China Halts Trading in Key Bond Futures as Panicky Investors Sell Securities

This article by Yifan Xie and John Lyons for the Wall Street Journal may be of interest to subscribers. Here is a section:

Some of these bubbles have burst dramatically over the last 18 months, with the crash in China’s stock markets last summer the most notable example. On Thursday, the pain spread to China’s $9 trillion bond market, which remains overwhelmingly driven by domestic investors, despite some opening up to foreigners this year. The yield on 10-year government bonds had reached as low as 2.6% in August.

“People woke up to the fact that the bond bubble is too large,” said Hao Hong, co-head of research at Bocom International, which is owned by Hong Kong’s Bank of Communications. “The bond market in China is under severe pressure, across the board.”

The U.S. Federal Reserve’s decision to raise interest rates helped trigger the selloff. Chinese investors believe it increases the chance China will guide its own rates higher to stem the yuan’s recent decline against the dollar and heavy capital outflows from the country.

But the bond market slump also exacerbates the policy dilemma facing China’s central bank. It has tightened short-term lending in recent weeks in an effort to make it harder for speculative investors to borrow money. The problem is that such tightening moves—along with any future rate rises—could provoke market plunges and panics as liquidity dries up.

Here is a link to a PDF of the above article.

One of the greatest challenges the Chinese administration has is that many of its capital markets are dominated by individual investors rather than institutions. Coupled with a wide spread between the lending and deposit rate speculation is rife and that tends to encourage manic periods of both buying and selling.

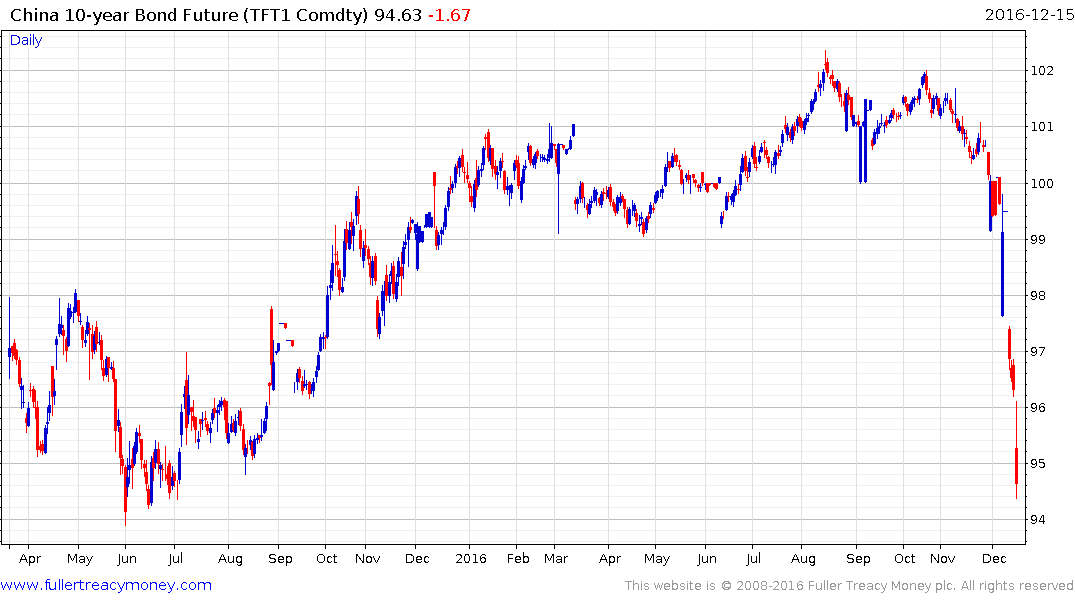

The bond market is orders of magnitude larger than the equity market so while retail selling at the margin has had a marked effect, leading to the halting of trading today, the Administration has ample scope to support prices if it needs to. Bond futures have only been in existence since March 2015 and this is the first real test of the market’s liquidity.

When we look at the yield chart there is certainly some rationale for concluding the bull market evident since late 2013 is over.

Perhaps more important is the fact that while Party rhetoric emphasises nationalism, Chinese citizens tend to vote with their feet. A $1.2 trillion loss in reserves in just over a year is not small money. The Dollar continues to trend higher against the Offshore Renminbi and Bitcoin is testing its highs.

Since the Chinese government has very little control over the price of bitcoin it might represent the best overall indicator of Chinese capital flight. This real-time graphic from flatleak.com is a useful one for highlighting just how much bitcoin buying Chinese citizens engage in. http://fiatleak.com/

The stock market has returned to test the region of the trend mean and will need to find support soon if potential for higher to lateral ranging is to be given the benefit of the doubt.