Lululemon Or Puma Could Be Answer to VF's Deal Drought

This article by Brooke Sutherland for Bloomberg may be of interest to subscribers. Here is a section:

VF hasn't publicly announced any deals for four years -- its longest drought ever, according to data compiled by Bloomberg.

It's last big takeover was the $2 billion purchase of boot maker Timberland in 2011, and it dropped a pursuit of surf brand Billabong in 2013 after the company wanted more than VF thought it was worth.

The dearth of new deals is starting to make itself felt: Analysts are projecting VF's sales will rise just 2.8 percent this year, the smallest gain since 2009.

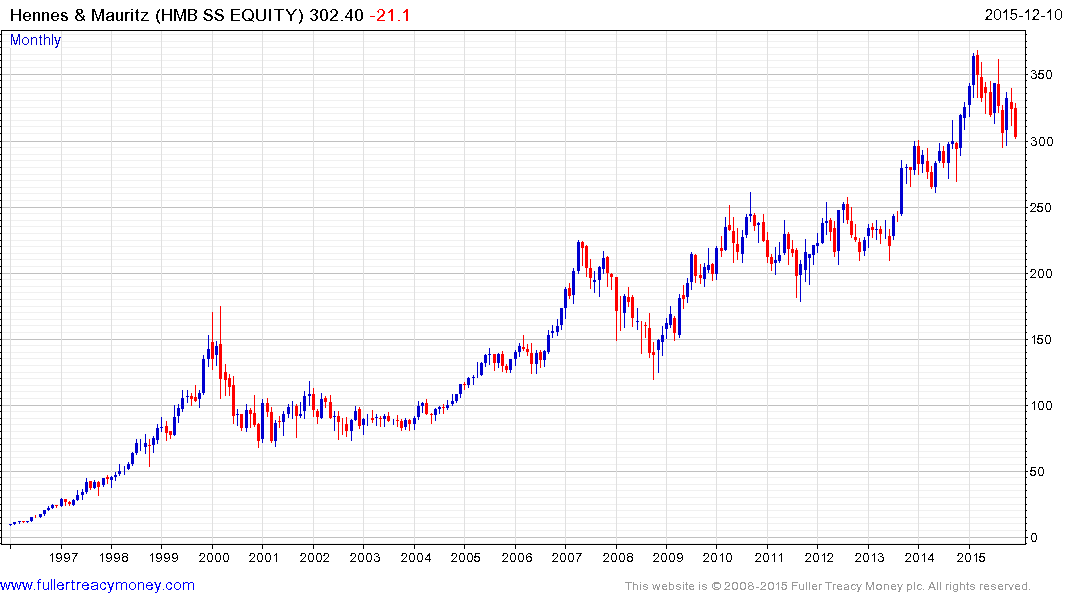

Part of that slowdown is tied to a broader trend among retailers from which VF hasn't been immune. Cheap, fast-fashion brands such as H&M and Zara are drawing customers away from middle-of-the-road purveyors of basics like jeans and T-shirts, just as they get slapped by the strong dollar. Weaker demand and piled-up inventory forced VF to cut its profit forecast in October, sending the shares into a tailspin.

VF still has a lot going for it. The company's brand mix is diversified enough to help shield it from downturns in specific categories and a robust supply chain lets it better manage inventory levels in response to changes in demand, says Canaccord analyst Camilo Lyon. All of that should position VF to ride out the retail industry's current hardships. But taking advantage of opportunities to bargain shop for more brands as others struggle would put it in an even better position.

Companies like H&M and Inditex have new lines hitting stores every week. As I mentioned on my return from China in November there are shops in major cities with new lines every day. For companies still wedded to the idea they can do a new collection for every season this represents a major wakeup call and there are clear winners and losers.

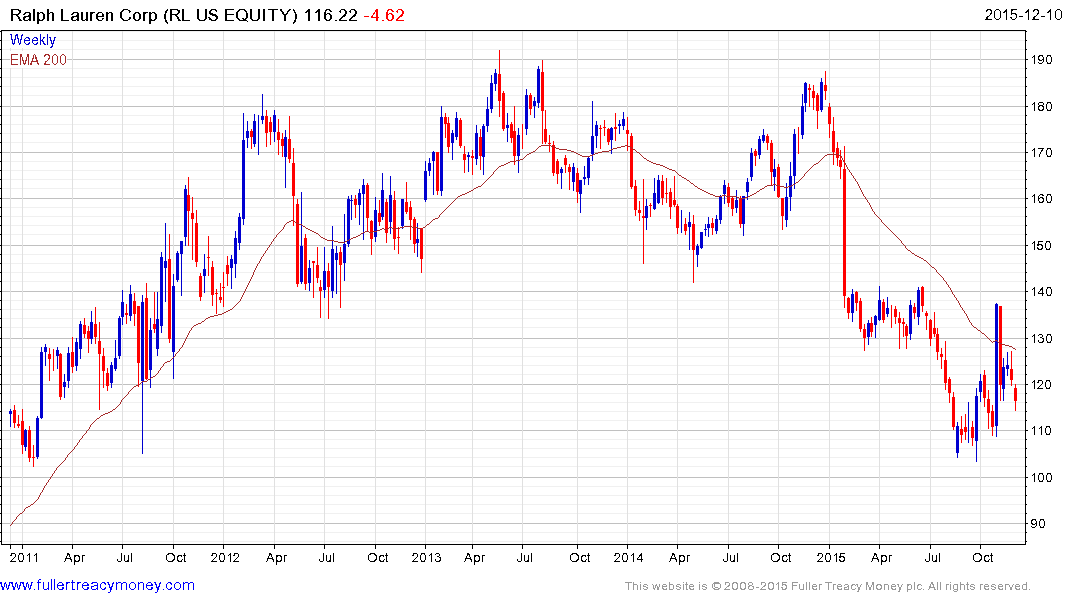

Ralph Lauren has at least stabilised over the last couple of months but a sustained move above the trend mean would be required to question the medium-term downward bias.

Philip Van Heusen has been trending lower for nearly two years and while increasingly oversold relative to the trend mean a break in the progression of lower rally highs would be required to question medium-term supply dominance.

VF Corp lost momentum from late last year and dropped down from that range in October. A sustained move above the trend mean would be required to question completed top formation characteristics.

H&M and Inditex continue to exhibit relative strength but both are currently consolidating earlier advances and will need to hold their respective November lows if there trends are going to remain consistent.

Back to top