Goldman Says the Years of Emerging-Markets Doldrums Are Over

This article by Ye Xie for Bloomberg may be of interest to subscribers. Here is a section:

Goldman Sachs predicted that developing countries will grow 4.9 percent next year, from an estimated 4.4 percent in 2015, marking the first acceleration since 2010. While it is still below the long-term trend, the improvement can only help boost investor confidence given the current “widespread bearishness,” the analysts wrote.

“We would part ways with the extreme pessimism that we sometimes encounter about the long-term prospects for EM assets,” they said.

The MSCI Emerging Markets Index rose 0.5 percent at 10:31 a.m. in London, extending its weekly advance to 2.5 percent. A gauge of 20 developing-nation currencies gained 0.8 percent in the past five days, paring this year’s slide to 12 percent.

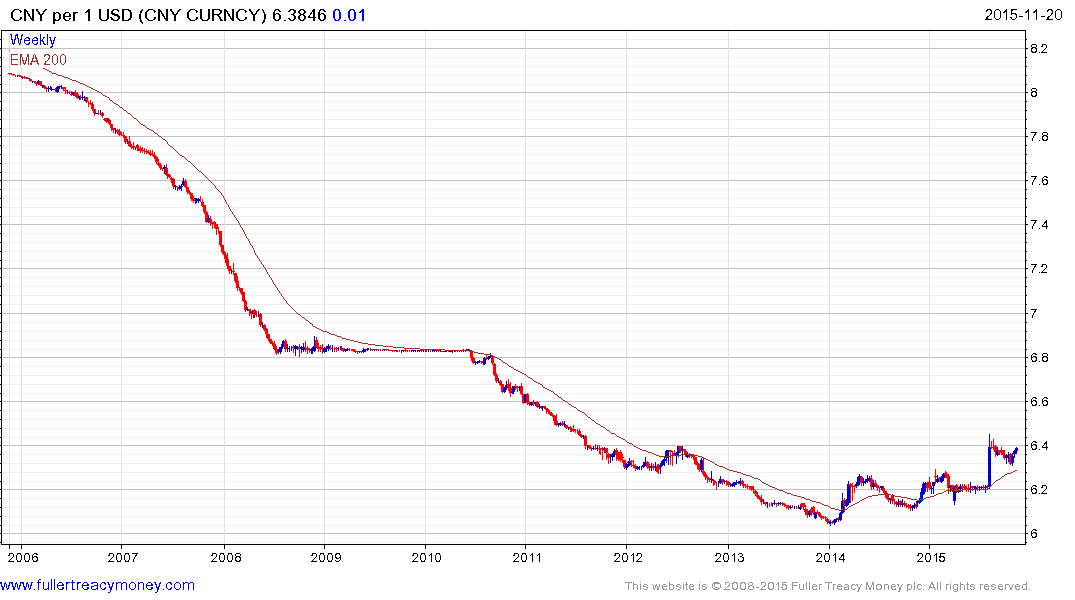

Goldman Sachs said the biggest risk is a “significant depreciation” of the yuan. A stronger dollar and slower growth in China may prompt policy makers to allow the currency to fall with a spillover effect rippling through emerging markets, the report said.

“In our view, the fallout from such a shift is the primary risk,” the analysts said.

Falling commodity prices and competitive devaluation have played havoc with Eastern European, Latin American and Asian currencies. At the Singapore venue for the Chart Seminar earlier this year the majority of the currency discussion focused on the need to hedge exposure to the Euro while delegates considered the risk represented by the Chinese Yuan too much trouble since the market has been inert for so long. There is career risk in being too early particularly if another market is offering greater short-term opportunities, but is also worth remembering that we define a range as “an explosion waiting to happen”. When the status quo shifts there can be meaningful changes in trend. I suspect this will be a topic of conversation at next week’s London venue for The Chart Seminar now in its 46th year.

The Dollar bottomed against the Yuan nearly 2 years ago and nothing has happened yet to challenge its dominance. This is a major trend change and it would be surprising to see it unwind any time soon. China is now a destination for imports from all over the world so how the Yuan performs will have an impact on public policy in markets that rely on Chinese consumption.

