The worst of both worlds

Thanks to a subscriber for this report from Spectrum Insights which may be of interest. Here is a section:

Australia’ economy shrunk by 0.5% in 3Q16. Typically in such a situation a cut in official interest rates can ease the pain. While the RBA may choose to lower interest rates, its impact on customers’ borrowing costs may be limited. In fact mortgage rates could rise again soon.

Why? The RBA only controls the cost of borrowing overnight. The longer the term of the bond, the more the market sets its yield. As the marginal investor in the A$ bond market is from overseas what happens in the global market place drives our longer term bond yields.

Just as Australian home loan borrowers could do with some relief interest rates are edging up. The reason is Australian banks raise insufficient deposits to fund their loan book. The balance of funds comes from the bond market. Should the cost of borrowing for our “AA” rated banks rise further customers will likely get more hikes on their mortgage rates.

A concern Spectrum has is if the U.S continues to grow at near its current 3% run rate both U.S and Australian bond yields could rise further. Borrowing while rates were falling was easy

Since the 1980’s Australian households have piled on the debt. Much of this has gone into residential real estate. The continuous fall in interest rates and rising property prices created a re-affirming inducement to borrow more. Today, Australian households have world beating debt levels. This makes parts of the sector hyper-sensitive to rate rises. Should the cost of borrowing rise notably from here wide-spread financial stress within Australian households looks set to follow.

Here is a link to the full report.

.png)

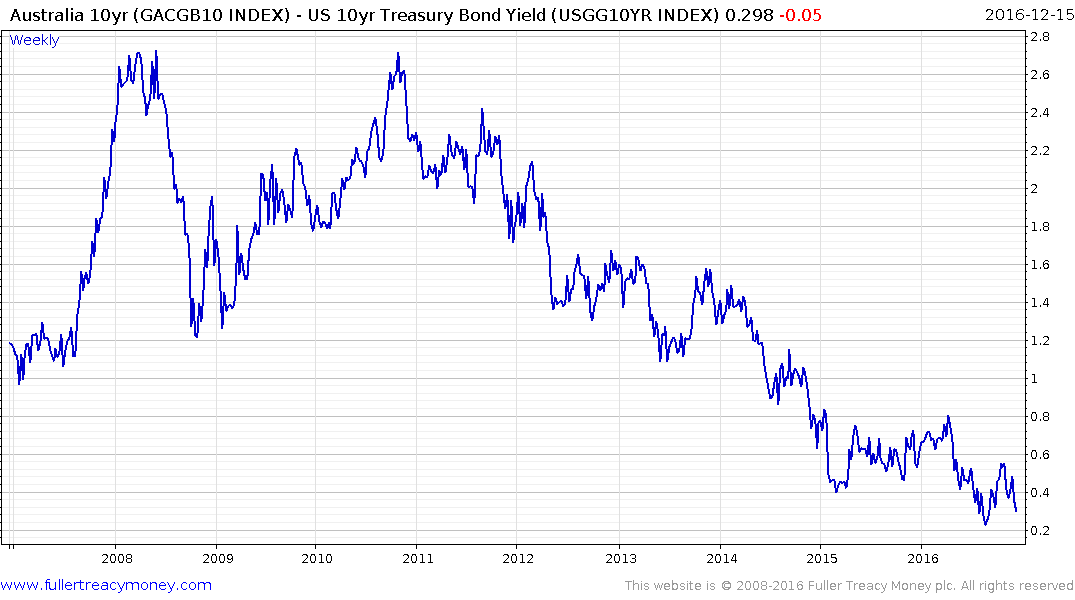

Australian 10-year bond yields last traded above the trend mean in 2013 when rates were 2.5% or 100 basis points above today’s level. The yield is closing in on the 3% level more in sympathy with US Treasuries than any particular hike in Australian inflation expectations.

The spread between US and Australian 10-year debt has shrunk to less than 30 basis points from a peak in 2011 of 270. With US interest rates rising and a stronger Dollar the relative advantage of investing in Australian bonds from the perspective of a foreign investor in rapidly evaporating.

The Australian Dollar encountered resistance this week in the region of the trend mean and a sustained move above 75¢ would be required to question potential for additional weakness.

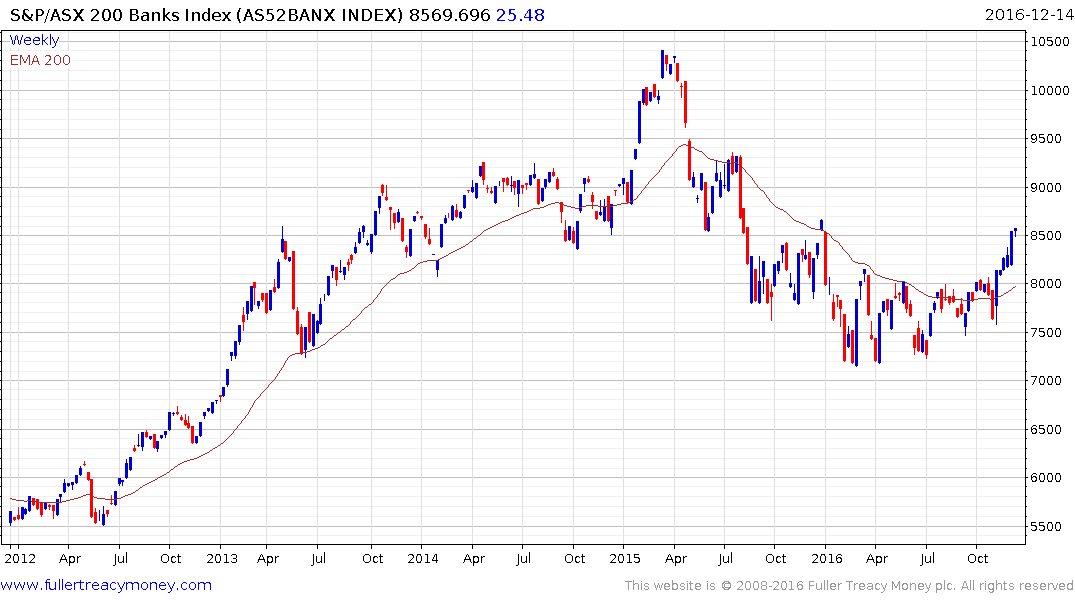

The S&P/ASX 399 Banks Index has held a progression of higher reaction lows since early this year and rallied impressively from early November to break the medium-term progression of lower rally highs. While somewhat overextended in the very short-term a sustained move below the trend mean would be required to question medium-term scope for some additional upside.

There is a key difference between the US and Australian housing markets however. The USA with Fannie Mae and Freddie Mac is dominated by 30-year fixed rate mortgages. Home equity lines of credit tend to up the leverage homeowners have once they buy a home but their personal risk from rising interest rates provided they can afford the repayments is relatively steady compared to the variable rate and interest only options that predominate in countries like Australia and the UK.

Here is a link to National Australia Bank’s mortgage offerings where variable rates, interest only and 95% mortgages are offered and where the longest fix is for five years. .

The RBA might not be keen to raise rates but the global bond markets are competitive and if rates are rising elsewhere banks will need to offer additional compensation to investors if they are to sell their offerings. That suggests yields are likely to rise and that is a challenge for the housing market not least since households carry so much interest rate risk.