Euro-Area Maintains Momentum as Weaker Currency Helps Factories

This article by Piotr Skolimowski for Bloomberg may be of interest to subscribers. Here is a section:

The latest signs that the economy is growing at a steady -- if not spectacular -- pace come a week after the European Central Bank’s decision to prolong its asset purchases through 2017, while lowering the monthly amount starting in April.

With euro-area inflation still low, President Mario Draghi said the central bank will have a presence in markets “for a long time.” He also warned of potential uncertainty ahead linked to national votes in 2017.

“There is clearly the potential for political uncertainty to derail growth as elections loom in the Netherlands, France and Germany, and Brexit discussions begin,” said Markit Chief Economist Chris Williamson.

Williamson said the intensification of inflationary pressures was the “most significant development” this month and something that will “please ECB policymakers.”

?In Germany, the region’s largest economy, the composite PMI was at 54.8 this month after a reading of 55 in November, capping the strongest three-month period since the second quarter of 2014. France’s index rose to 52.8 -- an 18-month high-- from 51.4.

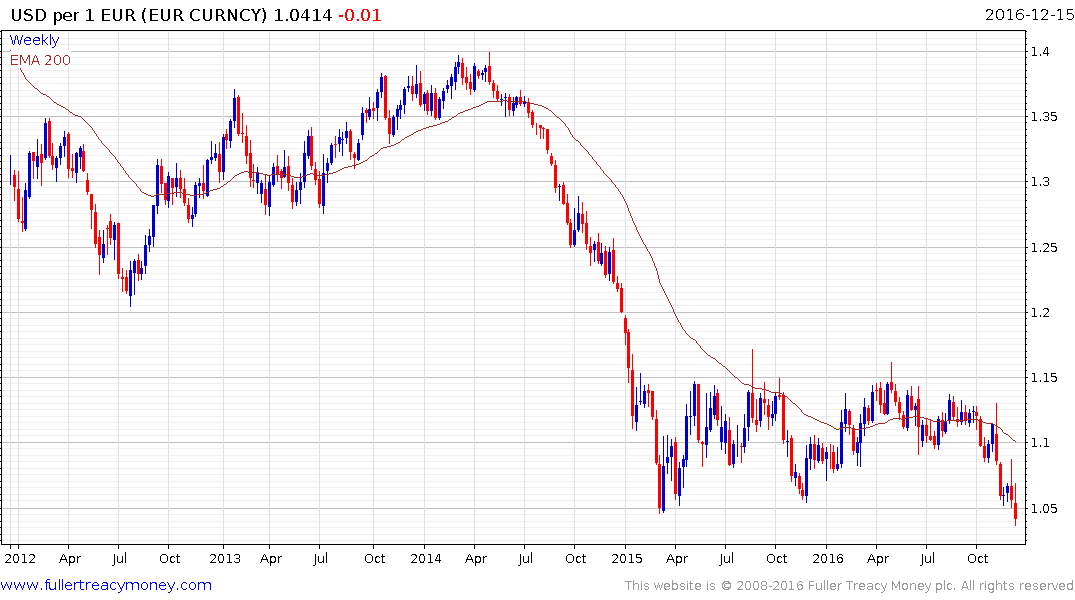

The Euro broke decisively below $1.05 today to extend its medium-term downtrend following an almost two-year long distribution. That will enhance the competitiveness of all Eurozone companies versus their non-Eurozone opposition but will do nothing to ameliorate Germany’s advantage relative to the periphery.

That relative advantage enjoyed by Germany is what the fiscal austerity regime implemented on the periphery was designed to solve. However it represents very hard medicine for the millions of people who have had to endure reduced standards of living. Since the policy is inherently deflationary the problem with austerity is it tends to be self-feeding while nothing has been done to tackle the outstanding debt issues.

With so much political uncertainty arising as a direct consequence of the growth-less policies pursued in the Eurozone the potential for a reversal and increased fiscal stimulus next year cannot be ruled out.

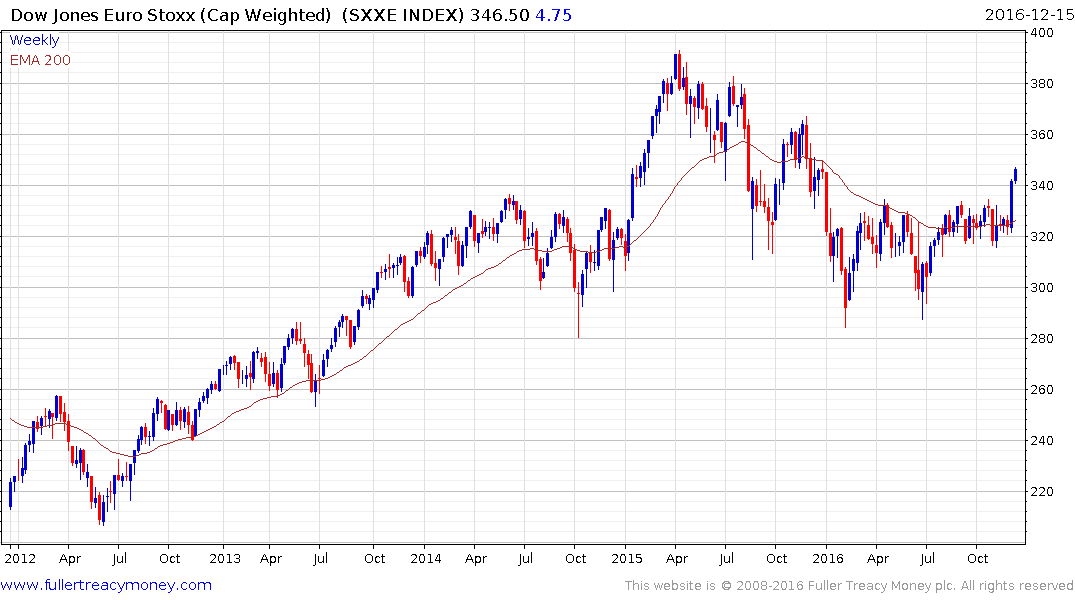

The Euro Stoxx Index is rallying in nominal terms as the Euro declines and had already surged last week to break the medium-term progression of lower rally highs. A sustained move back below 320 would be required to question potential for additional upside.