Jobs Machine Banishes Winter Woes as U.S. Payrolls Beat Forecast

This article by Michelle Jamrisko for Bloomberg may be of interest to subscribers. Here is a section:

Hourly earnings climbed from a year ago by the most since August 2013, while an increase in the number of people entering the labor force caused the unemployment rate to creep up to 5.5 percent from 5.4 percent. The report bolstered the case for Federal Reserve policy makers to begin raising rates this year.

“This only reinforces the view that the economy is a lot healthier than the GDP data imply,” said Joe LaVorgna, chief U.S. economist at Deutsche Bank Securities Inc. in New York, whose projection for a 275,000 gain was among the closest in the Bloomberg survey. “How weak can the economy be when we’re generating this kind of job growth?”

Broad-based employment gains from builders to trucking companies to local governments show hiring managers are confident the economy will regain its footing after faltering early this year. The dollar surged to a 13-year high versus the Japanese yen and Treasuries tumbled.

Wage growth is a big news item, and probably more important than the number of jobs created since it is a symptom of tightness in the labour market. It is all the more important because one of the key arguments used by economists over the last few years to defend QE was that there is just too much slack in the economy. The Fed has data that says inflation is low and wage growth is picking up but the Dollar is strong and bond markets are weak so the decision on whether to raise rates this year remains finely balanced.

