12 reasons to own gold now: Part 2

This article by Anthony Hart for Mineweb may be of interest. Here is a section:

Astute readers will notice this was the topic of my first blog post…and it hasn’t lost its relevance in the week since (surprising huh…). Due to some of the reasons contained within the dozen detailed in the last two days…and many more…gold continues to have a legitimate role to play in insuring your overall portfolio for the ongoing systemic risk, and volatility (and potential failure) inherent in the current global financial system.

Gold has always been a long-term store of value whose price has the potential to experience a high degree of volatility over the short term. As such it has some of the characteristics of a currency while also representing a diversifying quality within a portfolio. However gold does best when people lose confidence in the ability of other currencies to hold their value either through deflation and low interest rates or through runaway inflation and high rates.

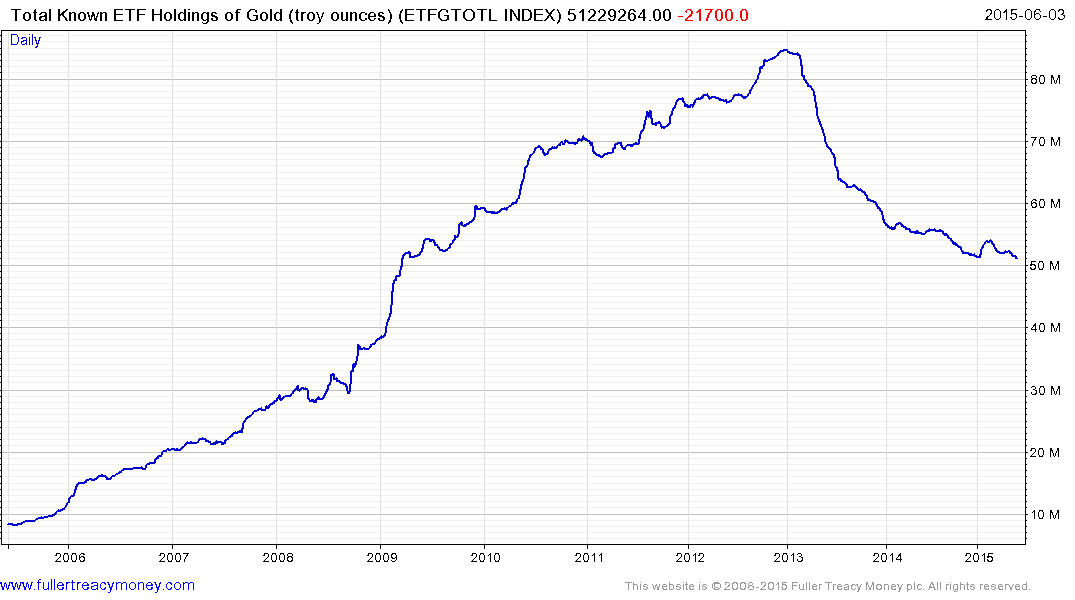

In the decade from 2003 gold was remonetised in the eyes of investors as the Dollar trended lower, interest rates fell and price trended higher. However there is now an argument that gold has been demonetised in the eyes of at least some investors. ETF holdings of the metal have returned to test their low and are 35% below the 2013 peak.

Gold prices are testing the lower side of a six-month range having encountered resistance in the region of the 200-day MA four weeks ago. Upward dynamics similar to those posted following similar retests will be required to check the slide.

Platinum prices are testing the lower side of a short term range and are in need of an upward dynamic to check momentum.

The NYSE Arca Gold BUGS Index has returned to test the lower side its six month range and is also in need of an upward dynamic to reinvigorate the bullish argument.

All of this suggests precious metals are in need of a bullish catalyst to reinvigorate demand.