Brexit Shock May Have Silver Lining for Bruised Asian Investors

This article by Kana Nishizawa, Jonathan Burgos and Justina Lee for Bloomberg may be of interest to subscribers. Here is a section:

The victory of the “Leave” campaign stunned many investors who’d put wagers on riskier assets over the past week as bookmakers’ odds suggested the chance of a so-called Brexit was less than one in four. MSCI’s Asian measure dropped 3.7 percent on Friday, led by losses in Japan, South Korea, Australia and Hong Kong. A gauge of Asian currencies weakened the most since China devalued the yuan in August.

“This is just a knee-jerk reaction,” said Tony Chu, a Hong Kong-based money manager at RS Investment Management, which oversees about $17 billion. “Most stocks we look at in Greater China have little to do with the U.K. or the European economies.

We still like Internet-related stocks, consumption and health- care stocks. That’s where we see relatively better earnings prospects.”

The Shanghai Composite Index slid 1.3 percent on Friday, while volume increased less than other major Asian benchmark gauges. Foreign investors are limited by quotas from buying and selling mainland Chinese equities, with local individuals accounting for about 80 percent of trading.

Most Asian markets advanced on Monday. The Topix index rebounded 1.8 percent at the close, as the Shanghai gauge climbed 1.5 percent. Australia’s S&P/ASX 200 Index added 0.5 percent. Hong Kong’s Hang Seng Index dropped 0.2 percent, trimming an earlier loss of 1.4 percent.

To be sure, in the short term, fund managers are girding for higher volatility and a flight out of all but the safest assets. Asia can’t escape a global deterioration in risk sentiment, Harvest Global Investments Ltd. says.

Europe, and most particularly the Eurozone, represent the epicentre of global risk. The UK certainly represents a lightning rod for bearish sentiment and that pressure is falling primarily on the Pound. However, potential future issues reside with how the EU will deal with what is an existential threat.

Europe represents a destination for Asian exports so there is likely to be some blowback if the deflationary environment intensifies. However since there is no legacy of cross ownership or massive over investment in the Eurozone, then ASEAN in particular could potentially benefit from investor angst towards Europe.

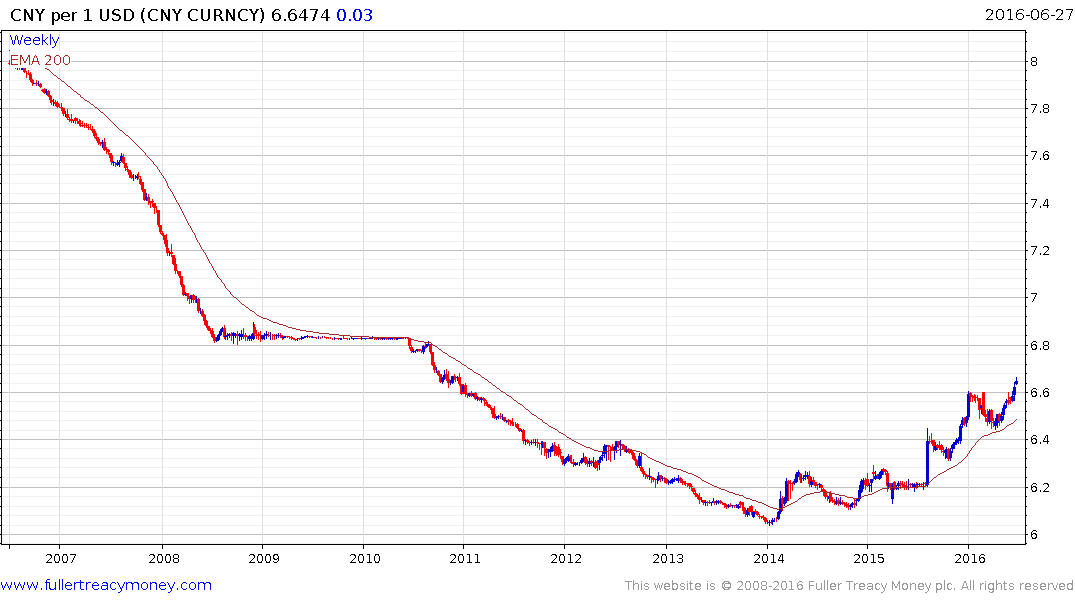

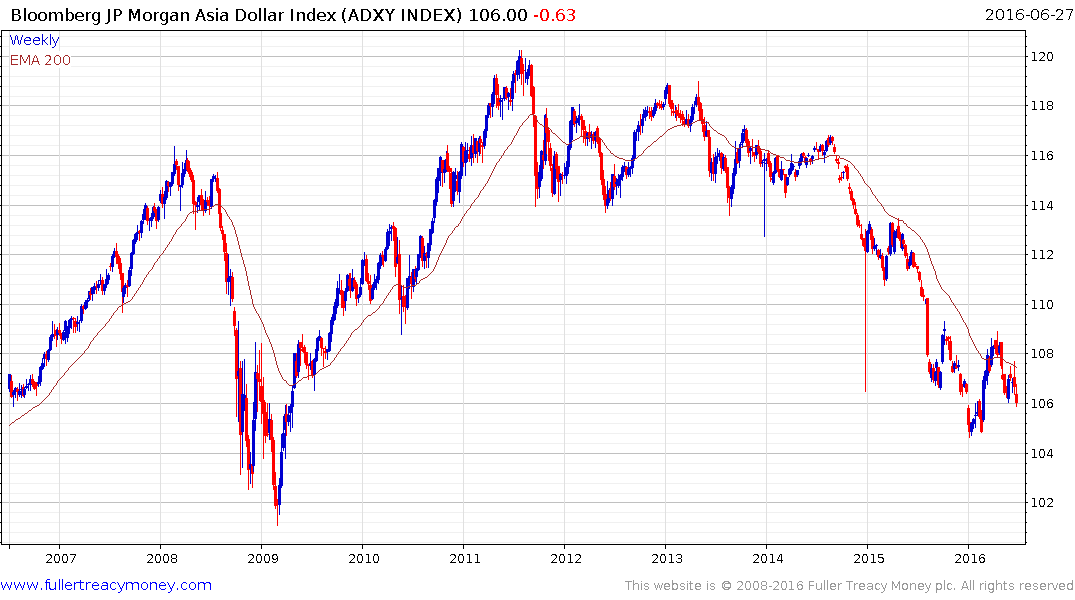

The relative weakness of the Renminbi is taking some pressure off of ASEAN currencies to continue to support their respective currencies. The Asian Dollar Index remains in a medium-term downtrend and confirmed resistance in the region of the trend mean last week. A sustained move above it would be required to question medium-term downside potential.

The Chinese, Indian, Vietnam, Philippines, Indonesia, Malaysia and Thailand indices have been cushioned somewhat both by the relative weakness of their currencies and their distance from the problems assailing Europe. Relative valuations are also more attractive for Asian energy importers so there is potential for the region to continue to outperform.