Indonesian Nationalism

This article by Neil Chatterjee for Bloomberg casts a cautious tone on political machinations within Indonesia. Here is a section:

Indonesia’s leaders want to wean the country off of commodities and push investment in value-added manufacturing and services to emulate the success of countries like South Korea and create a more even distribution of wealth. With a population hungry for jobs, there is fertile ground for the elite to paint the issue in nationalist terms and blame foreigners to win votes and serve its own interests. After all, countries from Australia to Zimbabwe are pursuing similar drives to earn more from their resources. Critics including the World Bank say such policies often backfire, and that driving away investors could cost Indonesia more than $6.5 billion in lost taxes and royalties over the next three years. That could exacerbate an economic slowdown and cripple efforts to build roads, schools, hospitals and other infrastructure.

It will still be a while before Joko Widodo’s victory is confirmed by the Supreme court and his administration takes over. Indonesia ranks towards the top of global corruption rankings so anything a new government can do to reduce graft and streamline planning will help improve perceptions that the country of 300 million can begin to reach its productive capacity.

The last few days of the previous administration’s rule saw an easing of export restrictions on ores but it remains to be seen what Widodo’s attitude to the ban is. In attempting to ensure greater benefit from its natural resources, Indonesia is attempting to mirror China’s development where a focus on infrastructure development in its early stages paid off.

Indonesia’s Construction, Property and Real Estate Index, Finance and Infrastructure, Utility and Transportation Index have been this year’s top performers; rising 41.5%, 27.4% and 23.89% respectively year-to-date.

The wider market has rebounded steadily from the 2013 lows and is now testing the region of the highs. A sustained move below the 200-day MA, currently near 4800 would be required to question current scope for additional upside.

Elsewhere regionally, the Philippines has a similar chart pattern.

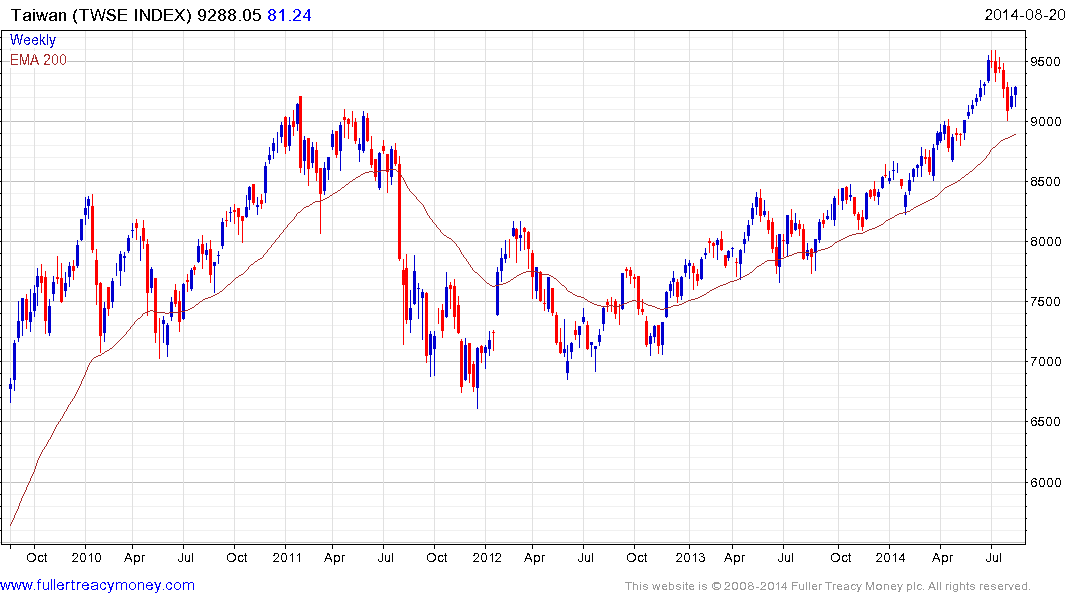

Both Malaysia and Taiwan found support in the region of their respective 200-day MAs last week

South Korea continues to look more likely than not to extend the breakout from a three-year range.

The Hang Seng also continues to extend its breakout.