Oil Tanks Are Running Dry at the Biggest US Crude Storage Hub

This article from Bloomberg may be of interest. Here is a section:

Operationally, pulling oil out of tanks when levels fall below the so-called “suction line” is difficult and expensive, and the quality of crude can be compromised by the presence of water and sediment.

For now, traders are expecting stockpiles to halt their decline by October and possibly start building up again, depending on how exports shape up. Indeed, this week’s drawdown was less than 1 million barrels — the first time that’s happened since early August.

Cushing’s role in global oil markets has also diminished in recent years since the US lifted an export ban. Most barrels now flow straight from the prolific oilfields in Texas’ Permian Basin to the coast, where they are shipped to overseas buyers.

Shale oil producers are complaining about rising costs, the burden of regulatory compliance and supply chain disruptions. The net result is they are in no mood to invest heavily in new supply when there is such an uncertain regulatory cloud hanging over their businesses. That’s inhibiting the non-OPEC+ supply response to higher prices. The Strategic Oil Reserve cannot be emptied twice, so that is an additional factor supporting prices.

Brent crude broke out of its short-term shallow range today to hit a new recovery high. A sustained move below $92.50 would now be required to check momentum.

The best performing shares on the S&P500 this year are Nvidia and Meta Platforms. Over the last 3 months, the best performers are dominated by oil companies. Right now, oil is one of the few assets in a clear uptrend and that is going to concentrate speculative flow on the sector.

The best performing shares on the S&P500 this year are Nvidia and Meta Platforms. Over the last 3 months, the best performers are dominated by oil companies. Right now, oil is one of the few assets in a clear uptrend and that is going to concentrate speculative flow on the sector.

Following on from the discussion in the above piece, the other significant similarity between 1980 and now is oil prices are surging. Between early 1979 and the early 1980s oil prices jumped from around $13 to £38. The magnitude of the move to date is nowhere near as large, but oil prices are certainly trending higher.

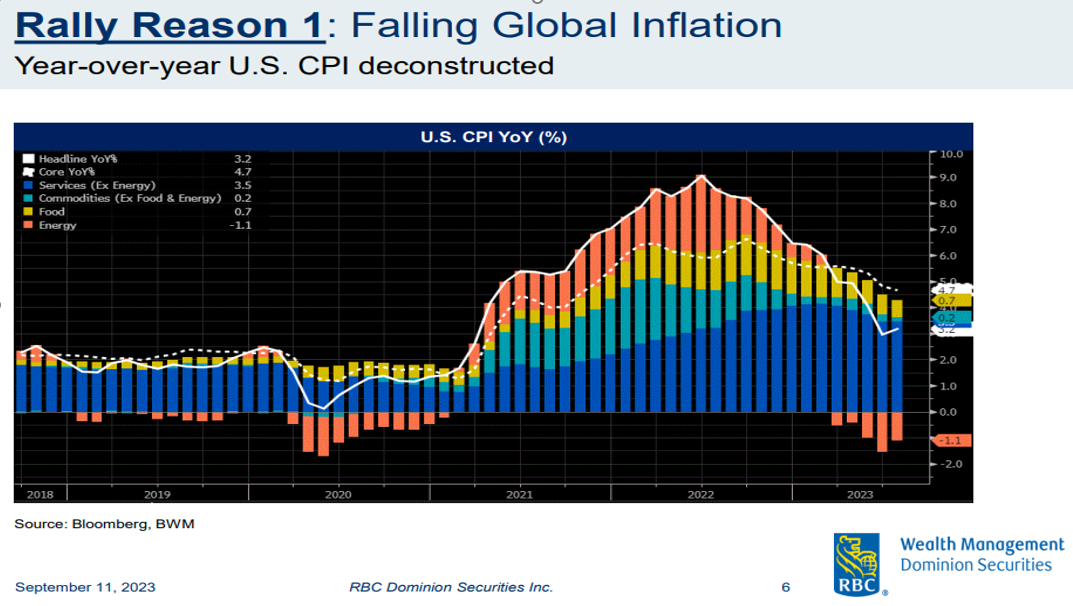

This graphic highlights how much influence energy prices have on raw CPI. It is quite likely there will upside surprises over the coming quarters.

Major oil companies like Shell and BP are breaking higher.

APA is firming from the region of its trend mean.

APA is firming from the region of its trend mean.