Rigs Running Hot Offshore as Shale Scales Back

This article by Zain Shauk for Bloomberg may be of interest to subscribers. Here is a section:

It’s a different calculus for prolific deep-water wells, which can produce far greater quantities of crude over a longer time span than a typical onshore well. The new wells are the latest step in a long-term development plan where much of the investment -- in pipelines, platforms and subsea processing systems -- already has been made.

“When you’re 90 percent complete, you’re not going to stop,” Gheit said.

Gulf of Mexico production will jump from 1.4 million barrels per day in 2014 to an average of 1.58 million barrels per day in 2016, a 13 percent increase, according to Wood Mackenzie projections. The growth in deep-water will add to total U.S. output, which is projected to grow by 14 percent over that period as rising efficiency continues to push shale production up despite declines in drilling.

‘Mega Projects’

Deepwater oil developments are so enormous they are referred to within the industry as “mega projects,” featuring platforms that can cost as much as $2 billion, wells that cost about $300 million to drill, and a system of pumps and processing equipment along the seafloor that can add another $100 million, Sandeen said.

“These aren’t onshore projects where you’re going to produce from a well for a few years,” said Jackson Sandeen, a senior research analyst covering the Gulf of Mexico for Wood Mackenzie. “These are 30 to 40 year projects where a slight bump in the road in the short term is not really going to affect the project in the long term.”

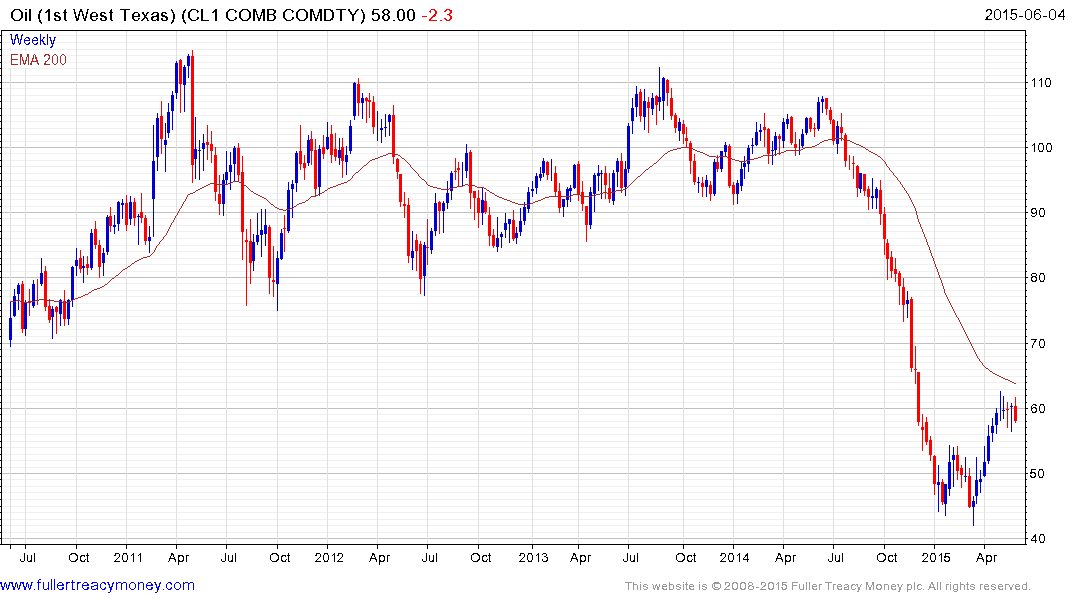

Oil prices have paused following a rally to close the overextension relative to the mean. Shale oil producers which in many respects represent an important source of marginal supply have been cutting back and the number of rigs in operation has collapsed. The reality of unconventional oil and gas drilling means they have to keep drilling new wells due to the early decline rates associated with hydraulic fracturing. As a result they have relative flexibility of supply because they can choose to stop drilling when prices are low only to ramp up production when prices are high. The flexibility, but high debt of unconventional oil and gas drillers contrasts with the expansive balance sheets but inelasticity of supply characterised by the major oil companies.

Iraq has spent billions modernising its energy infrastructure and that supply is now coming back onto the international market despite the unrest which continues to plague the centre of the country. The above article highlights how massive investment in deep water drilling is coming to fruition and this is despite the hiatus that was associated with the Macondo accident. Mexico is also welcoming foreign investment in its energy infrastructure after decades of going it alone. Meanwhile OPEC decided yesterday to leave production unchanged.

After more than a decade long bull market, long-term investment in additional supply is delivering while demand growth is sluggish and faces a nascent threat from solar. In such circumstance the potential for oil prices to range in a volatile manner remains the base case.