Email of the day on Vietnam:

I would also be grateful for an update of your view on the Vietnam market, which has broken out above its 200 day MA and is approaching the top of a multi-year trading range. The government has announced the merger of the Hanoi and HCM stock exchanges as well as other market friendly initiatives which could perhaps be behind the recent outperformance of Vietnam vs other Asean indices.

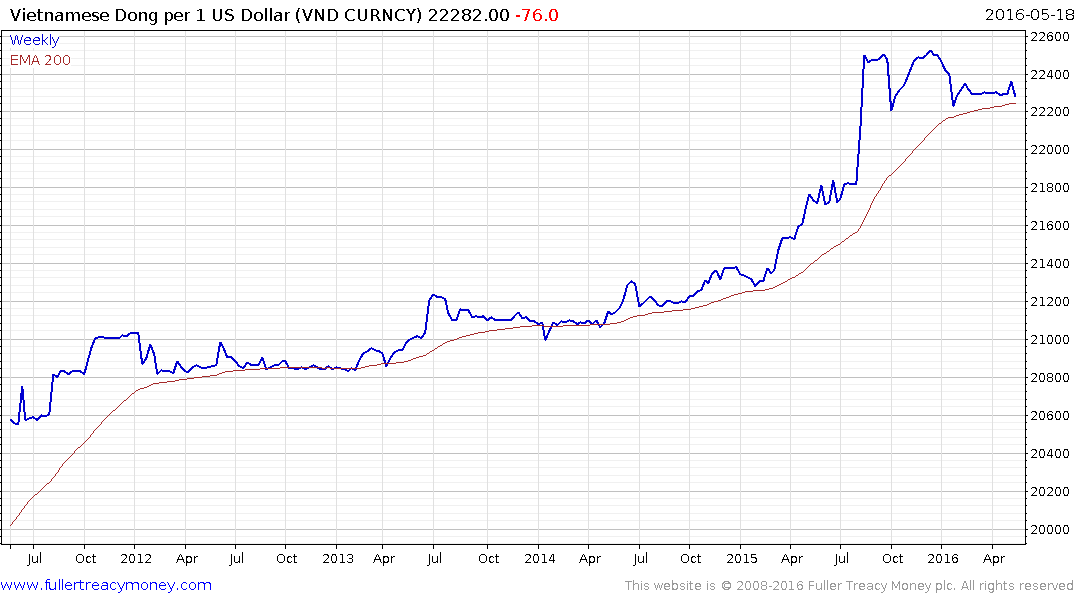

Vietnam’s Communist Party is attempting to improve the governance of the economy and has been through a painful period where inflation has been running ahead of expectations. The Dong took the brunt of selling pressure but has been reasonably steady so far this year. Nevertheless, a sustained move below the MA would be required to question medium-term Dollar dominance.

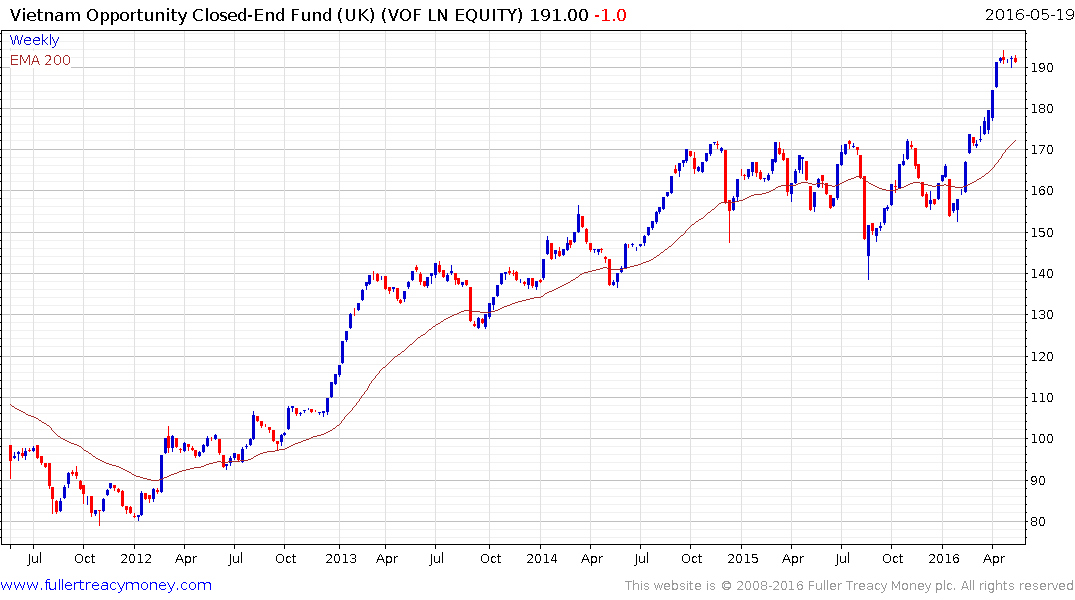

As you mention the stock market is now testing the upper side of a two-year range and a short-term overbought condition is evident. At least some consolidation of recent gains is looking likely, not least as a risk-off phase on global markets is now looking more likely than not. How well it holds its gains during any reaction will be a barometer for how much demand there is from investors.

.png)

Vietnam Dairies is a share to watch because it is heavily owned by overseas funds. The foreign ownership threshold is fully committed so if a fund decides to sell there is no guarantee they will be able to open the position again. The share is back testing its highs and a loss of consistency would be a clear indication foreign funds are liquidating positions in Vietnam; which has not been the case for the last few years despite Dong weakness.

The London listed Vietnam Opportunities Fund is trading at a discount to NAV of 20% and holds 30% of its assets in cash. The fund broke out to new recovery highs in March and some consolidation is looking likely. However, a sustained move below the trend mean would be required to question potential for additional medium-term upside.