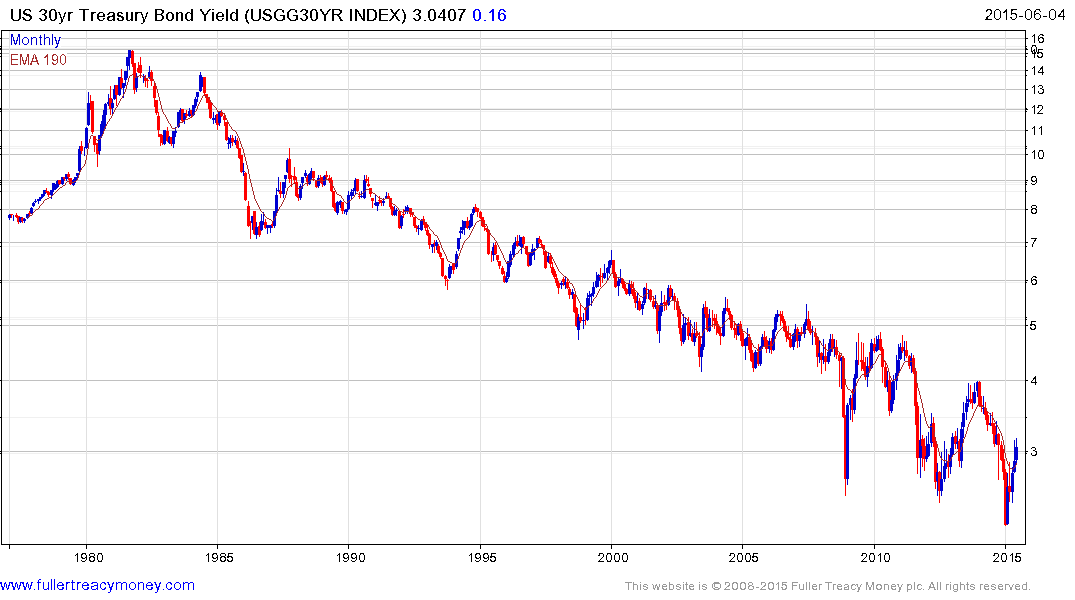

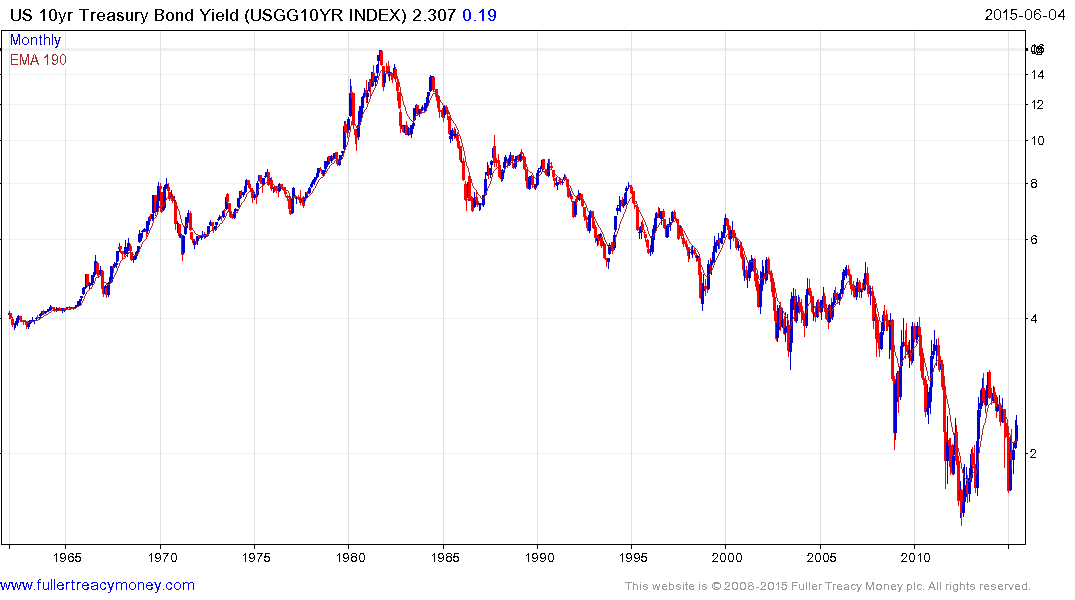

These long-term log scale charts of US 30-year and 10-year Treasury yields give us some perspective. The key levels in terms of the long-term downtrends are 4% and 3.2% respectively. Action this week suggests that the potential for yields to retest those areas is now more likely than not. Sustained moves below their respective 200-day MAs would be required to question that view.

If we assess the consistency of the generational long downtrend, volatility has definitely increased and supports the view this is type-3 bottoming activity.

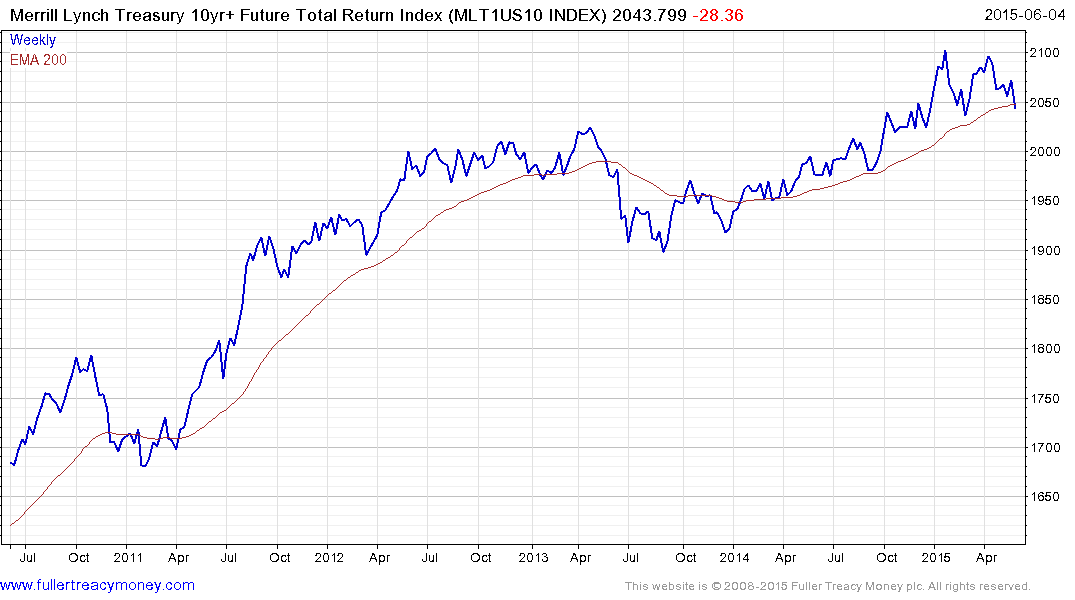

The Merrill Lynch Treasury 10yr+ Futures Total Return Index has dropped back to test the March low and the region of the 200-day MA. It will need to find support in this area if the medium-term progression of higher reaction lows is to remain intact.

The Dollar Index continues to sustain the move above 90 and the activity posted over the last three months is consistent with consolidation and mean reversion following a major breakout. A sustained move below 90 would be required to question medium-term scope for additional upside.

Back to top