Conviction themes for a fat and flat market; equities to N over 12m

Thanks to a subscriber for this report from Goldman Sachs. Here is a section:

Markets have been calmer and cross-asset correlations with oil have fallen since our last GOAL on March 21. Declines in bond yields, owing to a continued dovish Fed, a weaker dollar and stronger commodity prices, have been the key cross-asset moves. This has lifted bond and credit returns, but equities have not benefited much. Global earnings growth revisions have been negative and equity valuations remain high, with the equity risk premium a less useful predictor of returns owing to uncertainty over trend growth and normalisation of bond yields (see GOAL – Global Strategy Paper No. 18: Valuation investigation: Varying signals for the ERP, May 3, 2016).

We stick with our ‘fat and flat’ view for equities. After the rebound from the trough on February 11, and with the S&P 500 at the upper end of its recent range, we downgrade equities to Neutral over a 12-month horizon, in line with our 3-month view. Until we see sustained signals of growth recovery, we do not feel comfortable taking equity risk, particularly as valuations are near peak levels. Our equity strategists have become more defensive, owing to heightened drawdown risk and growth scarcity (see US Weekly Kickstart, May 13, 2016 and Strategy Expresso, May 16, 2016). While we see some upside to equities in local currency (particularly Japan), we expect the dollar to strengthen (see FX Views, May 13, 2016), resulting in poor USD returns over the next 12 months (Exhibit 1).

We prefer to implement the divergence theme via FX rather than equities; equities are generally more volatile than FX and, while the equity/FX correlation for Europe and Japan remains negative, it has increased recently (Exhibit 2) (see GOAL: Lost in translation, October 2, 2015). For Europe, equity/FX correlations could become even less negative as political risks in Europe intensify. We also move to Neutral across equity regions on a 12-month basis (in line with our 3-month basis) alongside these effects.

Here is a link to the full report.

.png)

Corporate Profits have come in below expectations in the first quarter which makes it harder to justify valuations at where they are right now.

Companies are not spending as much on buybacks and what they are spending is buying less because prices have gone up so much already. Quite apart from that buybacks inflate earnings per share which has a knock-on effect that compresses P/E ratios.

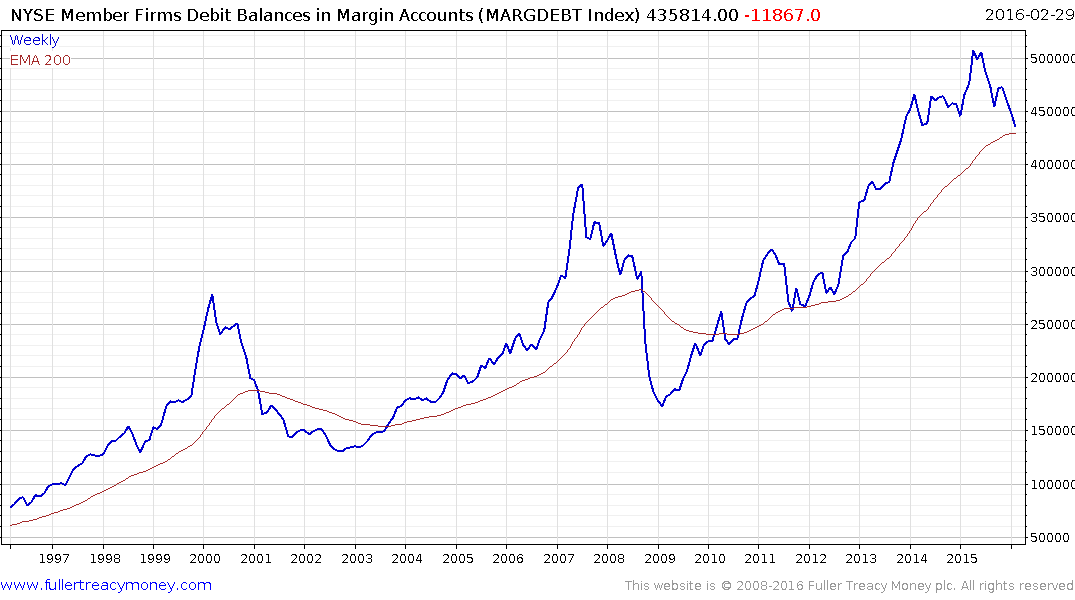

NYSE Member Firms' Margin Debt Balances hit a medium-term peak in April 2015 and failed to hold the breakout to new highs. It has since pulled back to test the lower side of the underlying range and the region of the trend mean. A sustained move below it would complete a Type-3 top formation.

“Don’t fight the Fed” must be one of the oldest maxims in markets and yet the bond market has been at odds with the clear signals given by the Fed for much of the last six months. 12-month yields signal traders are now beginning to price in the possibility the Fed might indeed raise rates more than once in the next year.

Just like an addict who requires progressively greater quantities of a drug just to sustain an equilibrium, the market has developed a reliance on liquidity and higher rates risk a feeling of withdrawal.

The paradox of course is that the likelihood of Fed rate hikes is likely to take a back seat if the market falls and fears of economic contraction take precedence. On the other hand if the market rallies, the potential for rate hikes increases and markets come under pressure. It’s a fine balancing act so the Fed can be expected to tread carefully. In the meantime the incentive to get long and leveraged is not supported by valuations or liquidity and the S&P 500 still has a mild downward bias as it pulls back from the upper side of its more than yearlong range. As I highlighted yesterday wages are the most likely arbiter for the Fed’s actions considered other competing influences on policy.

Back to top