India Plans to Sell 50-Year Bond on Growing Insurer Demand

This article from Bloomberg may be of interest. Here is a section:

“Investor demand has been strong, supported by the expansion of the formal sector, with households allocating a higher share of financial savings in life insurance, pensions and provident funds,” Gaura Sen Gupta, economist at IDFC FIRST Bank wrote in a note.

The authorities are trying to increase the tenure of debt sold and expect yields to decline after India’s inclusion in JPMorgan Chase & Co.’s emerging market index, a government official, who didn’t want to be named, told reporters.

The government will sell 300 billion rupees ($3.6 billion) of the 50-year bond in the October to February period, which accounts for almost 5% of its total borrowings.

The growing footprint of life insurers — which now own a quarter of government debt — has already impacted the nation’s yield curve. Earlier in the year, longer-dated debt was priced at lower yields than shorter-maturity paper.

The rise of India’s middle class is a major development for the global economy. The spending power of several hundred million people is improving annually. That is creating demand for financial products which the government is taking advantage of. It also represents a fertile market for global brands who can increase the range products sold in the country.

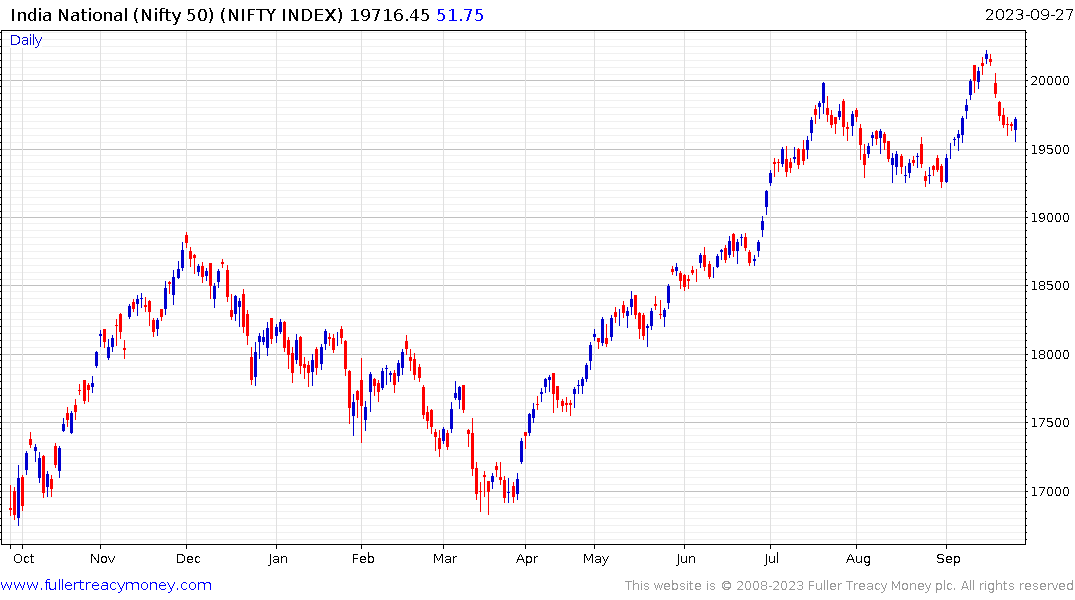

The Nifty Index posted a small upside key reversal today to confirm near-term support amid a short-term oversold condition.

The Nifty Index posted a small upside key reversal today to confirm near-term support amid a short-term oversold condition.