2014 in the Rearview Mirror; 2015 as Cool as the Other Side of the Pillow

Thanks to a subscriber for this report from H.C.Wainwright & Co focusing on emerging gold miners. Here is a section:

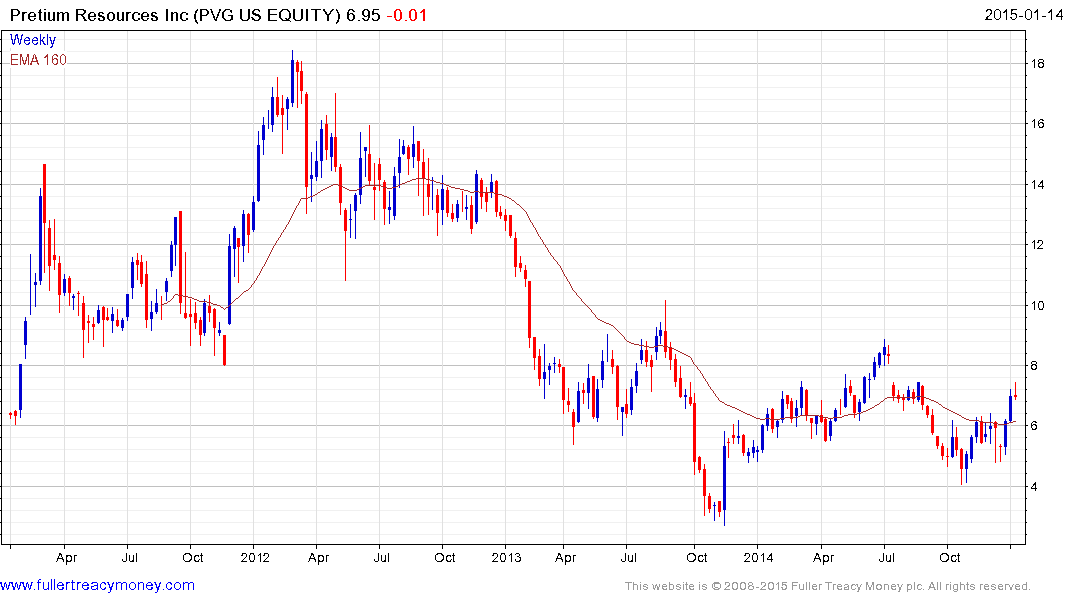

Highlights: We anticipate a number of coverage companies with a focus on gold to continue forward in 2015 irrespective of volatility in the gold markets. Of note, we anticipate Pretivm Resources to be in a position to make a construction decision at the high-grade Brucejack project in 2H15. Looking into Nevada, Gold Standard is striving to further expand the Railroad-Pinion project as well as upgrade components of the deposit to higher resource categories. Allied Nevada Gold is striving to improve operations at the Hycroft Mine which has the potential to improve cash flow in 2015. Pershing Gold has a goal of completing a Preliminary Economic Assessment (PEA) at the Relief Canyon project, which could allow the company to make a production decision shortly afterwards. Brazil Resources continues working not only on its multiple gold projects in central Brazil but also is making plans to pursue a spin-out of the Rea uranium project into a separate public company. Vista Gold plans on a number of optimization studies at the Mount Todd project in Australia with an eye on final environmental permits in hand by the end of 2015.

In our opinion, the key to success in 2015 is fairly basic for each company although dissimilar goals have been set forth. Each management team should not over promise either on the timeline or scope of what can be accomplished in 2015. While we have seen a modest rebound in the gold market since fall 2014, the overall climate does not warrant nor reward overreaching endeavors. Our advice to any gold company is to dedicate time and efforts toward more efficient and long-term enhancements to individual projects while keeping a tight budget. The companies which can deliver better operating results in a cost effective manner could see a positive reception from the market.

Here is a link to the full report.

The falling price of oil in tandem with the relatively steady performance of gold is generally positive for gold miners provided they can control costs in other parts of their businesses. The sector was one of the worst performers for two consecutive years with the result that individual miners are now being judged on their individual merits.

There is considerable variation in the performance gold miners and those that pay a dividend have tended to outperform.

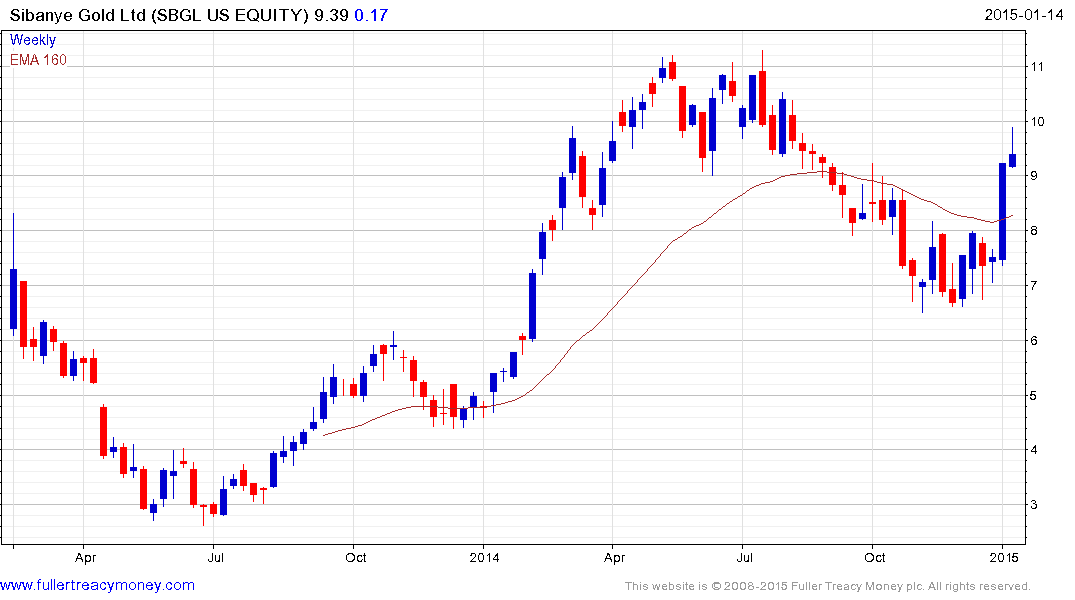

Sibanye Gold (Est P/E 8.94, DY 2%) bounced impressively last week and some consolidation of that gain is possible. However a sustained move below $7.75 would be required to question medium-term scope for additional higher to lateral ranging.

Hong Kong listed Zijin Mining (Est P/E 16.34, DY 4.26%) has held a progression of higher reaction lows since mid-2013 and while somewhat overextended relative to the 200-day MA at present, a sustained move below HK$2 would be required to question recovery potential.

Among explorers Pretium has a market cap of almost a billion. The share posted a large upside weekly key reversal in November 2013 and found support above that level in November 2014. A sustained move below $6 would be required to question medium-term scope for additional upside.

Back to top