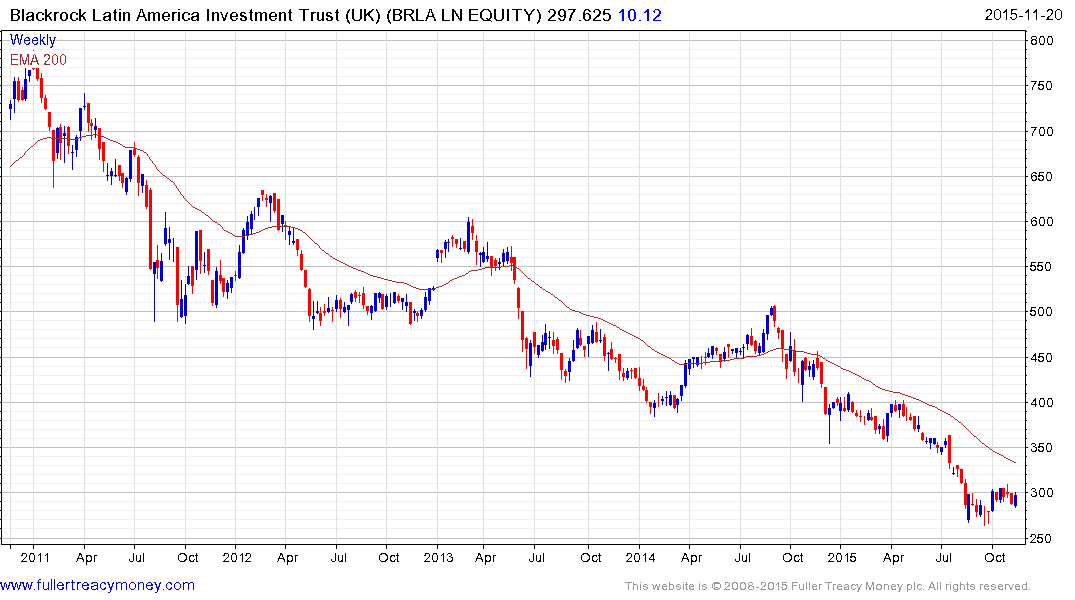

The Brazilian Real more than halved against the Dollar from 2011 and is now unwinding its oversold condition following an accelerated decline between July and late September.

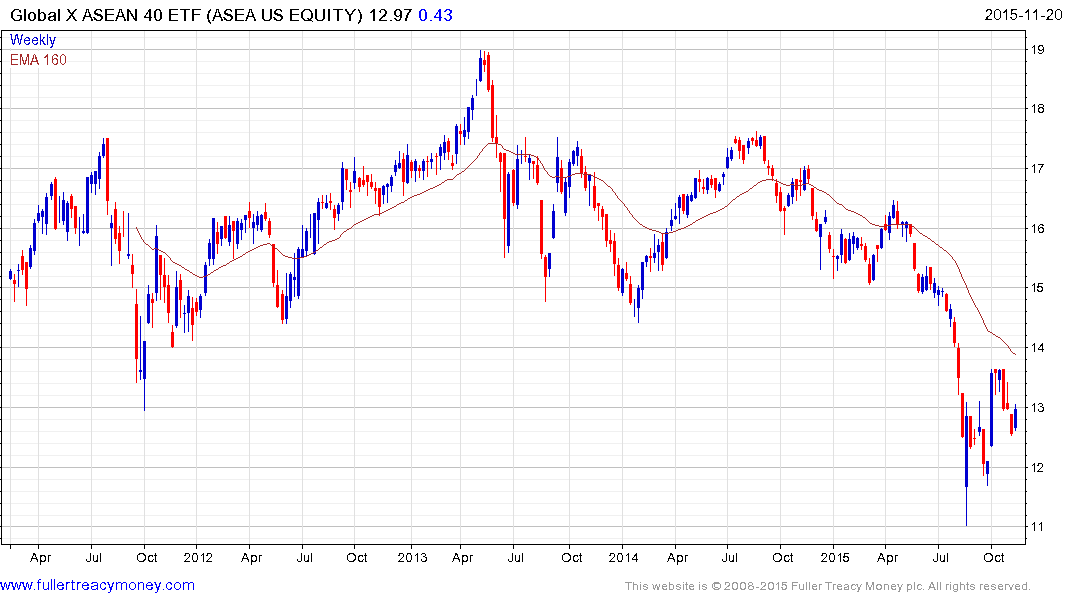

The Indonesian Rupiah experienced a similar decline and retested its Asian Financial Crisis low in September.

The South African Rand also halved from 2011 and is now unwinding its oversold condition.

These types of moves are worrying for investors but once they are convinced the currencies have found more than short-term lows thoughts turn to how much competitiveness has improved. A halving in the value of a currency does wonders for the manufacturing sector and the low price of oil also means commodity pricing is not a headwind. There is every chance emerging market growth will exceed expectations next year.

The UK listed Blackrock Latin America Investment Trust is trading at a discount to NAV of 10% and yields 6%. It found support this week above the September low and a clear downward dynamic would be required to question potential for mean reversion.

The US listed Global X ASEAN 40 ETF hit a low near $11 following an accelerated decline in August and has held a progression of higher reaction lows since. A sustained move below $12.50 would be required to question current scope for continued higher to lateral ranging.