Zuma Sparks Outrage in South Africa by Axing Finance Chief

This article by Michael Cohen Amogelang Mbatha for Bloomberg may be of interest to subscribers. Here is a section:

“The government has crossed a line which it hasn’t crossed for the last 20 years,” Steven Friedman, director of the Center for the Study of Democracy, said by phone from Johannesburg. “This is really, effectively, the first finance minister to be fired since 1994. The accurate perception is that the reason he was fired is that he was doing his job, insisting on fiscal discipline.”

While Zuma announced in February that the government had taken a decision to build new nuclear plants, Nene insisted that South Africa had to be able to afford them. Nene also clashed with the chairwoman of South African Airways, Dudu Myeni, a former schoolteacher who also heads Zuma’s charitable foundation, after he refused the national carrier permission to restructure a plane-leasing deal.

“It is common knowledge that Nhlanhla Nene sought to rein in excessive government spending and was causing too much of a blockage for President Zuma in respect of the nuclear procurement deal and SAA,” Mmusi Maimane, the leader of the main opposition Democratic Alliance, said by e-mail. This is “yet another example of how President Zuma puts himself first and the country second.”

Some of the best vacations I’ve had have been to South Africa and with the Rand making historic lows against a host of currencies the Sardine Run in 2016 is sounding increasingly enticing. While the Rand’s decline certainly makes South Africa more attractive as a tourist destination, the slide in standards of governance mean the country will be less attractive for foreign companies seeking manufacturing and services venues.

The Rand had been weak previously and the last thing it needed was for deteriorating standards of governance to make international headlines. It plunged on today’s news to reassert the medium-term decline and there is little evidence on the chart to suggest the fall is over. As with so many commodity producers, a change of government is probably required to restore confidence South Africa is capable of introducing the reforms necessary to stem budget deficits.

The 10-year, Rand denominated, government bond yield surged higher today and while there is potential for a pause in the region of 10%, a sustained move below the MA would be required to begin to question medium-term supply dominance.

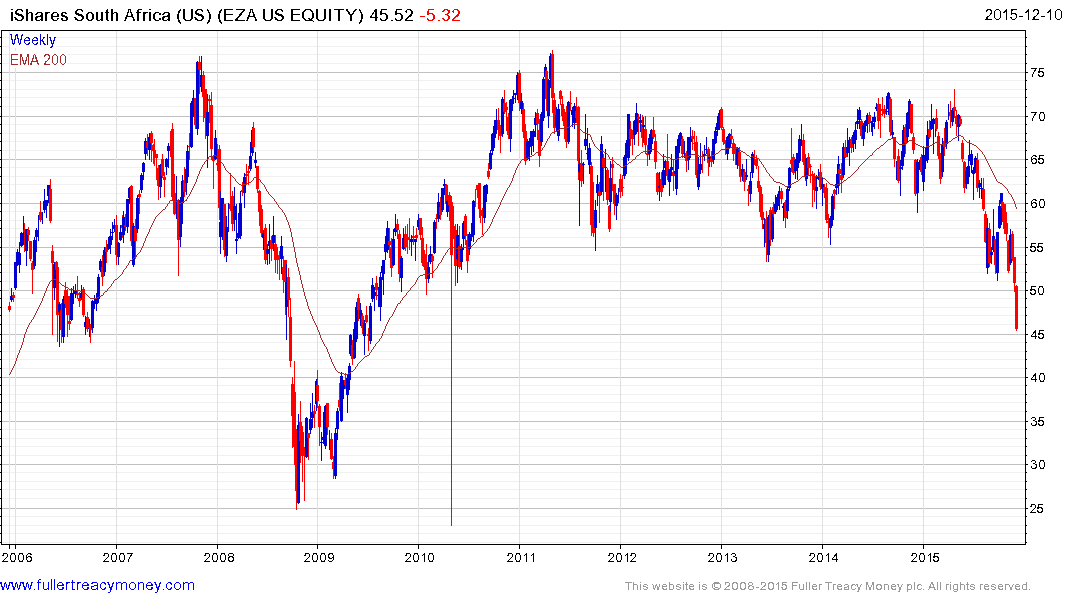

The iShares MSCI South Africa ETF extended the breakdown from an almost 5-year range today and while oversold, a clear upward dynamic would be required to question medium-term scope for additional weakness. .