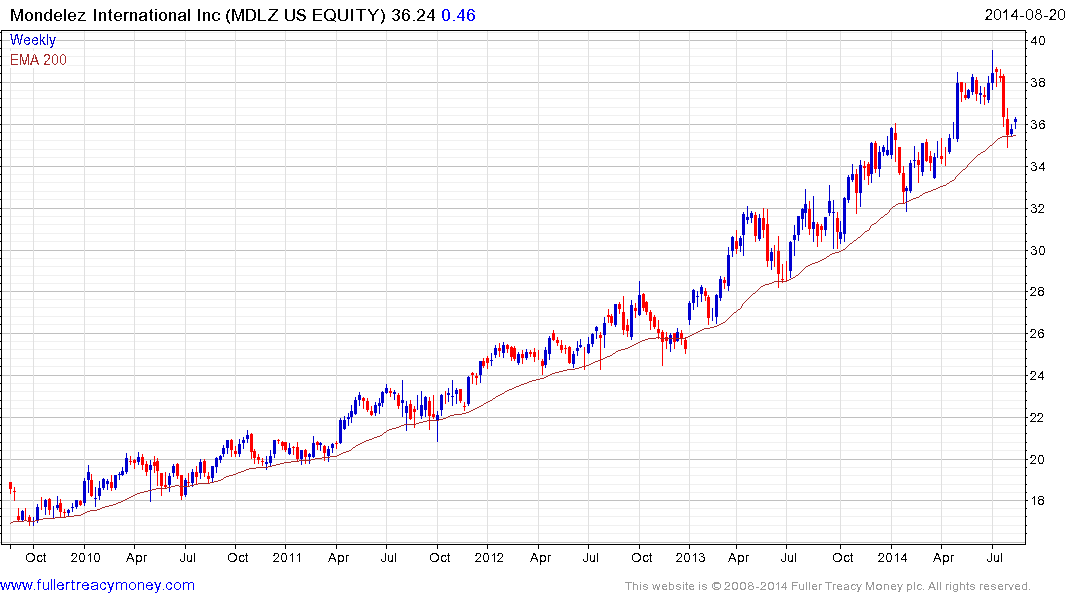

Mondelez International has returned to test the region of the 200-day and the progression of higher reaction lows. It will need to find support in this area if the medium-term uptrend is to remain consistent.

The Nasdaq-100’s uptrend picked up pace from March and its July reaction was the shallowest of all the major indices. While it is becoming increasingly overextended relative to the 200-day MA a break below 3850 would now be required to check momentum.