Is there hidden treasure in the mining industry?

Thanks to a subscriber for this report from McKinsey which may be of interest. Here is a section:

The principal drivers of cost inflation vary by commodity, so we have identified and projected the most important costs for each commodity. In the 2000 to 2013 period, cash cost inflation for the marginal producer has been close to 20 percent annually for copper, iron ore, and potash (coal has been lower at around 11 percent), primarily due to the geological factors just described.

Inflation is influenced by external factors (for example, local consumer prices, increase in wages and diesel prices, and local-currency appreciation versus the US dollar) and internal ones (for example, productivity, metal grade, and geological mine conditions). Assuming a scenario of lower oil and diesel prices and a strengthening US dollar versus the local currencies of mining producers, our analysis suggests that external cost factors will be flat, or even negative, for most commodities.

Inflation due to internal factors, however, is here to stay. Even with productivity gains, mines will increasingly suffer from declining ore grades and deteriorating mine conditions, such as deeper shafts, worsening stripping ratios, and longer hauling distances. We expect the level of geological cost inflation will continue to be the main determinant of cost increases, and that total inflation will average 4 to 7 percent per year going forward.

In the extractive sector supply and demand data are endlessly picked over for clues to how prices might respond. However it is important to consider that demand growth is much less volatile than supply. The global population continues to expand, not least because people are living longer. Additionally, living standards, on aggregate, are improving. Higher standards of living require greater use of resources such as energy, steel, copper, zinc, tin, soy etc. so demand tends to trend higher over time.

The re-entry of China onto the global market as a major consumer of commodities resulted in an acceleration in the pace of demand growth which is now being unwound. Demand growth is not negative but the pace of that growth has moderated.

The problem for the mining and oil sectors is that they invested fortunes in developing new supply to cater to demand growth numbers that are no longer relevant. This is why the sector continues to underperform and it will continue to do so until supply contracts enough to cater to the reality provided by the market today.

Supply is a multiple of geology, technology, energy, capital, labour and regulation/politics. A great deal of commentary has focused on declining ore grades but this is not new. Declining ore grades only matter if one assumes technology will not improve. In the 300 years since the dawn of the Industrial Revolution, technology has contributed to productivity growth that has outstripped the pace with which the easiest ore bodies have been mined out. Considering the pace with which technological innovation is accelerating, it is reasonable to assume new practices, machines and modelling will greatly enhance mine productivity.

Mining is energy intensive so the low oil price has meant the cost of production has trended lower and marginal operations have been able to survive a while longer despite low prices for their products. We have seen expansion plans shelved but the economics of mining mean once a mine enters production it has to continue. To do otherwise would mean debt has no chance of being repaid. This situation will continue until prices have fallen enough to drive marginal producers out of the market. If we look at the coal, iron-ore and nickel markets smaller companies are going bust.

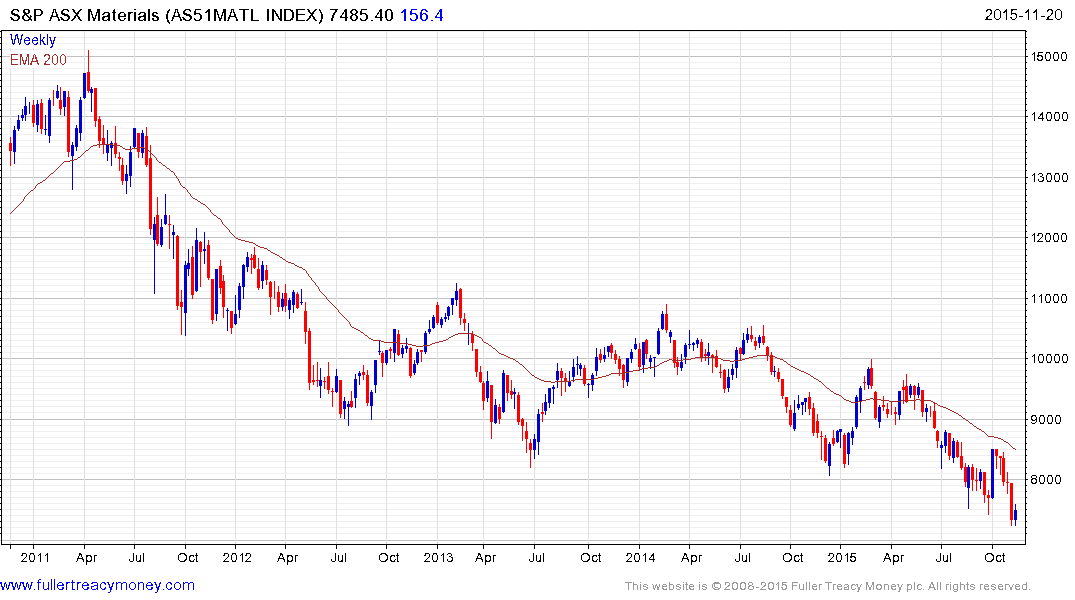

The question then is how much of the bad news is already in the price. That’s why we look at price trends. Medium-term downtrends are still evident and short-term oversold conditions are becoming increasingly stretched. Potential for mean reversion has increased but breaks in medium-term progressions of lower rally highs will be required to signal a return to demand dominance.

The FTSE-350 Mining Index steadied this week in the region of the September low but will need to hold the 800 level if support building is to be given the benefit of the doubt.

The S&P/ASX Materials Index moved to a new low last week but has steadied somewhat this week. It will need to sustain a move above 850 to break the medium-term downtrend.